September 30, 2011

For a downloadable version, click the following:

WHAT PRICE BAILOUTS? WHAT PRICE THE ELIMINATION OF THE GLASS-STEAGALL RESTRAINTS AND THE continuance of the ‘TOO BIG TO FAIL DOCTRINE’?

Is our financial system becoming a cesspool? When the restraints imposed on the financial system resulting from the passage of the Glass-Steagall Act (www.econnewsletter.com/jul162011) and like legislation were beginning to be phased out by court cases, regulatory decisions and finally legislation, the new found freedom looked promising. Bank holding companies were popping up like mushrooms after the first frost. Sister subsidiaries, within a bank holding company, were to be separated from one another by supposedly impregnable fire walls, so-called Chinese Walls (en.wikipedia.org/wiki/Chinese_wall). As time has passed, the true nature of such firewalls has been exposed as flammable as papier-mâché. The corporate culture of the increasingly ‘conglomerated’ bank holding companies is more and more dominated by the high rolling investment bankers and not the more sedate and risk averse commercial bankers.

This can be seen by the statements such as that of Mr. Dimon, head honcho of the investment banking subsidiary with its bank holding company JP Morgan Chase (or is it the other way around?…hard to tell) concerning the commercial banking capital ratios as determined by the Basel III accord:

blogs.wsj.com/marketbeat/2011/09/12/jamie-dimon

I’m very close to thinking the United States shouldn’t be in Basel any more. I would not have agreed to rules that are blatantly anti-American,” he said. “Our regulators should go there and say: ‘If it’s not in the interests of the United States, we’re not doing it’.

Global Regulators Approve Big Bank Capital Surcharge

Published September 28, 2011

www.foxbusiness.com/industries/2011/09/28/global-regulators

Commentary in Bloomberg on Basel III

Published September 22, 2011

Recall that it was the collapse of the gold-coated junky derivatives marketed by the investment bankers that triggered the current and ongoing collapse of the U.S. financial system. With the aid of the apparent color blind, rather, ‘only see green’ rating agencies, the yield chasing and normally sane investment officers of government units, pension funds and financial institutions became ravenous collectors of the financially trashy CDOs (collateralized debt obligations) including MBSs (mortgage-backed securities).

U.S. Federal Reserve System, Federal Financial Institutions Examination Council

www.ffiec.gov/nicpubweb/Content/HELP/Institution

- Bank Holding Company

- A company that owns and/or controls one or more U.S. banks or one that owns, or has controlling interest in, one or more banks. A bank holding company may also own another bank holding company, which in turn owns or controls a bank; the company at the top of the ownership chain is called the top holder. The Board of Governors is responsible for regulating and supervising bank holding companies, even if the bank owned by the holding company is under the primary supervision of a different federal agency (OCC or FDIC)

- Commercial Bank

- A financial institution that is owned by stockholders, operates for a profit, and engages in various lending activities.

- Investment Bank/Company

- Acts as underwriter or agent that serves as intermediary between issuer of securities and the investing public.

Should Bank of America and the rest have avoided the lure of investment banking?

(Investment) Bank Of America?

BofA aims to build its way up to the top tier of investment banks. It won't be easy.

May 22, 2006

www.businessweek.com/magazine/content

After all, it earned $16.9 billion last year, 85% of that in commercial and retail operations, where it's a force unequaled.”

…

BofA CEO Kenneth D. Lewis is convinced that bigger growth opportunities are in investment banking, especially stock underwriting, initial public offerings, and mergers-and-acquisitions advice.”

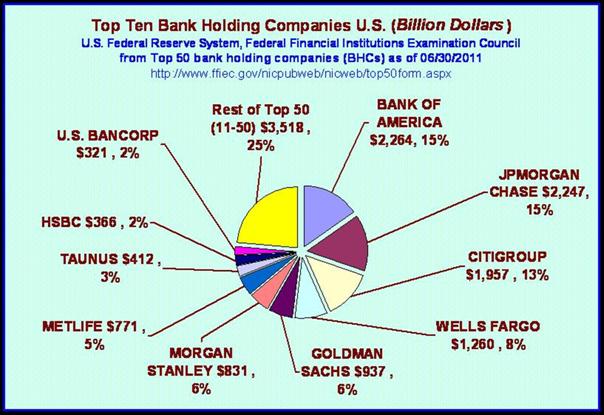

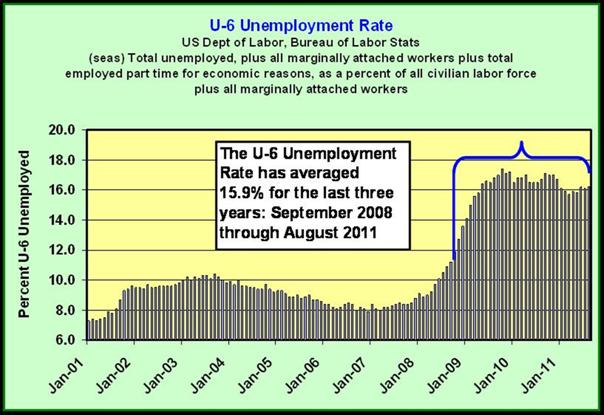

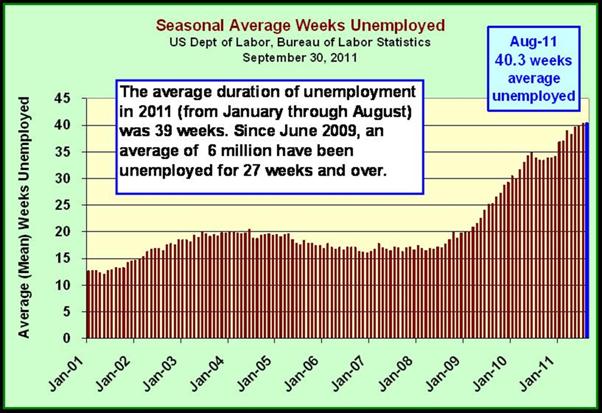

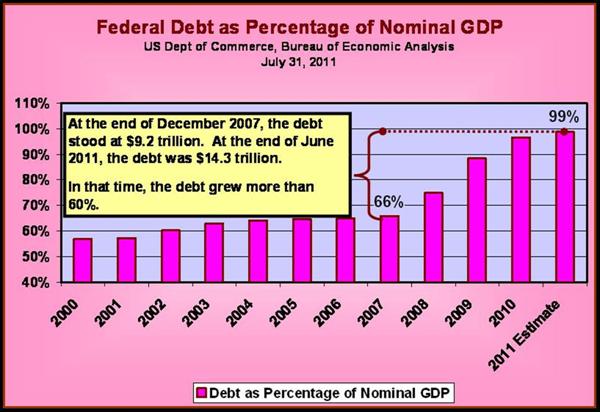

Fees, commissions and profits for the investment banking gang soared into the billions as they planted the seeds of contagion for the U.S. financial system and the overall economy and those of several other nations. The earlier bailouts of the so-called hedge funds such as Long-Term Capital Management LTCM (brought to you by Black-Scholes (en.wikipedia.org/wiki/Black_Scholes), were really highly speculative and market destabilizing funds masked as hedge funds. The First Responders to bail out mania, the Federal Reserve System, our beloved central bank, came to the rescue, along with the presidential administration and its captive U.S. Congress joining them with our wallet wide open. Once again the ‘too big to fail doctrine’ was invoked, (or is it really the ‘save the old boy network docrine’?). Federal government budgetary deficits soared and the unemployment rate roared to heights challenging those of the Great Depression (the non sugar-coated U-6 measure quickly rose to and has stalled for three years, averaging around 16%).

The Great Recession became firmly entrenched as the housing market collapsed along with the comatose-like behavior of the markets in which the public’s pension funds and hard earned savings were invested. The Golden Years for many have become the rusty years. Sovereign risk for the U.S. Federal government is an imminent danger and an increasing number of municipal governments rock at the edge of bankruptcy.

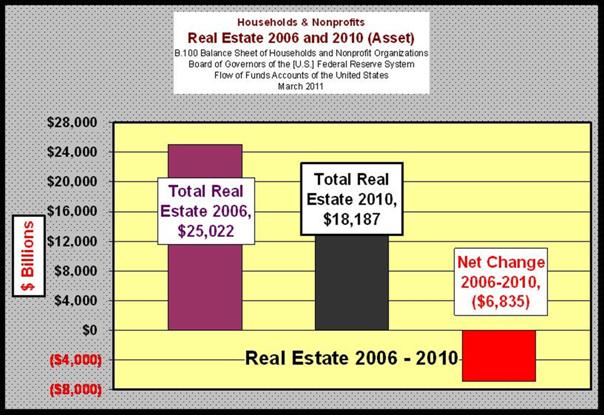

27% reduction in real estate values from 2006-2010 – so much for the nest, let alone the nest egg…

MISSION ACCOMPLISHED; REDUCE HOUSEHOLD NET WORTH PRIMARILY THROUGH COLLAPSING REAL ESTATE VALUES BY $7 TRILLION, THUS NEUTRAZING THE WEALTH EFFECT AND ENDING IRRATIONAL EXUBERANCE

www.econnewsletter.com/jun082011

Recall from earlier articles on this web site (www.econnewsletter.com/jul162011), financial services firms employ a relatively high degree of debt or financial leverage (ratio of liabilities to assets). This is due to the relatively low operating leverage (ratio of profits to assets or ROA – Return on Assets). To achieve a reasonable return on equity (ratio of profits to owners’ equity or ROE – Return on Equity) they balance off the low degree of operating leverage with a high degree of financial or debt leverage. But this low cushion of owners’ equity results in a high degree of vulnerability to bankruptcy. This was usually understood by commercial bankers. Back in the 1950s and 1960s before the department store mentality of conglomerate holding companies became dominant, capital ratios (where capital overwhelmingly consists of in owner’s equity) for large commercial like Bank of America and Citibank often were between 2 and 3 percent. This worked as those large banks served the lower risk, short-term end of the credit market and did not compete with the bond market. Long-term loans emanating from those banks were rare.

All of that has changed. Longer term lending and relatively higher credit risk lending became much more important. Of course the average interest rate risk and credit or default risk of their portfolios rose considerably.

Domestic regulators pressured the depositories to raise their capital ratios in this higher risk environment. With the recession of 1980-82 engineered by the FED to eliminate much of the inflationary pressures that had built up in the 1970s, inflation eased substantially and interest rates fell as the inflation premium fell. The Fisher effect which was virtually absent in the late 1950s (complete illusion), became virtually fully operative by 1980 (rational expectations).

As regulators in the U.S. and the budding E.U. began to realize that the commercial banking landscape had permanently changed, capital ratios became the focus of regulatory scrutiny. Since then, three ‘Basel Accords’ have occurred. Because increased risk taking in credit creation activities was the new mode, the idea of risk-based capital ratios became front and center. Low capital ratios and high levels of risk-taking are an explosive formula for bank failure. If yield is to be chased, a larger buffer to ward off bankruptcy is necessary in the form of higher capital ratios.

The irony of this is that the high profits from higher yielding credit creation activities initially increase profits and the ROE (return on equity). When risk materializes – as it will sooner or later…the lack of sufficient capital results in bankruptcy, or in the questionable policy of bailouts. The steady trend for higher capital ratios reduces financial or debt leverage and hence causes a lower return on equity, thus bringing the profitability of credit creation activities by commercial banks back to square one.

Remember that when commercial banks and the other non-commercial bank depositories create credit, it is usually achieved by creating addition M-1 money in checkable deposit form and lending it out, so to speak. But there is a ‘rub’ here to borrow a term from Will Shakespeare. Given a capital ratio, as assets in the form of loans increase, the dollar amount of capital must also be increased. Either more profits must be retained or more capital stock must be sold. If capital ratios are raised, the problem of maintaining sufficient capital is exacerbated.

NOW YOU KNOW A MAJOR REASON FOR THE LACK OF CREDIT CREATION THAT IS OCCURRING.

Who should you trust for the good life, free market capitalism or creeping socialism?

www.econnewsletter.com/aug012011

Given the much higher level of Federal Debt as a percent of GDP and the ever-increasing rise in sovereign risk and the questionable success of the first round of bailouts by the FED and Treasury, a second round will meet much more intensive resistance than did the first. Remember that during the Great Depression, 40 percent of all commercial banks disappeared (www.econnewsletter.com/jul162011) and legislation such as the Glass-Steagall Act was instituted separating commercial banking from other credit related activities such as investing banking.

History could repeat itself.