2010 Volume Issue 1

September 23, 2010

For a downloadable version, click the following:

HERE WE GO AGAIN

The broken CD (record) routine…before it was Japan and Germany eating our lunch, now it is China

We were recently reading an article by Andy Grove, (www.bloomberg.com/news/2010/how-to-make-an-american-job-before-it-s-too-late-andy-grove) concerning the demise of job creation especially in Silicon Valley. Mr. Grove points to the shrinking number of high tech jobs and how they have moved offshore, to the Far East in particular.

Today, manufacturing employment in the U.S. computer industry is about 166,000 -- lower than it was before the first personal computer, the MITS Altair 2800, was assembled in 1975. Meanwhile, a very effective computer-manufacturing industry has emerged in Asia, employing about 1.5 million workers -- factory employees, engineers and managers.

Unfortunately, foreign exchange issues, one of the major causes for this demise was not mentioned. This article is an attempt to correct that shortcoming with a bit of economic history and analysis.

Readers of a more “mature” age will remember Japan and Germany as two of the Post-World War II economic miracles. The U.S. had lost its edge in nearly every respect to the industrious and otherwise superior Japanese and Germans, or so the story went. Douglas McArthur, Konrad Adenaur, et al, were the miracle workers who helped in transforming those recently defeated foes into economic juggernauts.

Now it is the Chinese miracle and once again, the U.S. has lost its competitive edge, or so the story goes. Lest you forget, in between were other miracles like the Tiger economies of Southeast Asia such as South Korea, Singapore and Malaysia.

This is not to denigrate those people and the good they did. The purpose of this article is to tell the ‘rest’ of the story, as the late Paul Harvey used to say. Without an acceding U.S. to play its pivotal role, the sine qua non of those success stories, those miracles would not perhaps have ever occurred. Let us go back to the early post-World War II era and briefly examine the so-called Japanese and German economic miracles.

Elevating the US Dollar to the status of key currency

In order to jump start the economies of the World that were reverting to a peace time basis, many nations became members of the IMF (Breton Woods) fixed exchange rate system. It is often called a gold exchange standard and some called it a U.S. Dollar standard. (Citation: International Money Game, by Robert Z. Aliber).

Robert Z. Aliber

Winter 2005

The Dollar's Day of Reckoning

www.wilsonquarterly.com/article.cfm?AID=544

For a variety of reasons, the U.S. Dollar was the only suitable currency to serve as the key world currency of the time. All member nations pegged their currencies to the U.S. Dollar and the U.S. Dollar was pegged to gold. The U.S. product and financial markets were to be open to the member nations making the Dollar the medium of exchange and the liquid store of value. If some of these nations were so desirous, they could exchange Dollars into gold with the U.S. Treasury at the agreed upon rate of $35 for each ounce of gold. By around 1947 many nations had joined the system and it officially lasted until the early 1970s when this system collapsed.

In order to make the system work, the U.S. Dollar was deliberately overvalued or overpriced. This gave an advantage to nations like Japan and Germany in terms of their trade balances. It made them more competitive since their currencies were cheaper than they would have been at equilibrium levels. They quickly developed chronic trade balance surpluses and the U.S. a chronic trade deficit with these nations and with the world as a whole.Bretton Woods (http://en.wikipedia.org/wiki/Bretton_Woods_system).

Japanese Yen

Yen per $1 USD

- August 1946_15 yen/USD

- 12 March 1947_50 yen/USD

- 5 July 1948_270 yen/USD

- 25 April 1949_360 yen/USD

- 20 July 1971_308 yen/USD

- 30 December 1998_115.60 yen/USD

- 5 December 2008_92.499 yen/USD

Deutsche Marks

Date # marks=$1 US

- 21 June 1948 3.33

- 18 September 1949 4.20

- 6 March 1961 4

- 29 October 1969 3.67

- 30 December 1998 1.673

Current Account Deficit <--> Combined Capital Account Surplus

As many analysts have since pointed out, this ‘elevated peg’ had to be if the Dollar was to become the key currency. Current account balance deficits which reflected not only the trade balance (merchandise and services accounts) but also a U.S. deficit in its unilateral transfer account (reflecting massive U.S. aid such as the Marshall Plan and military aid such as NATO) were the measure of the exportation of Dollars to serve as the World’s key currency. In fact if the U.S. exportation of Dollars was treated as are gold exports in the Balance of Payments Accounts as gold was treated for nations like South Africa, the U.S. chronic trade deficit would have all but disappeared, at least until the mild inflation of the late 1960s and early 1970s began.

As the Germans and Japanese imported dollars they invested them in the U.S. financial markets as do the Chinese today. Déjà vu… “All things change and everything stays the same” as sacred Scripture tells us. The Combined Capital Accounts Balance surplus in the BOPA is of course the mirror image of the Current Account Balance deficits in the same BOPA.

U.S. Trade Deficit: Good, Bad, or Irrelevant?

www.econnewsletter.com/oct102003

Time out…excerpted from a 2009 blog (soon to repost)

Why 25+ Years of Trade Deficits? A tale of High Real Risk-adjusted Interest Rates and the Appreciating Dollar

If the reader has examined the previous blogs on this issue, we should be pretty much on the same page for the discussion that follows. A short journey through the history of U.S. monetary policy for the last forty years or so will help. Recall that the 1970s saw an acceleration of inflation ultimately reaching nearly 20% at an annual rate by late 1079 and early 1980. In the spring of 1980, the FED (U.S. Federal Reserve) took a 180 degree turn and went from accommodation of inflation, much of which was due to the two oil supply side shocks of 1973 and 1978, and began a policy of “wringing out” the inflationary overhang and ignoring the consequences of a rising unemployment rate. Once the inflationary pressures began to subside, nominal interest rates fell abruptly.

The Fisher Effect was at work again

www.econnewsletter.com/fishereffect

However, the fall in inflation was slightly greater than the fall in nominal interest rates. This caused real interest rates adjusted for risk to be relatively high compared to other nations. By around 1982, the U.S. began to experience a shift from a long standing surplus in its Trade and Current Account Balances to growing deficits.

Even when the Fed funds rate was 1.00% in 2004, the capital flowed in!THEY HAVE TO INVEST THEIR DOLLARS SOMEWHERE – Foreign Investment in the U.S.

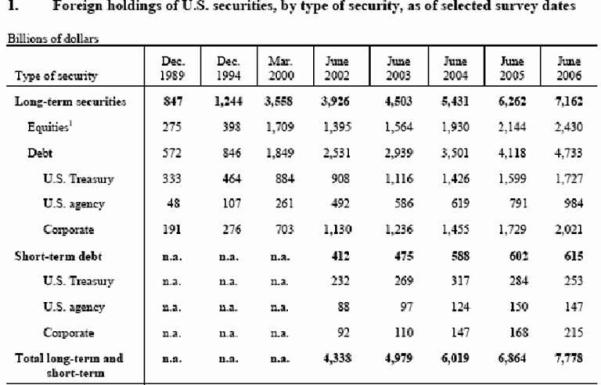

Report on Foreign Portfolio Holdings of U.S. Securities as of June 30, 2006

Department of the Treasury and Federal Reserve Bank of New York

Board of Governors of the Federal Reserve System (May 2007)

The conventional wisdom was that the U.S. slow rates of productivity growth, with accompanying increases in unit labor costs and credit card crazed consumers hell bent on instant gratification, were driving up imports and rising costs were slowing export growth.

But was this the real reason for the reversal in the Trade and Current Account balances? We think not.

There are five accounts in the conventional presentation of the BOPA (Balance of Payments Accounts). That structure does not indicate causality. Causality between the Current Account (nearly all of which is usually the Trade balance) and the Combined Capital Accounts can run either way.

This author holds and has argued for years, that because of the policy of intolerance to inflation adopted by the FED in the spring of 1980, real risk-adjusted interest rates in the U.S. were relatively high and were a major factor that caused a surplus in the U.S. Combined Capital Account and caused the growing deficit in the Trade Balance.

The U. S. was and still is the place to invest financially. This net inflow of capital results in the demand for the Dollar (to invest in the U.S.) to rise relative to the supply of the Dollar (to invest in the rest of the World), making the Dollar scarcer and causing it to appreciate (causing the “strong Dollar”). Of course this means that foreign currencies are cheaper and the prices of foreign goods in Dollar terms are cheaper than if the Dollar had not appreciated and had remained weaker. The price of the Dollar in terms of foreign currencies rose (foreign currencies depreciated on a trade weighted basis versus the Dollar) causing the foreign currency price of American goods and services to rise and be more expensive than if the foreign currencies had not depreciated. The result was that U.S. imports of goods and services rose sharply relative to the U.S. exports of goods and services and a chronic trade deficit as well as a chronic Current Account Deficit Balances developed.

It was the Combined Capital Account Surplus that caused the Current Account and Trade Balance Deficits and NOT the other way around.

--- back to our story

The over-valuation or over-pricing of the Dollar was intentional in order that an increase in the international money supply of Dollars could occur. This left a ‘Dollar overhang’ consisting of the Dollar investments in the U.S. of nations like Japan and Germany. Again, this is akin to the situation with the Chinese in 2010.

The partial liquidation of these dollar financial investments financed the massive invasion of the Japanese transplants into the U.S. automotive industry. It is now allowing a similar South Korean invasion, à la Hyundai, etc. It will soon finance the Chinese invasion of the American business scene. The U.S. is still a popular venue for world investments.

You will not have to wait long for the Chinese invasion of the U.S. domestic economy. Recall the Chinese attempt to buy Unocal and Maytag a few years back. As Chinese labor becomes more expensive (www.businessweek.com/news/2010-06-11/china-reaches-lewis-turning-point-as-labor-costs-rise), just as German and Japanese labor became back in the Post-World War II era, the Chinese will begin to manufacture goods in the U.S. How quickly we forget! Labor troubles are already brewing in mainland China. How wrong Karl Marx was!

Note that most of the transplants operate in right-to-work states (media.mlive.com/news_impact/RTWHari4word.pdf). The inability of Chrysler to thrive and maybe even survive in union-shop states has not been lost on the foreign transplants.

China exports goods and the U.S. exports dollars

The U.S. imports goods and China imports jobs

Now let us look at the so called Chinese miracle and the arguments of the naysayers who are counting out the U.S. of A. More than twenty years ago in 1989, the Communist government of mainland China was busy in places like Tiananmen Square battling and sometimes killing young Chinese students. Chinese youth is just like youth everywhere, if they are not kept busy, they will raise hell. If it is really jobs they want, “give them jobs”, and at reasonable wages for the time, became the Chinese government’s answer.

(1984)

Problem: Who will buy the goods thus produced??

Solution: The over-consuming Americans will, of course.

Problem: At $0.50 U.S. for one (¥) (CNY) Yuan or Renminbi a television imported from China was too expensive even to U.S consumers.

Solution: Go into foreign exchange markets and buy Dollars and sell Yuan until the price of a Yuan fell 75% to $0.125. Peg the exchange rate there by continued intervention. Then exports from China into the U.S. would be a bargain at 75% less than previously. At that pegged rate resulting in the Yuan price of the Dollar rising from 2 to 8 Yuan, Chinese imports from the U.S. would be four times as expensive. Within 10 years, from January 1984 to January 1994, the Yuan went from $0.488 per Yuan to $0.115 per Yuan.

Suddenly, Walmart became (unofficially) Chinamart. The U.S. trade deficit with China ballooned and we began to export Dollars to China to pay for our net imports from them. They promptly used the Dollars to buy U.S. government debt securities. The U.S. Congress met that Chinese need for investing surplus Dollars by running persistently large federal budgetary deficits funded by the issuance of U.S. Government marketable securities in the form of Treasury or T-bills, T-notes and T-bonds.

It helped keep interest rates in the U.S. down in two ways: the supply of Chinese owned Dollars were continually looking for investments in the U.S. keeping security prices up and hence, interest rates down. Our persistent (and depressing) trade deficits kept inflation down in the U.S. thus moderating the Fisher Effect arising from other inflationary pressures in the domestic economy. The Chinese willingly added to our aggregate supply of goods and services by exporting more to us than they imported. Sounds like Japan and Germany after WW II all over again.

Why did the U.S. accept this Chinese initiative of pegging the Dollar price of the Chinese Yuan at close to 75% below its equilibrium level? Such Chinese actions have lasted over five consecutive Presidential administrations although some changes began to occur during the latter Bush years.

From Geopolitical Expediency to Political Necessity (JOBS)

China has the nuclear bomb; as does India, Pakistan, and maybe North Korea. All three are neighbors of China. We needed and still need a stable China to neutralize their nuclear neighbors. Similarly, we may soon need a stable nuclear friend larger than and as close to Iran as Israel.

The massive increase in the Chinese trade balance gave them that stability very quickly. At the time, lack of jobs was not a problem in the U.S. even with hordes of immigrants flooding the U.S., both legally and illegally.

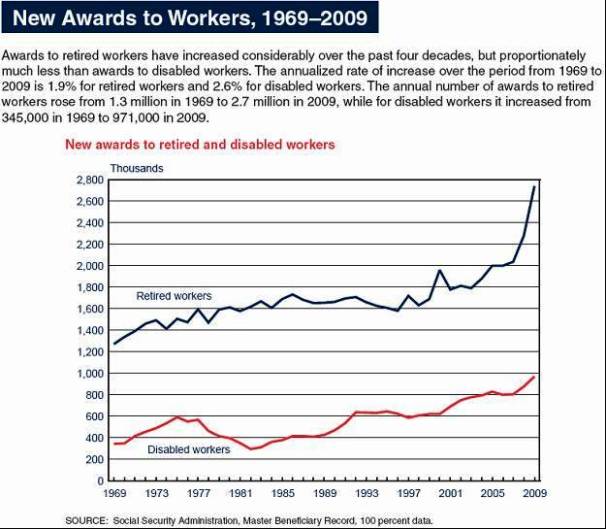

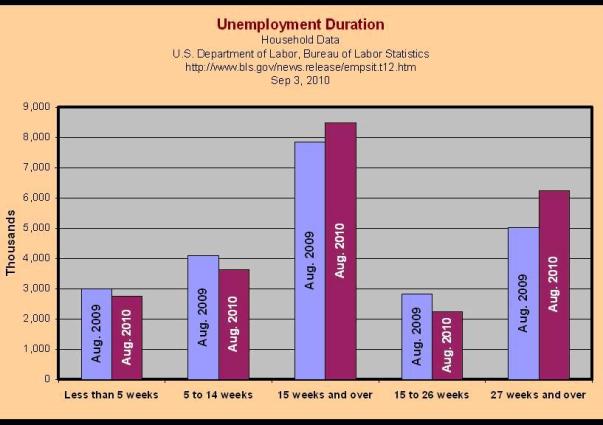

Lack of jobs is now THE major problem in the U.S. economy. A stubborn and severe recession is exacerbating the dismal job outlook and causing accelerated early retirements from the labor force, record numbers seeking long term disability status, and an increasing number of very long duration unemployed. The U.S. is beginning to look a lot like Europe!

www.ssa.gov/policy/docs/statcomps/di_asr/2009/sect01.html

All Social Security disabled beneficiaries in current-payment status, December 1970–2009

The number of disabled workers grew steadily until 1978, declined slightly until 1983, started to increase again in 1984, and began to increase more rapidly beginning in 1990. The growth in the 1980s and 1990s was the result of demographic changes, a recession, and legislative changes. The number of disabled adult children has grown slightly, and the number of disabled widow(er)s has remained fairly level. In December 2009, about 7.8 million disabled workers, just under 921,000 disabled adult children, and over 236,000 disabled widow(er)s received disability benefits.

…back to the pegged currency issue

Why has China’s pegging of the exchange rate caused the U.S. trade deficit with China and what are the consequences in respect to the U.S. job market and unemployment rate?

International trade transactions involve two (2) prices. In this context, there is the Yuan price of the Chinese goods and the Dollar price of the Yuan. By discounting the Dollar price of the Yuan from $0.50 to $0.125, the Chinese effectively reduce the price to U.S. customers. This constituted a 75% discount on goods coming into the U.S. from mainland China.

The Yuan price of the Dollar went from 2 Yuan per $1 USD to 8 Yuan per $1 USD. This is a quadruple increase in the price of goods and services to the Chinese for U.S. goods and services. Thus our imports from China rise precipitously and our exports to China collapse. From close to a balance in our trade balance (technically our combined Merchandise and Services Accounts) when the exchange rate before pegging was $0.50 per Yuan to a huge deficit in our net exports goods and services (or trade balance) after the exchange rate was pegged by the Chinese at $0.125 for 1 Yuan.

Economic theory tells us that imports depress the macroeconomic level of economic activity and thus depress the demand in U.S. labor markets. Exports do just the opposite. Since a trade deficit means that U.S. Imports exceed U.S. Exports, the Chinese pegging of the Yuan substantially below its equilibrium level depresses the U.S. economy.

There is a good side to this. If inflation is the fear and NOT the lack of American jobs, as it was 20 years ago, it is a win, win situation. China is more stable and inflationary pressures are eased in the U.S. But that was then and this is now. Inflation is not a problem and probably will not be in the near future. Lack of jobs is a serious and growing problem in the U.S. The massive fiscal stimuli recently legislated by Congress, has been primarily to grow government and not restore and create new jobs in the private sector. We are now between a rock and a hard place, as the saying goes.

Remedy? Yes.

Actionable Solution? You decide

We have the power to negate the Chinese pegging of the Yuan below its equilibrium level. This would add to the woes of mainland China and destabilize them. This long standing policy of nearly twenty years now, has a much higher opportunity cost than before. The cheap Yuan is one of the causes of the high unemployment rates in the U.S. Letting the Chinese peg the dollar/Yuan exchange rate to stimulate their economy is no longer a win-win policy, but a ‘they win - we lose’ (jobs) policy.

Given the huge deficits Congress legislated and the resulting quantum jump in U.S. national debt, further policies of fiscal stimuli are now very costly to the integrity of the Dollar and the independence of our monetary authority, the Federal Reserve System. Similar policies in nations like Greece and Portugal have made everyone aware of the problem of sovereign risk, the growing threat of repudiation of a nation’s governmental debt. We may have no choice but to force the Dollar/Yuan exchange rate back toward an equilibrium level. This will have positive jobs implications in the U.S. but unfavorable effects on the future problem of inflationary pressures being reincarnated as well as the political cost of an unstable Chinese mainland.

We shall see how this plays out in the months/years ahead…