Volume***

February 3, 2012

For a downloadable version, click the following:

THE CHINESE MIRACLE; OR IS IT REALLY A U.S. POLICY DEBACLE?

THE CHINESE MIRACLE; OR IS IT REALLY A U.S. POLICY DEBACLE?

Very much like the Japanese and German economic miracles after WWII, we have been hearing about the Chinese economic miracle. But a major reason for these so,called miracles was a willingness of the U.S. to accept an overvalued Dollar which led to persistent and significant U.S. Trade Deficits (technically called deficits on Merchandise and Services Account).

It's been a long while since the Chinese decided to end the riots in China such as Tiananmen Square in spring and summer of 1989 and put their swelling ranks of city dwellers, especially the young ones, to work at what seemed to them reasonable wages. It has been so long now that many have forgotten how they have achieved all of this.

"The largely student, run demonstrations aimed for continued economic reform and liberalization."

en.wikipedia.org/wiki/Tiananmen_Square_protests_of_1989

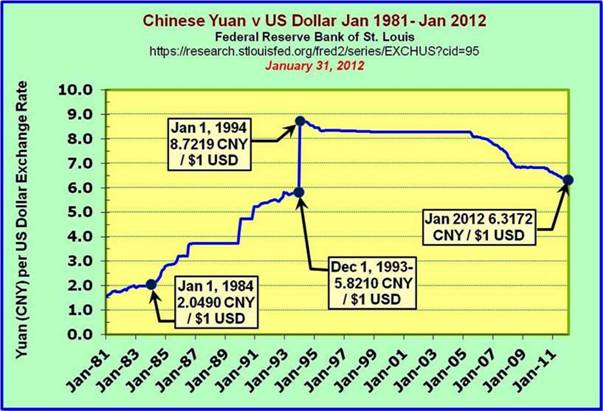

Few remember that further back, in 1984 and earlier, it cost $0.50 U.S. for 1 Chinese Yuan. This was before Walmart became what many call them now, China Mart. For quite a while it had been close to $0.125 U.S. for 1 Yuan. That's correct, from one,half of one dollar for 1 Yuan to 12 and one,half cents for 1 Chinese Yuan. Even now, 1 Chinese Yuan costs about $0.16 U.S. or 16 cents for 1 Yuan (January 2012 = 6.3172 CNY Chinese Yuan per $1.00 U.S. Dollar USD).

Remember that in international trade and finance, there are two prices the buyer must face. In this case, first it is the Yuan price of the good or service or the investment and secondly it is the Dollar price of the Yuan. With no change in the former and a 75% reduction n the latter, the combined price falls by 75%.

The effects of China devaluing the Yuan in terms of the U.S. Dollar

- Before devaluation of the Yuan

- 1,000 Yuan flat screen TV set

- At $0.50 for 1 Yuan to the dollar, the cost of the TV set is $500. U. S.

- After Chinese intervention in the foreign exchange market to devalue the Yuan to $0.125 for 1 Yuan, the Dollar cost of the same TV set fell to $125 for the U. S. importer or a reduction of 75%

Voila, witness the Chinese Miracle?????

Nor does it end there. Before devaluation of the Yuan, 100 bushels of wheat at $5.00 per bushel cost $500 or at 2 Yuan for $1, a total of 1,000 Yuan. After the devaluation of the Yuan to 8 Yuan for 1 Dollar, the cost of the 100 bushels of wheat rose to 4,000 Yuan or a 300% increase in the Yuan price of the wheat.

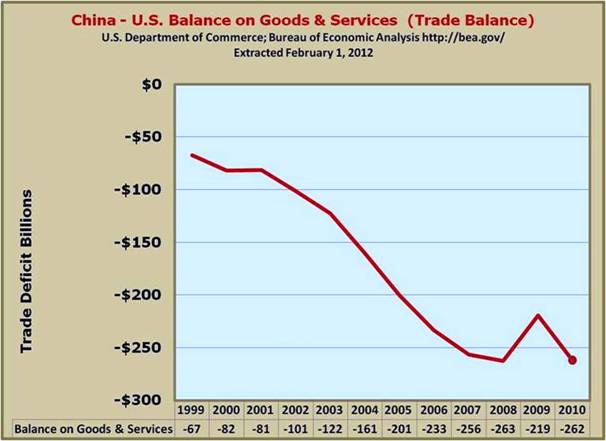

The result, U.S imports from China rise and U.S. exports to China fall and our trade deficit with China rises precipitously. Jobs in the U.S. are lost in large numbers.

No, it is not a Chinese miracle, but it is a U.S. policy debacle.

In this scenario, the 1,000 Yuan price of the flat screen TV to the American company (e.g., Walmart) would be $500 for the TV when the Yuan is at $0.50 per Yuan. After Chinese intervention in the foreign exchange market by selling Yuan and buying Dollars the Dollar price of a Yuan moves to $0.125 per Yuan and the television now costs $125 (75% discount). This is why we buy Chinese goods! While the exchange rate has moved to $0.16 per 1 Yuan, the Yuan is still very much undervalued relative to the $0.500 per 1 Yuan. The current discount from the mid 1980s is still about 70%.

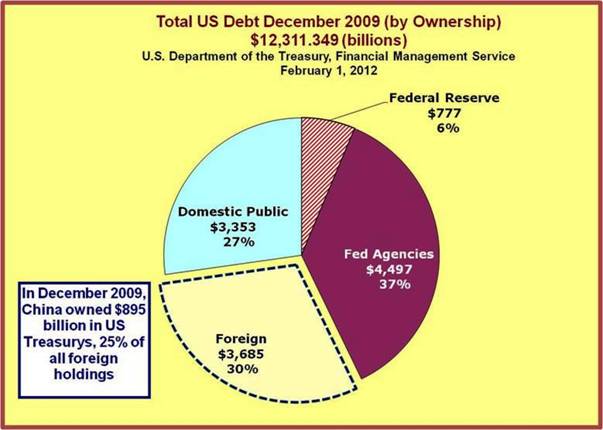

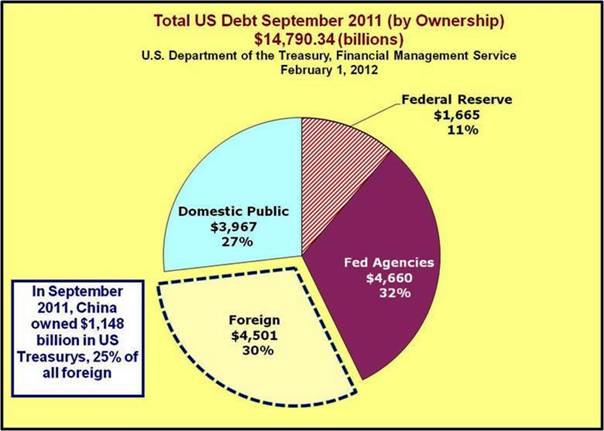

This has caused the U.S. to develop a persistently large trade deficit with China and the need to finance it by borrowing large amounts from the Chinese and thus accumulating a large outstanding debt with them.

This is a major reason why it can be truthfully said that the U.S. lost jobs to China. Of course overcompensated and bloated management and labor, especially labor represented in collective bargaining by unions, played an important role.

Automation in U.S. manufacturing spurred on by such high costs of doing business has helped cause the job loss in the U.S. as well. But when you reduce the cost of a 1 Chinese Yuan by 75% from $0.50 U.S. $0.125 U.S. for 1 Yuan and maintain that exchange rate for a long period, U.S. imports of goods and services from China will be persistently higher than before the Yuan was depreciated of it you prefer, devalued.

At the same time this means that U.S. goods are much more expensive because the cost of imports from the U.S. by China rose by 300% as the cost of 1 Dollar increased by 300% from 2 Yuan to 8 Yuan per Dollar.

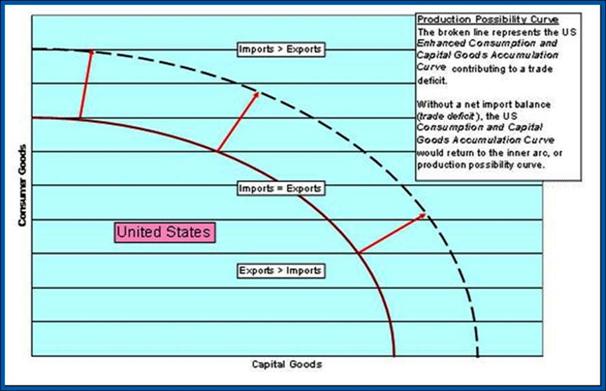

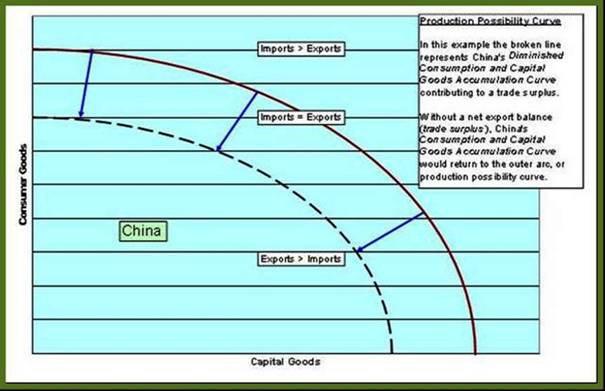

The benefit to the U.S. from this benign policy of not countering China in the foreign exchange markets (by selling Dollars and buying Yuan) and the resulting Trade Deficit, was to allow the U.S. to operate beyond it product possibility curve in terms of total consumption and real investment.

We have gone into the production possibility constraints and consumption aspects of the relationship with China in a number of previous newsletters:

Why 25+ Years of Trade Deficits?

A tale of High Real Risk,adjusted Interest Rates and the Appreciating/Depreciating Dollar

www.econnewsletter.com/jan122011.html

U.S. Trade Deficit: Good, Bad, or Irrelevant?

archive newsletters/2003%20Volume

The cost to China was the necessity of operating within their production possibility curve in terms of combined consumption and real investment. This persistently rising personal income of the Chinese but less goods and services available for domestic purchase has resulted in significant inflationary pressures in China. In the U.S., it has led to a reduction in inflationary pressures and at times, the fear of deflation occurring.

Recall from foreign exchange theory that China purchased Dollars and sold Yuan to devalue the Yuan by 75% bringing the Dollar price of the Yuan from $.50 per 1 Yuan down to about $.125 U.S. per 1 Yuan. The U.S. chose not to counter these moves. Under severe criticism from critics in the U.S., the Chinese let the Dollar depreciate a little from around $.125 per 1 Yuan to around $0.16 per 1 Yuan.

The relatively small depreciation of the Dollar (same as appreciation of the Yuan) still leaves the Yuan nearly 70% cheaper than it was when all this began, now many years ago. Since several presidents and Congressional majorities from both political parties have been in power over this time period, it would seem a splendid example of bipartisanship in this disastrous policy!!!

A Chinese miracle?

No.

An American bipartisan policy debacle?

Yes.

The resulting debt to China will still remain but forcing the exchange rate back to its t rue equilibrium will eliminate the trade deficit with China. A secondary effect of the Dollar depreciation would be to substantially reduce the Yuan value of their accumulated investment in the U.S. Future Chinese investments and imports from the U. S. would be much cheaper at something closer to 2 Yuan for a Dollar instead of the current 6+ Yuan for one dollar.