2012 Volume Issue 11

April 26, 2012

For a downloadable version, the following:

…a bit more compressed version of the PDF

The Income Distribution and its Relationship to Competition from the Perspective of Theoretical Welfare Economics

There has been much debate over the redistribution of income of late with the financial district occupiers referring to themselves as the ’99-percenters’, but let’s revisit the initial income distribution and how competition can drive us toward a more optimal theoretical welfare economic status.

Theoretical Economic Welfare Conditions

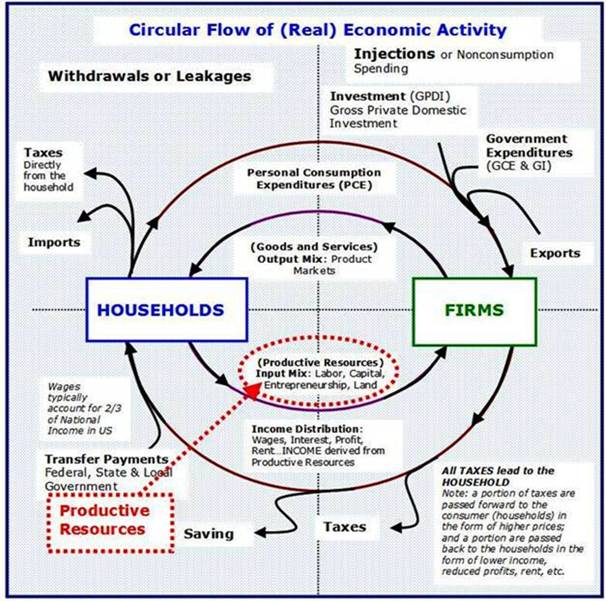

The effects of this increase in competition bring the income distribution closer to the theoretical economic welfare condition of equity -- consumers pay the lowest price possible consistent with the reward to resources equal to their opportunity cost -- and thus to conformity with commutative justice. It simultaneously causes the market price to approach the theoretical economic welfare condition of efficiency.

As the distribution of income is more closely based on opportunity costs of the productive resources such as labor and capital, the closer is the economic system to conformity with distributive justice. This in turn reduces the need for government to reallocate income.

1776 WAS QUITE A YEAR. While revolution in the British colonies had begun a year earlier in America and might be listed as most noteworthy, it was the year of the publication of Adam Smith’s Wealth of Nations, also a revolution of an intellectual type. Following Quesnay’s Physiocratic lead, Smith assaulted the bastion of Mercantilism, a school of economic policies consistent with the rise of the British Empire.

THE U. S. TRADE DEFICIT

September 9, 2011

Over several centuries, as small political units were combining into nations, an economic doctrine developed in conjunction with nation building. It was called Mercantilism in England. In France a similar doctrine was called Colbertism and in Germany, Cameralism. A surplus in the trade or merchandise and services balance in those days was called a favorable trade balance. The excess of exports over imports often meant that gold or gold coins were the means of settling the balance with the gold flowing into the nation with the surplus. This was a means of financing the building up of the strength of the budding nation as it could buy mercenaries, such as Hessians for England as they conquered and occupied colonial America.

One of the most famous terms he coined by Adam Smith, was the INVISIBLE HAND

. He was referring to vigorous competition in markets. He only used it a few times (once in Wealth of Nations) but it is central to his support of free market capitalism. In effect he was saying, do your damndest to maximize your self-interest, but if the Invisible Hand of vigorous competition is present in the market, your self-interest will also lead toward a maximization of the common good.

Of course, absent the Invisible Hand, all bets are off. In that case he explained that,

People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.

Adam Smith – An Inquiry into the Nature and Causes of the Wealth of Nations

Michael Forsyth MP (British)

Adam Smith's Relevance for Today

For [Adam] Smith, government should not seek to subvert the creative process that is the market, but should establish the framework necessary to keep it alive. It should enforce competition. It should not give in to the well-argued demands of monopolists and would-be monopolists. It should punish people and authorities who conspire to fix prices, divide up markets, or restrict production.Monopoly,wrote Smith,is a great enemy to good management

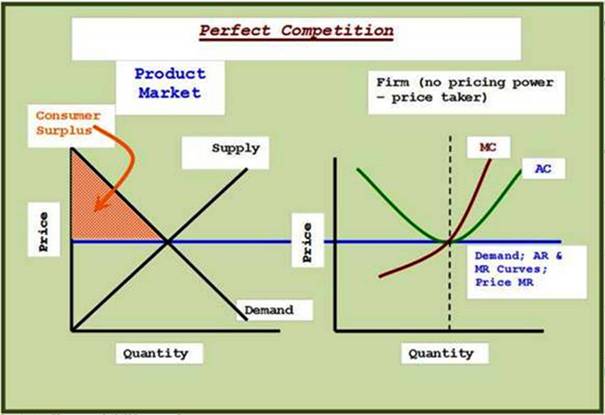

The limiting case of vigorous competition is termed perfect or pure competition. While it may exist in the mind, it does not in reality. A few markets come close. Don’t let this lead you to thinking that competition does not matter as some more ideologically oriented economists argue. As markets become increasingly competitive, they gradually take on the characteristics of the limiting case of perfect competition.

If the limiting case of perfect competition occurred, the optimal state of economic welfare of society would be reached. On a microeconomic level, efficiency and equity would result and on a macroeconomic level, high employment (natural rate of employment) and a reasonable degree of price level stability (very mild deflation) would result once a long-term equilibrium occurred.

Keep in mind that we are not ignoring market imperfections (market failures). We will present that material in the next posting…fear not.

In articles on other websites we have argued, as have many others that the path to justice is best reached by ensuring as much competition as is possible in markets within a free market capitalistic system.

A few definitions for the sake of clarity…

Efficiency

Efficiency means that the per capita standard of living is at a maximum given the stock of resources, technology, etc. The consumer is able to purchase the greatest quantity of goods and services at the lowest possible price, thus maximizing the real purchasing power of their income. This can be viewed as the consumer’s income having the most ‘bang’ for the buck. Technically, one condition achieved when efficiency exists is that the price equals marginal opportunity costs.

Equity

Equity means that the consumer surplus is at a maximum subject to the constraint that all productive resources are receiving a reward or income just bit higher than their opportunity cost, no more and no less. There is no producer surplus (no ‘economic rent’ nor surplus rewards to capitalists, labor nor entrepreneurs). This is what keeps you working at your current job. You are compensated just enough to keep you from leaving for greener pastures.

Consumer Surplus

The consumer surplus is an estimate of how much more consumers would be willing to pay for the market quantity purchased if they had to, but do not have to if only one price is charged to all buyers (no price discrimination). While a laptop computer might be worth several thousand dollars to a potential buyer, competitive forces have pushed the prices down to less than a thousand; thus, moving toward maximizing the consumer surplus.

Opportunity Cost

In the following paragraph, the reservation price could be the next best alternative to a productive resource. This could for example, be the price below which leisure would be chosen over work or consumption over saving and investing.

This is the compensation that a productive resource such as labor, could earn in its next best COMPETITIVE alternative employment. Remember that the productive resources include not only labor, but debt and equity capital, entrepreneurship and land (which encompasses natural resources). Included in opportunity cost of equity capital is what is referred to as ‘normal’ profits (or its financial equivalent, required rate of return on the investment).

Using labor as an example, if you are receiving less than your opportunity cost from your employer, in a competitive environment, you would simply find another job that covers your opportunity cost. Conversely, if you are receiving in excess of your opportunity cost as a productive resource such as labor or management, this violates the principle of equity and, if left unchanged and occurring in competitive product markets, it will eventually have ramifications in terms of long-term viability for the firm, e.g., General Motors and Chrysler.

Producer Surplus/Economic Rent

Normal profits or opportunity cost level profits are a cost in economics just as is the cost of labor compensation. Equity capitalists are self-employed. Technically and simply, the firm they own employs them. The self-employed include stockholders. Income or compensation to productive resources in excess of this opportunity cost level is called a producer surplus (economic rent is the more traditional term), and is above what is needed to bring and keep the resource in the firm’s employment.

Connection between Consumer Surplus and Producer Surplus

Any producer surplus flowing to the productive resources such as labor or the owners (equity capitalists) came at the cost of a reduced consumer surplus and some degree of deadweight loss. This causes the consumer/buyer to pay more than they would otherwise have to pay in a more competitive environment. As competition increases, downward pressure of product prices will eventually reduce the producer surplus and increase the consumer surplus along with a restoration of the deadweight loss to the consumer surplus.

A Microeconomic Perspective

As economic markets become increasingly competitive, they approach what are called the microeconomic welfare conditions of equity and efficiency. Equity, which is significantly different than equality, is achieved when the consumers pay the lowest price possible, subject to the condition that all productive resources, labor, debt and equity capital, entrepreneurship, and land receive their opportunity cost, no more and no less. When the consumers pay the lowest price possible, subject to the constraint of paying all resources their opportunity cost, economists say that the consumer surplus is maximized.

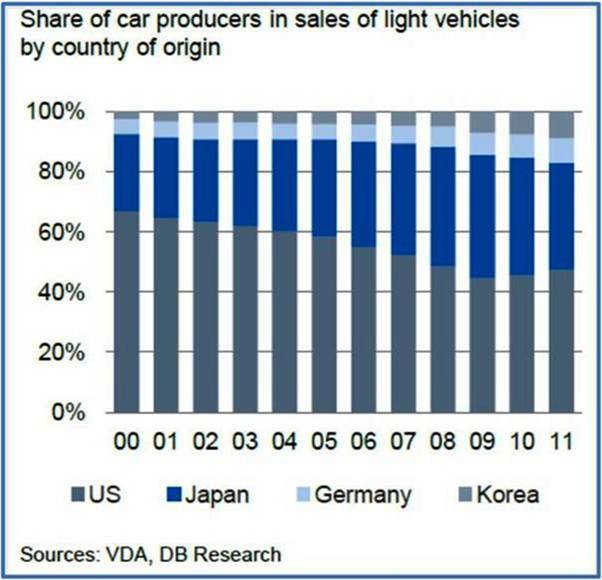

An example of increasing competition is the entry of additional firms into a market, such as the U.S. automotive market in the 1950s. About ninety percent of that market was shared by three American auto firms. Initially, virtually all of the competition was from imported vehicles that held around ten percent of the market. Within a few years, foreign automotive firms began to transplant their operations into the U.S., primarily in low labor cost areas. They were typically more highly automated and used a lean management style that resulted in a relatively low cost structure. Initially competing at the low end of the market, the transplants began to dominate it. Later they also began to compete seriously in the pricier end of the market.

The transplants gradually increased their market share using primarily domestic U.S. productive resources, until they currently have nearly sixty percent of the market, most of which is from U.S. based operations and some imports into the U.S. Initially, the quality of the foreign imports and transplant produced vehicles was suspect and reduced the substitutability of those vehicles for those produced by the Big Three American firms. This quality problem was gradually addressed and overcome, thus making the transplant vehicles increasingly good substitutes for the Big Three produced vehicles that were also increasingly using less costly and higher quality foreign made components in their own vehicles.

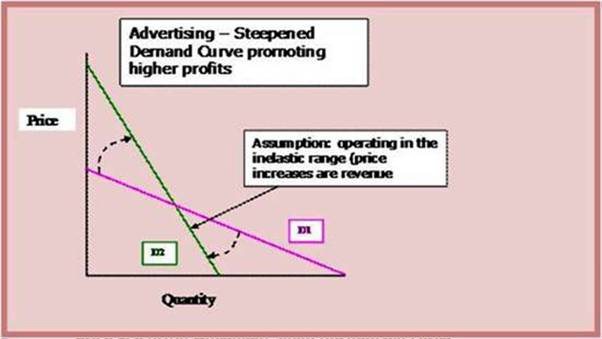

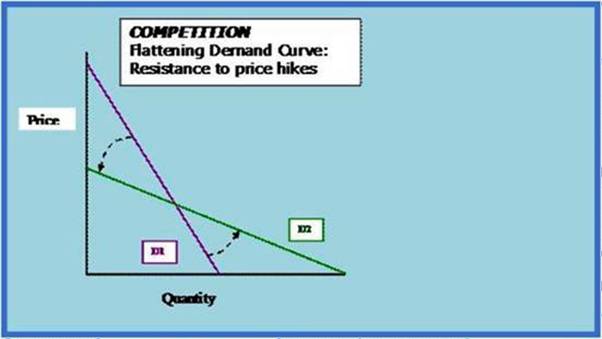

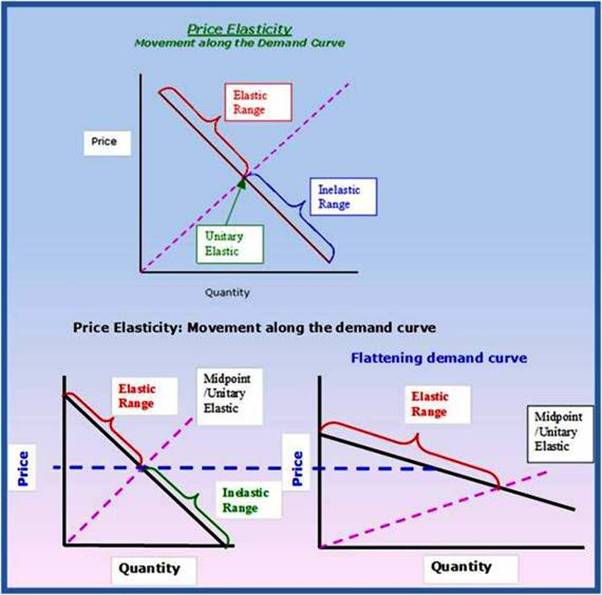

Technically the increase in competition increases the supply of the product in the market, in this case motor vehicles, thus exerting downward pressure on the market price. There may also be a positive quality effect on the goods and services produced. At the level of the firm, as competition increases, the price elasticity of demand facing the firm increases. Technically, the firm’s demand curve rotates toward the horizontal. This causes individual firm’s price increases to be less revenue enhancing. Economists would say that the more substitutes and the greater their substitutability for existing products, the greater the substitution effect when prices are changed. If competition increases significantly enough, price increases by individual firms will actually decrease total revenues from sales of their product. Economists call this the price elastic range of the firm’s demand curve which corresponds to the upper half of most firms’ demand curves.

Individual firms lose their market power to control the price as competition increases. They become more price takers and less price makers, as the expression goes. This in turn decreases the rewards to the productive resources that produce the goods and services in the transformation process of production. As competition increases, the surplus rewards to the productive resources in excess of their opportunity costs decrease thus increasing the consumer surplus. Some of the dead weight loss is restored to the consumer surplus, as well.

The effects of such increases in competition bring the income distribution closer to the theoretical economic welfare condition of equity -- consumers pay the lowest price possible that enables the firm to pay productive resources their opportunity cost -- and thus to conformity with commutative justice. It simultaneously causes the market price to approach the theoretical economic welfare condition of efficiency which occurs when the price the firm receives for its product is equal to the sum of the marginal opportunity costs of all the productive resources helping produce the product.

Since everyone is a consumer while only some are productive resources and those productive resources have differing opportunity costs, maximization of the consumer surplus while rewarding productive resources with their opportunity costs, reduces the more severe inequalities stemming from the exploitive use of market power, a byproduct of the lack of competition. This promotes social justice and enables the policies to promote social justice to focus upon other basic causes of social injustice such as illegitimate types of discrimination.

A Macroeconomic Perspective

As competition increases, the economy moves toward the widely desired goals of high employment and a reasonable degree of price level stability. As these goals are approached, the need for government intervention through monetary and fiscal policies is reduced significantly.

When markets lack significant competition, prices tend to be rigid downward. In pursuit of profit maximization, when demand weakens, in order to reduce market surpluses and rising unwanted inventories, firms tend to reduce output by a greater amount than if the market in which they sell their products were more competitive.

Pursuant to profit maximization, there is usually little reluctance to raise price when the demand they face increases causing a shortage at the prevailing price. This lack of competition introduces a downward rigidity in pricing giving rise to twin biases toward both recession and inflation.

As markets become increasingly competitive the downward price rigidity weakens as firms lose market power and control over price. Competitive pressures force the price downward and as a result, the economy more closely approaches the macroeconomic goals of high employment and a reasonable degree of price level stability. The fall in the price reduces the decrease in quantity supplied needed to restore equilibrium in the market. This reduces the need for government intervention to achieve the widely accepted goals of high employment and a reasonable degree of price level stability.

As pointed out previously, when equity is closer to being achieved, it reduces the degree of government intervention to reallocate income to lessen the degree of inequality in the income distribution. Thus the income distribution conforms more fully to the welfare conditions of equity aids in the achievement of efficiency as well. What drives the economy toward these microeconomic and macroeconomic conditions is what Adam Smith referred to as the Invisible Hand of competition. A more technical version of the presence of the Invisible Hand refers to the inability of firms and productive resources to manipulate supply or demand. As competition increases, the market power to influence price by individual firms and productive resources, decreases.

The constraints [length] on this presentation necessitate analysis of only the supply side and how increasing competition works to eliminate market manipulation which in turn brings the economy closer to the economic welfare conditions of equity and efficiency in the micro aspect of the economy and high employment and a reasonable degree of price level stability in the macro aspect of the economy. As these economic conditions are approached through greater competition, the need and political agitation for the redistribution decreases since the extremes of the income distribution are lessened.

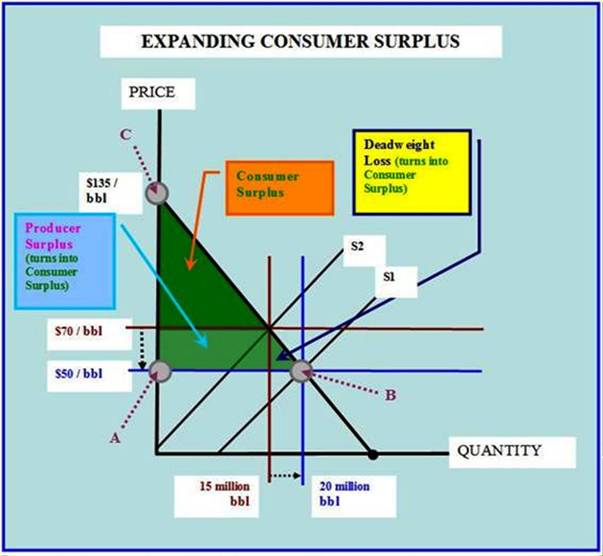

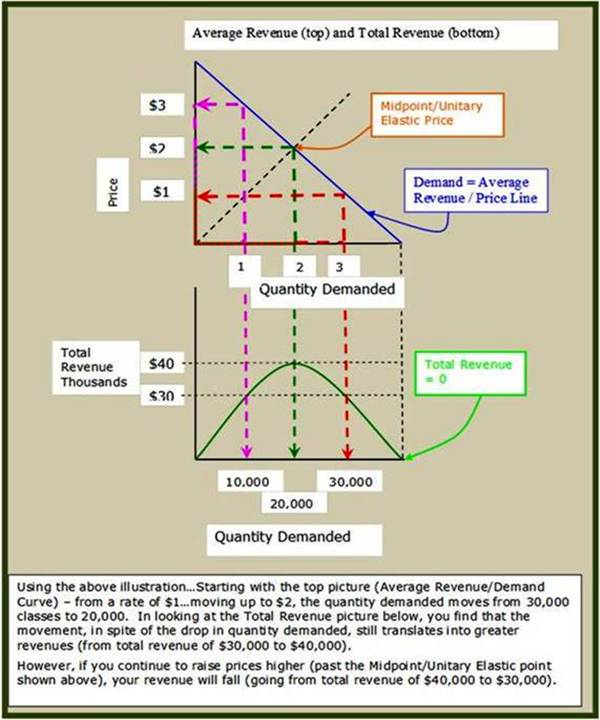

As competition in a market decreases, individual firms such as members of the oil cartel, OPEC, as well as the re-cartelized American segment of the oil industry (our domestically operating firms go along with market prices dominated by the offshore OPEC gang) are able to expropriate some of the consumer surplus and convert it to producer surplus (economic rent) with an additional loss to the consumer called the deadweight loss. The inequality in the income distribution becomes greater and increases the support for increased government intervention to make it less unequal by redistribution schemes.

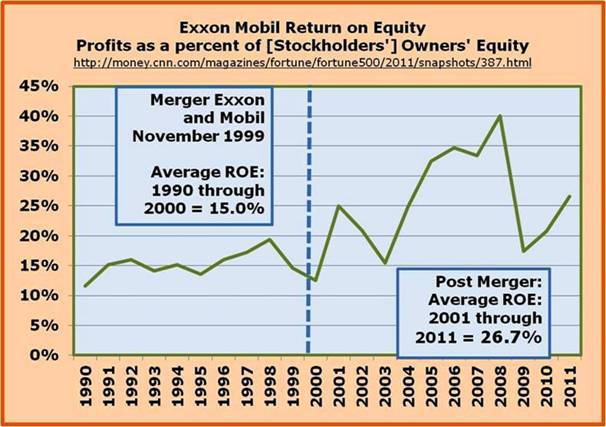

The excessively high rates of return on equity (profits divided by owners’ equity) of oil giants like Exxon Mobil give testament to the resulting violation of the welfare condition of equity.

The welfare condition of efficiency is also violated resulting in a lower per capita income while at the same time aggrandizing the more concentrated firms in the market.

The wielding of monopoly power is not confined to the product markets for goods and services but also occurs in the markets for productive resources such as labor, through devices such as unions that bestow upon them a power to control the price by reducing the supply of labor. Unions are labor cartels and while increasing total compensation to workers, they reduce employment and reduce job security. OPEC sells less oil but receives more revenue. Organized labor receives high total compensation rates but to fewer workers.

Why has [or has] the U.S. lost its competitive edge?

September 24, 2010

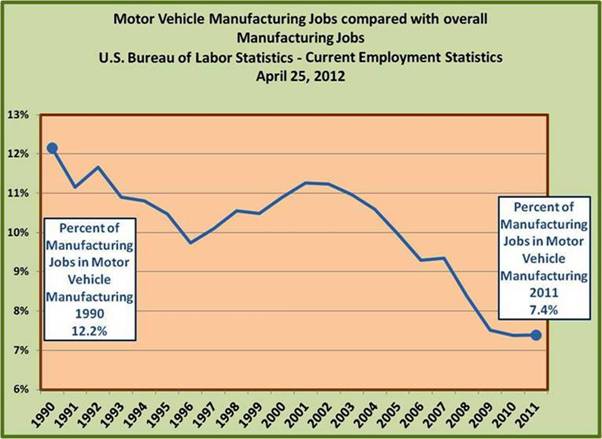

Overly protective policies favoring labor unions have made unionized labor such as those organized by the UAW too expensive and in particular the products of the formerly Big Three are no longer competitive. The market share of the formerly Big Three has shrunk from nearly 90% of the U.S. light vehicle market in 1950 to around 40% of that market now. The transplants, including Toyota, Nissan, Hyundai, etc., from mostly Asia have most of the 60%. The two tier labor contract Between the UAW and the Big Three may have been a case of too little, too late.

Heritage Foundation on Big Three labor compensation in 2008…

UAW Workers Actually Cost the Big Three Automakers $70 an Hour

December 8, 2008

The shift in employment to right-to-work states in the automotive industry is not unique. There has been a general trend in that direction for many segments of the economy. Department of Labor statistics show clearly the decline of the share of the civilian non-governmental labor force in recent years that are unionized. Interestingly, a rise in the unionized share of civilian governmental labor force has been occurring.

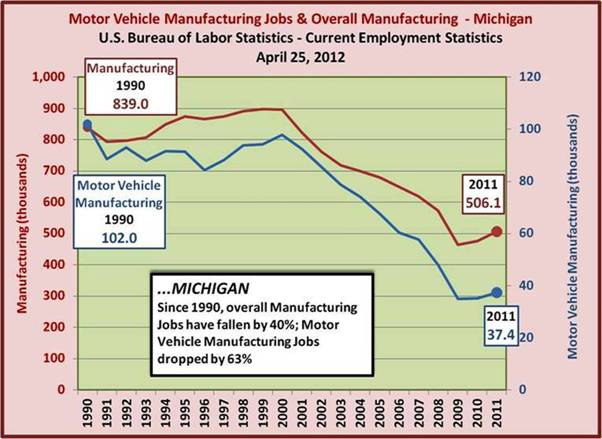

The ongoing structural unemployment in the UAW portion of the auto industry, specifically, the former Big Three, is such an example. Loss [in the long term] of market share to the transplants such as Toyota and Honda and accelerated automation have decimated the ranks of labor in the Big Three portion of the U.S. auto industry.

Deutsche Bank Research

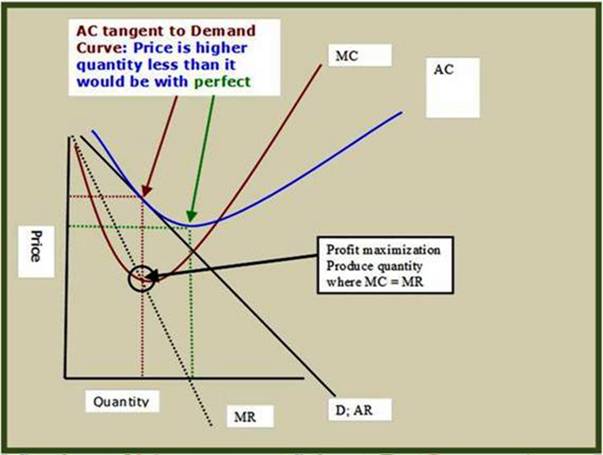

Firms with market power seeking to maximize their profits will reduce supply until the price they charge is that at which their profits are maximized. Technically, this is attained at a production level at which their marginal cost equals their marginal revenue. Since this also occurs at output levels where price is greater than marginal opportunity costs, the welfare condition of efficiency is violated and society’s overall per capita standard of living is lessened so the few can earn in excess of their opportunity costs. Both the economic welfare conditions of equity and efficiency are violated.

Measuring market power… (Abba) Lerner Index

The higher price enables the productive resources, initially equity capital, to expropriate a portion of the consumer surplus and earn more than the productive resources’ opportunity cost. This is the violation of equity. The use of this market power reduces the consumer surplus and converts it into producer surplus, a more modern tern equivalent to economic rent or reward to a productive resource greater than its opportunity cost. The excessive reward to the productive resource is due to the exercise of market power and not based on service to the consumers.

The resulting price causes a less than optimal level of production, thus violating the welfare condition of efficiency and lowering the per capita standard of living for the population. It also increases the pressure for increased government intervention to stabilize the economy through monetary and fiscal policies.

In these less than significantly competitive markets, the producer surplus can flow to other resources such as labor and management as we have seen in the Big Three portion of the automotive market where losses resulted in government bailouts while labor and management continued to receive substantial amounts of producer surplus (economic rent) well in excess of their opportunity costs. The bail out of financial services firms, especially the investment banking firms or the bank holding companies dominated by investment banking, is another such example.

These exercises of market power violate commutative justice as well as destabilizing the economy by introducing biases toward macroeconomic instability in the forms of recessions and unacceptably high inflation rates.

Let’s examine in a more specific manner how this damage to society occurs. The market power due to a lack of sufficient competition, introduces a degree of downward price rigidity. Twin biases toward recession and inflation result in less than an attainably higher level of employment as well as an inflationary bias and unacceptably high rates of inflation ultimately result. This is due to the firm’s willingness to raise prices when shortages develop but results in an increasing unwillingness, pursuant to profit maximization or loss minimization, to lower prices when surpluses develop due to a decrease in the demand confronting the firm. As a result these price changes display an upward or inflationary bias and exacerbate the downward movement of production and the upward movement of unemployment when demand weakens. This downward price rigidity reflecting the market power of firms when significant competition is lacking exacerbates cyclical movements in the economy. It is not due to free market capitalism, but to the lack of competition, Adam Smith’s Invisible Hand is weak or absent.

Government also increases its degree of intervention to reduce the increased inequality in the income distribution resulting from the exercise of market power by the firms and from the rewarding of productive resources in excess of their opportunity costs. Lack of significant competition also reduces the per capita standard of living of the population as efficiency as well as equity is violated.

The post WWII era is cluttered with monetary and fiscal policy interventions that are highly questionable in the results they caused. The tolerance of accelerating inflation in the late 1970s and then the abrupt reversal by the Federal Reserve System, engineering a two and one-half year long recession from early in 1980 to mid 1982 is one such example. The rapid run up of interest rates helping trigger the ongoing economic and financial crisis is another example of the destabilizing intervention by the monetary authority. A third example is the fiscal policy of the last three years in which the Federal budgetary deficit has tripled with few positive results and a growing fear of the inability of the U.S. Government to meet its debt obligations, manifesting sovereign risk for the country.

Cartelistic Free market capitalism, with lack of sufficient competition in many markets, gives rise to the power of firms and productive resources as evidenced by labor unions, and it engenders massive and frequent episodes of government intervention justified by intermittent periods of economic downturns and periods of significant rates of inflation. The need for such intervention can be lessened by implementing policies that promote competition.

The following technical notes and illustrations for those who find some of the material difficult and have the time to probe more deeply…

Price Elasticity of Demand and Total Revenue

Marketing/advertising’s goal is to reduce the substitution effect

Further on Price Elasticity of Demand: Shifting; flattening and/or steepening

Increasing competition, rotating the demand curve to a flatter position (price elasticity at each price increases)

When demand curve shifts to the right, price elasticity decreases with each price --- (greater ability to increase revenue with price increase)

Product differentiation (advertising) aims to reduce competition/ substitution effect --- (greater ability to increase revenue with price increase)

As we just explained, the relationship of the price of a good to the quantity demanded of that good is normally negative has an inverse relationship – when price rises, the quantity demanded of that good falls and price falls, quantity demanded of that good rises. The degree to which quantity demand responds to price depends upon substitution effects and income effects. As we saw, most goods are normal, so more often than not, the income effect does reinforce the substitution effect.

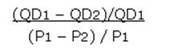

TR = P X QD

The total revenue a firm receives from selling a product depends upon the product of Price times Quantity Demanded (P X QD)…price times quantity demanded equals revenue (P X QD = Revenue). Now you have to stop and pause and think about this.

… All else equal (ceteris paribus),

- Profits = Revenue – Expense (cost)

- When revenue rises, profits rise

- When revenue falls, profits fall

- …ignoring cost for the moment…

Price Elasticity of Demand

The relationship of the price to quantity demanded and how it relates to total revenue is technically called the price and elasticity of demand.

Technically, the percentage change in quantity demanded divided by the percentage change in the price that caused the change in the quantity demanded.

Note: In other words we have to rule out all the factors that influence the quantity demanded. If we don’t, then we don’t have price elasticity of demand – that has to be understood.

So if you are trying to do this in real life – measure price elasticity, you would have to have complicated statistical routines which were able to mute the effects of all the changes that influence quantity demanded other than the price of that good itself.

What is the consumer surplus?

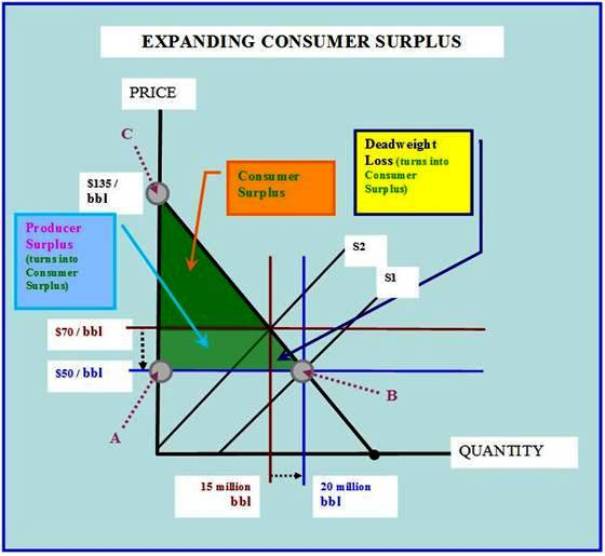

If you study the following graph explaining what a cartel such as OPEC does in order to increase the price, you will notice several things. First, note the triangle (for straight line demand curves) with its base as the perpendicular line from the price axis (Segment AB). Next, the line segment of the demand curve from where it meets the supply curve up to the price axis (segment BC). Lastly, we have the price axis down to the equilibrium price (segment CA). This is what is referred to as consumer surplus when the price is $50 per barrel. The buyers or consumers in this case, expend an amount equal to price of $50 per barrel times quantity demanded of 20 million barrels or $1,000,000,000 or 1 billion dollars. This is also the total revenue going to the firm. This revenue will then be used to pay all expenses with the remaining revenue being called profit, in an accounting sense. The triangle we have called the consumer surplus represents an estimate of additional expenditures the consumers would have paid if they had to in order to acquire the equilibrium quantity of 20 million barrels. In our example, the original consumer surplus is one half of [$135 -$50] or $85 times 20 million barrels or $1.7 billion.

Some of the potential revenue represented by the consumer surplus could be expropriated by the firm using a technique called price discrimination. A simpler tactic would be reducing the supply and driving up the price to everyone. If the firm is not able to do so, the consumer surplus stays with the consumers. Note: in this example, OPEC raised the price from $50/barrel for crude oil to $70/barrel of crude oil by reducing the supply from supply 1 to supply 2. The consumer surplus would shrink significantly – the consumer would pay more, receive less. The loss of the consumer surplus is equal to the increase in the producer surplus of [$70-$50] or $20 times 15 million barrels or $300 million plus the dead weight loss of one-half of ($20 times 5 million barrels) or $50 million. The total loss of consumer surplus would equal the sum of the two or $350 million. There are further implications of deadweight loss, (deadweight loss: neither the consumer, nor the producer receives this portion of the former consumer surplus; the result is loss of surplus value). Should we desire to see the effect of increased competition, assume a major new oil field came into production thus increasing the supply of oil from supply 2 to supply 1.

Now reverse the direction of the changes. The producer surplus would decrease and the deadweight loss in this case would go to zero. The consumer surplus would increase by the sum of the decrease in the producer surplus plus the decrease in the dead weight loss.

This has income distribution implications. Everyone is a consumer! Not everyone is a productive resource nor does each of the productive resources possess the same quality and quantity of resources. To the extent the economic rent or surplus rewards (in excess of opportunity costs★) is shifted to the consumer surplus by an increase in competitive pressures in the market, the income distribution of individuals and households will be less unequal than it would have been had the productive resources retained the surplus. Thus the increase in competition resulted in a greater conformity to the condition of equity and as we argue, greater conformity to commutative justice.

★Opportunity Cost

This is the compensation that a productive resource (e.g., labor is both the resource and the individual) could earn in its next best COMPETITIVE alternative employment. Remember that the productive resources include not only labor, but debt and equity capital, entrepreneurship and natural resources and space – the latter is usually referred to as land. Included in opportunity cost is what is referred to as ‘normal’ profits; again, this refers to the resource just receiving enough compensation to keep it from moving to its next best competitive alternative.

Efficiency is achieved when the per capita production of the economy is maximized given the current state of technology, stock of productive resources, consumer preferences, etc. Technically, this occurs when the price the buyers pay is equal to the marginal opportunity cost of the firm and firm’s average opportunity cost is at a minimum. As the economy becomes increasingly competitive, efficiency as well as equity is approached. If the ideal of perfect competition was to be reached, the welfare goals of equity and efficiency would be achieved.

Efficiency

Efficiency means that the per capita standard of living is at a maximum given the stock of resources, technology, etc. The consumer is able to purchase the greatest quantity of goods and services at the lowest possible price, thus maximizing their income. This can be viewed as the consumer’s income having the most ‘bang for the buck.’

In the following instance, while the price is tangent to the average cost curve, it is still above the marginal cost. This indicates a violation of the efficiency principle.

Theoretically, efficiency exists when for the typical firm in a perfectly competitive market, price equals its marginal [opportunity] cost and its average [opportunity] cost is at a minimum.

Productive Resources

- Labor, which is increasingly becoming human capital (The resource labor, e.g., includes [embodies] a huge quantity of invested human capital)

- Entrepreneurship – the decision-making ability that some people have (from the small business owner to Bill Gates at Microsoft)

- Capital, that is to say, plant, equipment, inventory, the housing stock, etc. (those things that we utilize to increase our wealth)

- Land, which is the name for all natural resources in a location