2012 Volume Issue 27

December 24, 2012

For a downloadable version, click the following:

…a bit more compressed version of the PDF

THE FISCAL CLIFF… Those that ignore the lessons of history will have to relive them…part one - revenues

With some recent exceptions, since the 1920s, a federal government fiscal pattern had developed that was a pleasant one for the body politic. The pattern displayed was one in which tax revenues rose at a greater rate over time than did federal government expenditures, including both programmed (sometimes referred to as ‘uncontrollable’ or non-discretionary) increases such as social security benefits and discretionary increases in federal government spending. Sometimes obscured by recessions and depressions and wars, both Republican presidents such as Eisenhower, Reagan, and Bush II and Democratic presidents such as Truman and Kennedy were concerned with the growing fear of economic stagnation and in some cases stagflation.

The fears of economic stagnation arose from shrinking federal budgetary deficits that would gradually become increasingly depressing federal budgetary surpluses due to relatively high tax rates and a growing tax base. The fiscal stimulus of these federal deficits was shrinking and being replaced by the constrictive effects of federal budgetary surpluses.

At a macroeconomic level, as Keynes pointed out; of and by themselves taxes depress by reducing aggregate demand, while government expenditures stimulate the overall level of economic activity by raising aggregate demand.

Andrew Mellon, the Secretary of the Treasury in the 1920s, convinced Presidents Harding and Coolidge, and at their urging, Congress reduced tax rates in 1921, 1924 and 1926. This succession of tax cuts resulted in a strong upturn in the U.S. economy, often referred to as the ‘Roaring Twenties’.

www.econnewsletteraug112011.com/

Mellon proposed tax rate cuts, which Congress enacted in the Revenue Acts of 1921, 1924, and 1926. The top marginal tax rate was cut from 73% to 58% in 1922, 50% in 1923, 46% in 1924, 25% in 1925, and 24% in 1929. Rates in lower brackets were also cut substantially, relieving burdens on the middle-class, working-class, and poor households.

By 1926 65% of the income tax revenue came from incomes $300,000 and higher, when five years prior, less than 20% did. During this same period, the overall tax burden on those that earned less than $10,000 dropped from $155 million to $32.5 million.”

Kennedy (JFK) convinced Congress that tax cuts were needed to forestall the problem of economic stagnation.

John Fitzgerald Kennedy on tax cuts – 1961

Economic expansion in turn creates a growing tax base, thus increasing revenue and thereby enabling us to meet more readily our public needs, as well as our needs as private individuals.

These words of JFK make him sound like a soul mate of Arthur Laffer, at least in the fiscal affairs of government. Kennedy’s words stand in sharp contrast to those of Barack Obama!

Remember the fears of first President Eisenhower and then President Kennedy as taxes out-paced government expenditures raised growing fears of economic stagnation. The Editor of this newsletter remembers lecturing on the distinctions made by James Duesenberry between the short-run or cross sectional consumption and the long-run or time series consumption functions.

The issue at hand was economic stagnation and some argued it was due to weakening consumption demand in respect to higher household incomes as reflected in a cross sectional consumption function data. At any given time, those with higher incomes spent a smaller percentage of their income than those of lower incomes, both on an average and marginal basis.

As Duesenberry pointed out, when aggregate consumption was related to aggregate income over time, a different picture emerged showing a more constant marginal propensity to consume. Look elsewhere for the causes of economic stagnation, was the conclusion.

Simply put, the data showed that for a given year, the propensity to consume (as a percent of household income) fell as the household‘s income increased. Could this be the culprit lurking in the data? Not so fast. This is a cross sectional analysis for a short period of time, e.g., each year. A long run view of this relationship, using times series data, showed a much different picture. The propensity to consume displayed a rather stable relationship of consumption in the aggregate to the nation’s income. It seems that the spending of households adjusted upward over time giving a more optimistic picture of the consumption to income relationship.

The economic literature of the time provides a wealth of ideas of possible causes of the potential for economic stagnation.

http://en.wikipedia.org/wiki/Fiscal_drag

The Alternative Minimum Tax originally (1970) targeted 155 high-income households; based on 2004 law, it would affect 20% of households by 2010.

Recall the legislation instituting a many bracketed progressive income tax rate structure. The tax brackets were based upon nominal income and not real or inflation-adjusted income. Then came a period of at first gradual and then more rapidly accelerating inflation and what became known as the BRACKET CREEP.

Since nominal incomes rose faster than real incomes, the tax payers CREPT into ever higher marginal tax brackets or tax rates. As the marginal propensity to pay taxes out of income rose, the marginal propensity to undertake personal consumption expenditures, fell.

This time, economic policies worked – as the tax bracket creep was to a great extent eliminated. A major cause of economic stagnation was eliminated.

By current standards, federal government expenditure policies – up until the last few years, were disciplined and thoroughly under control as they related to their financing by tax revenues. Should this pattern have continued, with this relative discipline over government spending, periodic tax rate cuts would be called for to avoid the recurrence of fears of economic stagnation. The federal budgetary debt would gradually shrink as a percent of GDP, as it did for many years. Sovereign risk was not a consideration for the U.S. of A. As a nation we could be generous to the disadvantaged both here and around the world. The current administration in the White House did not invent the concern for the disadvantaged. They are very confused as to who are the really disadvantaged.

It should be noted that the federal government has not had a budget for nearly three years. The unfairly criticized and much maligned House of Representatives passed one. The Senate did not. The huge federal deficit that has occurred over this budget-less time period should be qualified and called something like a ‘virtual’ budget deficit.

Obama, Democrats not serious about passing budget

By Ron Johnson, Special to CNN

updated 5:59 AM EDT, Mon April 30, 2012

www.cnn.com/2012/04/29/opinion/johnson-budget/index.html

On Sunday, April 29, it will be exactly three years since the U.S. Senate passed a budget.

http://budget.house.gov/news/documentsingle.aspx?DocumentID=306183

Tomorrow marks another disappointing record for the United States Senate: Senate Majority Leader Reid and his Democrat conference will have gone an unprecedented 1,200 days without adopting a budget plan as required by law. Not only have they failed to adopt a budget, but with America under threat of financial calamity, they have refused to even present a plan for public scrutiny. Last year, Majority Leader Reid said it would be ‘foolish’ to do a budget and the legally required Budget Committee mark-up was cancelled. No plan from his conference has seen the light of day. He refuses to disclose who he plans to tax and how he plans to spend taxpayers’ money.

Having little faith in the benefits of tax cuts to curtail federal government budgetary deficits, both Hoover and Roosevelt (FDR) during his first term resorted to convincing Congress to raise tax rates both on income and also to finance such programs as social security.

High Taxes and High Budget Deficits

The Hoover–Roosevelt Tax Increases of the 1930s (March 2003)

By Veronique de Rugy, Fiscal Policy Analyst, Cato Institute

www.cato.org/pubs/tbb/tbb-0303-14.pdf

After the crash and a sharp monetary contraction that pushed the economy into the Great Depression, the lessons of Mellon’s successful tax cuts were forgotten. Presidents Hoover and Roosevelt pursued large tax increases based on the mistaken ideas that the budget should be balanced during a contraction and that high tax rates would achieve that goal.

Veronique de Rugy goes on to say that in the Revenue Act of 1932, signed into law by Herbert Hoover, individual tax rates rose from 25% to 63% at the highest level.

Likewise, FDR followed on with a relish, and with passage of the Revenue Act of 1936, the highest marginal income tax rate prior to WW II went to 79% while reducing exemptions and earned income credit at the lower end. By 1940 the federal corporate income tax rate rose to 24% from its 12% level in 1930. Roosevelt also signed laws introducing or raising excise taxes on dividends, a capital stock tax, liquor taxes and higher estate taxes (inter-generational transfer of wealth).

De Rugy also notes, “Another reason that tax rate increases do not succeed in balancing the budget is that they shrink the tax base by reducing economic growth and spurring greater tax avoidance. As a result, the government typically gains only a fraction of the revenues it hopes to receive. Thus Hoover was tragically misguided when he advised in 1933 that it is obvious that the budget cannot [be] balanced without a most substantial increase in revenues.”

The fact is that higher taxing policies failed to bring about any significant economic recovery. As we have quoted many times in these newsletters on this website, Henry Morgenthau, Jr., Roosevelt’s long time Secretary of the Treasury said before a Democratic Congressional hearing in 1939, the FDR policies did not have a significant effect on unemployment but instead caused a huge increase in the national debt.

We are currently experiencing a bit of déjà vu, are we not?

President Obama may be the heir apparent to the mistakes of Herbert Hoover and FDR!

Again, it would be wise to remember the criticism that FDR’s policies were failures and the unemployment rate remained high until the military draft during which nearly 8 million, many of whom were unemployed, became members of the armed forces. This reduced the size of the civilian labor force giving the appearance of a falling unemployment rate – déjà vu one more!

As has been the case in recent years, the reputed improvement in the unemployment rate was achieved by eliminating the unemployed from the labor force. Perhaps the ongoing economic policies should be labeled, Houdini economics. All that is needed is lots of smoke and mirrors and a falling Labor Force Participation Rate.

www.econnewsletterdec102011.com/

http://blog.heritage.org/2009/01/14/were-spending-more-than-ever-and-it-doesnt-work/

William Beach January 14, 2009

Henry Morgenthau Jr. — close friend, lunch companion, loyal secretary of the Treasury to President Franklin D. Roosevelt — and key architect of FDR’s New Deal.

We have tried spending money. We are spending more than we have ever spent before and it does not work.

I say after eight years of this Administration we have just as much unemployment as when we started. … And an enormous debt to boot!

The date: May 9, 1939. The setting: Morgenthau’s appearance in Washington before less influential Democrats on the House Ways and Means Committee.

Again, déjà vu December, 2012…

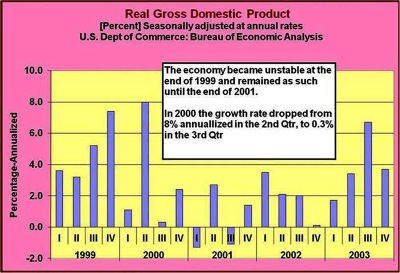

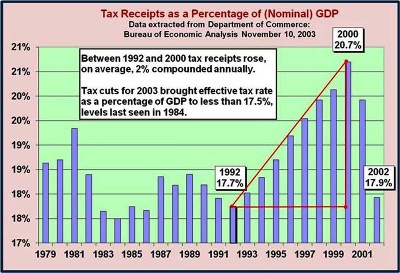

History would repeat itself again when President Clinton and his Treasury Secretary, Lloyd Bentsen (and later Robert Rubin), convinced Congress to enact significant tax increases in 1993. They appeared to be working in terms of deficit reductions but alas, the inevitable occurred and in Clinton’s last year in office, the economy went from significant real economic growth peaking in 1998-99 to a tumultuous crash in 2000 which lingered on until the so-called Bush tax cuts were enacted and became effective.

It appears that President Obama wants to go the route of tax rate increases. Obamacare (Patient Protection and Affordable Care Act) seems to have the potential of dwarfing by comparison, the initial tax increases resulting from the passage of the Social Security of 1935.

…but let’s not get ahead of ourselves.

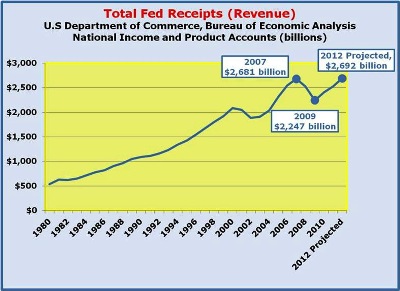

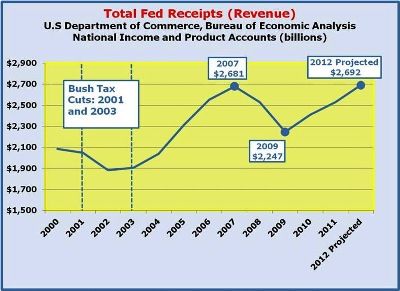

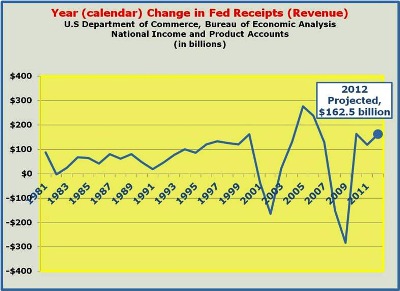

Much criticism has been hurled at the so-called Bush tax cuts as one of the culprits in the enormous increase in the federal budgetary deficits and the resulting increase in the national debt and its growing percent of GDP.

But a close examination of the data reveals a different picture even though the economy suffered a sharp decline in the tax base in 2008 due to the financial crisis that triggered the economic crisis in which we continue to wallow.

Note below that tax receipts once again showed strong growth after the financial crisis and the accompanying recession. Tax revenues were not the problem but rather uncontrolled expenditure increases aided and abetted by the lack of a budget for the federal government for over three years.

Our next newsletter will address the expenditures of the federal government and the burden of financing this large and growing government intervention into the economic life of the nation.

FYI

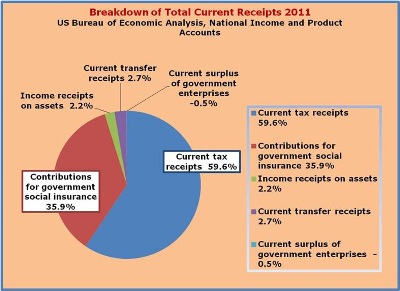

- Total Current Receipts (2011) = 100%

- The breakdown of these receipts is as follows:

- Current tax receipts 59.6%

- Contributions for government social insurance 35.9%

- Income receipts on assets 2.2%

- Current transfer receipts 2.7%

- Current surplus of government enterprises -0.5%