October 12, 2011

For a downloadable version, click the following:

Fed Open Market Operations…a trail of tears

OPEN MARKET OPERATIONS HAVE BEEN – AND - WILL CONTINUE TO BE THE FED’S CHIEF TOOL FOR IMPLEMENTING ITS MONETARY POLICY DECISIONS

The occurrence of the Financial Fiasco of Two Thousand and Eight (FFTTE) led to a significant departure for the FED (Federal Reserve System) in carrying out its policy decisions (www.econnewsletter.com/jan022009) They purchased private sector securities, for the most part CDOs (consolidated debt obligations) including MBSs (mortgage backed securities) as part of their share of bailing out the yield and commission-chasing losers, opened wide the nearly closed (at the time of the onset of the FFTTE) Discount Window and resorted to a variety of measures either not used for a number of years or a few that were novel.

Even though the financial system is far from being out of the deep woods, the FED has begun to revert to the operating style that preceded the FFTTE. Prior to the onset of the FFTTE, the Discount Window or Discount Facility was all but closed, albeit very gradually. The use of implementing policy changes through altering required reserve ratios has been both simplified and stabilized for a number of years. In days of yore, as one goes back in time, these were much more important and more frequently used than in recent years leading up to the FFTTE.

Recall the inverse relationship between interest rates and security prices. The causality runs both ways: when interest rates rise, security prices fall; and when interest rates fall, security prices rise. The interest rates are the discount rates that determine the discounted present values or market prices of the securities in question. When the FED wants to drive interest rates down as in the QE 1-3 (Quantitative Easing), it purchases securities. These actions increased the demand for the securities and caused the price to rise resulting in the yields or interest rates on them to fall.

In the previous issue of this newsletter, we revisited former Fed Chair, Alan Greenspan’s ‘conundrum’ (www.econnewsletter.com/oct062011):

October 6, 2011

Greenspan’s frustration with what he termed a conundrum, was due to the mistaken belief of the FED that by driving down short term interest rates, the longer term interest rates would also, like Humpty Dumpty, come falling down. Alas, they did not do so.”

June 1, 2005 – Baltimore Sun – Jay Hancock

In February [2005], he called low long-term interest rates (another way of saying high bond prices) a "conundrum" that was hard to explain in the face of the Fed's repeated increases in short-term rates.”

- Concerns about rising asset values (wealth effect)

- Concerns about inflation (cost push – coming from recartelized oil!)

- The Conundrum – rising Fed Funds (and hence, short term Treasury rates) but long-term rates not following

Alan Greenspan Testimony before Senate Banking Committee

February 16, 2005

www.federalreserve.gov/boarddocs

- “Among the factors contributing to the strength of spending and the decline in saving have been developments in housing markets and home finance that have spurred rising household wealth and allowed greater access to that wealth. The rapid rise in home prices over the past several years has provided households with considerable capital gains.”

- “Still, although the aggregate effect may be modest, we must recognize that some sectors of the economy and regions of the country have been hit hard by the increase in energy costs, especially over the past year.”

- “For the moment, the broadly unanticipated behavior of world bond markets remains a conundrum. Bond price movements may be a short-term aberration, but it will be some time before we are able to better judge the forces underlying recent experience.”

www.econnewsletter.com/aug082011

Remarks by Chairman Alan Greenspan

Reflections on central banking

At a symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming

August 26, 2005

www.federalreserve.gov/Boarddocs/Speeches

In Greenspan’s own words,

Our forecasts and hence policy are becoming increasingly driven by asset price changes. The steep rise in the ratio of household net worth to disposable income in the mid-1990s, after a half-century of stability, is a case in point. Although the ratio fell with the collapse of equity prices in 2000, it has rebounded noticeably over the past couple of years, reflecting the rise in the prices of equities and houses.

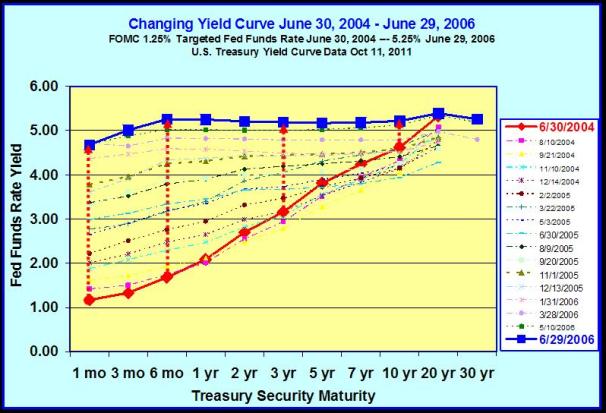

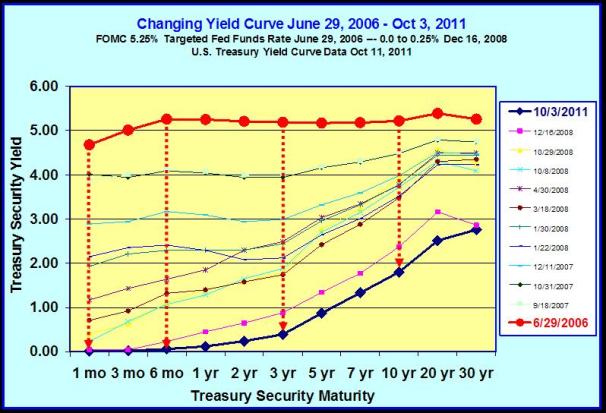

While the FED put upward pressure on short term interest rates, long term interest rates did not follow them upward; in fact, they fell a bit. Long term interest rates, (reflecting the market consensus as to the behavior of future expected short terms interest rates) did not rise. The yield curve flattened instead of rising in a more or less parallel fashion.

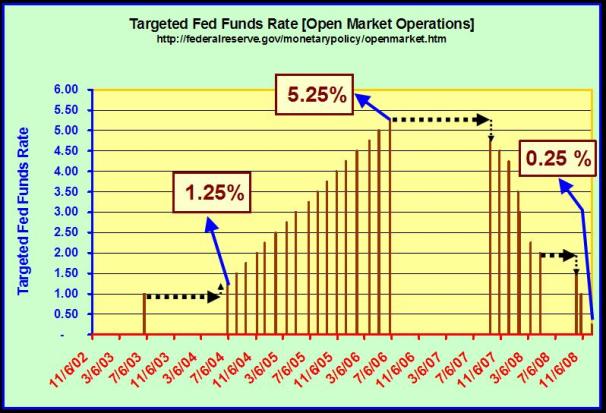

DRIVING UP FED FUNDS RATE (SHORT-TERM INTEREST RATES)

DRIVING DOWN FED FUNDS RATE (SHORT-TERM INTEREST RATES)

The need for having a portfolio including a significant quantity of long term securities is asymmetrical. They can always buy them in order to drive security prices up and interest rate down. But to drive long term interest rate upward, they must have a sufficient quantity of long term securities in their portfolio than can be sold. That is probably one of the reasons why the FED had announced its intention to purchase long term government securities. It not only drives such prices upward and interest rates downward, but it gives their portfolio the possibility of enabling the pursuit of restrictive monetary policies should higher inflation rates occur WHEN the economy once again starts to grow at a reasonable rate.

The FED could have relied on the private debt securities it had acquired, but it would have had to sell a good part of them at losses and the performing MBSs are often eliminated by the parties issuing those underlying mortgages, as they sell their homes after a few years and thus extinguish the mortgages that made up the pool that was behind the derivatives.

This type of ‘locked-in effect’ and the indeterminacy of the true terms to maturities of the underlying mortgages makes U.S. Government securities a better medium in which to conduct monetary policy operations. Should the FED face inflationary pressures in the future, it will have the portfolio needed to put upward pressure on interest rates by putting downward pressure on government securities by selling them.