August 11, 2011

For a downloadable version, click the following:

Credit_Rating_Agencies August 11, 2011 pdf

ARE THEY THE ARTISTS AND SCIENTISTS OF HYPOCRISY PAR EXCELLENCE: Our beloved credit rating agencies, bless them all; or have they learned their lesson?

A major factor in the collapse of mortgage backed securities (MBSs), the first phase of the financial and economic collapse in which we are currently mired, was the overrating of the MBSs by the rating agencies. As is the case in many professions such as accounting, management consulting, or financial securities rating, the one being audited or examined also pays the raters, auditors, etc., most of the time. Such conflicts of interest within this mode of operation seem to be inevitable. But as we have seen in such professions, it can lead to tragic results for society as a whole.

The accounting profession has experienced the slings and arrows of severe criticism resulting from Enron and other scandals. The rating agencies recently experienced more of the same, due to underestimating the risks and overrating the securities such as consolidated debt obligations (CDOs), most notably the mortgage backed securities (MBSs).

Now at least one rating agency has decided to bite the bullet and downgrade the U.S. Government debt; granted, only by a minimal downgrade. Is this learning from past errors, or just plain hypocrisy? You be the judge. ‘Fooled once, shame on you, fooled twice shame on me’ goes the old adage. The credibility once lost due to the mis-rating of the CDOs, especially the MBSs, is hard to re-establish. Their ratings should no longer be used as the sole criterion for performing due diligence. The problem for these agencies is that some investors are beginning to see outright acceptance of their ratings as a form of Russian roulette.

The rating agency that just downgraded U.S. Government debt, gave some reasons for their decision, one of which embodied, at best, faulty economic thinking. One of their spokespersons expressed disappointment that Congress did not raise tax rates.

In our last article on this website, we examined this issue. There is much evidence, going back to before the Great Depression, the one going back to the 1930s and not current one – the so-called Great Recession, that tax rate increases depress the tax base (the chief of which is nominal GDP) and offset, if not more than offset, the tax rate increase, especially when the economy is lethargic or recessing.

First, in 1924, Secretary of Treasury Andrew Mellon wrote (Laffer curve):

It seems difficult for some to understand that high rates of taxation do not necessarily mean large revenue to the Government, and that more revenue may often be obtained by lower rates." Exercising his understanding that "73% of nothing is nothing", he pushed for the reduction of the top income tax bracket from 73% to an eventual 24% (as well as tax breaks for lower brackets). Personal income-tax receipts rose from US$719 million in 1921 to over $1 billion in 1929, an average increase of 4.2% per year over an 8-year period, which supporters attribute to the rate cut.”

Mellon proposed tax rate cuts, which Congress enacted in the Revenue Acts of 1921, 1924, and 1926. The top marginal tax rate was cut from 73% to 58% in 1922, 50% in 1923, 46% in 1924, 25% in 1925, and 24% in 1929. Rates in lower brackets were also cut substantially, relieving burdens on the middle-class, working-class, and poor households.

By 1926 65% of the income tax revenue came from incomes $300,000 and higher, when five years prior, less than 20% did. During this same period, the overall tax burden on those that earned less than $10,000 dropped from $155 million to $32.5 million.

At the tail end of the Great Depression (1929 – 1939), Henry Morgenthau, the Secretary of the Treasury at the time and a friend and confidant of Franklin Roosevelt argued that unfettered government spending, which occurred on his watch, did great harm to the economy. He made his comments before a House [of Representatives] Ways and Means Committee in 1939. His criticisms have been supported by more recent studies of those policies.

May 9, 1939 (www.econnewsletter.com/jul262011)

We have tried spending money. We are spending more than we have ever spent before and it does not work.

I say after eight years of this Administration we have just as much unemployment as when we started. … And an enormous debt to boot!

Flash forward to JFK

Economic expansion in turn creates a growing tax base, thus increasing revenue and thereby enabling us to meet more readily our public needs, as well as our needs as private individuals.

From our November 19, 2004 Newsletter

For those sensitive to federal government deficits, recall the concept of the fiscal drag discussed in previous issues of the newsletter. While tax cuts tend to have the immediate affect of reducing tax revenues, those same tax cuts, tend to stimulate the growth of the tax base through economic expansion. This then enables the “growing out of the deficit,” as taxes rise faster than spending. Such a pattern can be seen more than once since the end of the Second World War (See Kennedy tax cut proposal, April 1961 www.nationalcenter.org/JFKTaxes1961.html).

Here comes Ronald Reagan (ERTA) Economic Recovery Tax Act of 1981

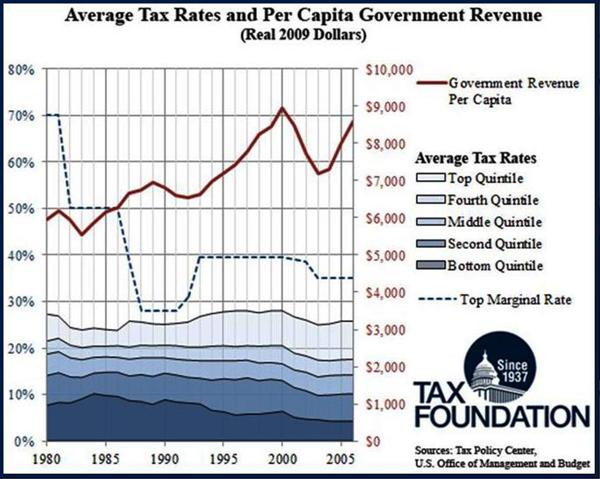

Arthur Laffer argued that what was needed in then and is needed now is a decrease in tax rates in order to grow the tax base. Remember that tax revenues are equal to the tax rates times the tax base such a GDP. The ‘Reagan tax rate reductions’ and the ‘Bush II tax rate reductions’ were followed by relatively long periods of significant economic growth (Reagan in particular; note that Bush’s recovery was stalled by the financial collapse, beginning in late 2007).

Economic Recovery Tax Act (ERTA) of 1981

www.house.gov/jec/fiscal/tx-grwth/reagtxct/reagtxct.htm

…in 1981 the top 1 percent paid 17.6 percent of all personal income taxes, but by 1988 their share had jumped to 27.5 percent, a 10 percentage point increase.

The share of the income tax burden borne by the top 10 percent of taxpayers increased from 48.0 percent in 1981 to 57.2 percent in 1988. Meanwhile, the share of income taxes paid by the bottom 50 percent of taxpayers dropped from 7.5 percent in 1981 to 5.7 percent in 1988.

Arthur Laffer, yet again

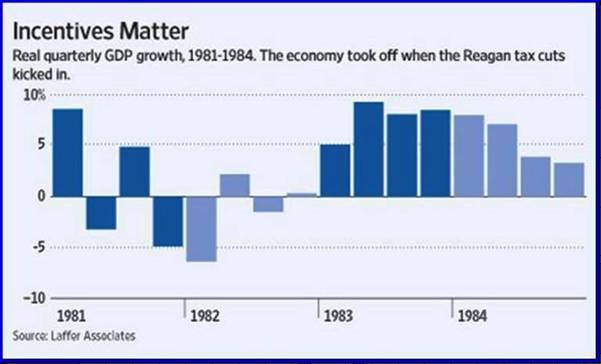

In 1981, Ronald Reagan—with bipartisan support—began the first phase in a series of tax cuts passed under the Economic Recovery Tax Act (ERTA), whereby the bulk of the tax cuts didn't take effect until Jan. 1, 1983. Reagan's delayed tax cuts were the mirror image of President Barack Obama's delayed tax rate increases. For 1981 and 1982 people deferred so much economic activity that real GDP was basically flat (i.e., no growth), and the unemployment rate rose to well over 10%.

But at the tax boundary of Jan. 1, 1983 the economy took off like a rocket, with average real growth reaching 7.5% in 1983 and 5.5% in 1984. It has always amazed me how tax cuts don't work until they take effect. Mr. Obama's experience with deferred tax rate increases will be the reverse. The economy will collapse in 2011.

President Obama on paying their fair share

August 2, 2011

m.whitehouse.gov/blog/2011/08/02/putting-americans-back-work

It also means reforming our tax code so that the wealthiest Americans and biggest corporations pay their fair share.

When Clinton became President in 1993, he inherited an annual federal deficit of $290 billion (1992) and a U-3 unemployment rate of 7.5% (1992). In 1995, he appointed Robert Rubin as Secretary of the Treasury (en.wikipedia.org/wiki/Rubinomics). He and President Clinton lobbied Congress to dedicate the higher taxes legislated in 1993 toward reducing the federal deficit and they agreed with him.

The economy had strengthened substantially under Ronald Reagan and much of George H.W. Bush presidencies. After the Clinton tax rate increases, for a few years things appeared to be going great and the Federal budget went from deficits to a surplus and by the beginning of 2000, Clinton’s last full year in office, that surplus was growing rapidly.

Again from Laffer…response to Clinton Tax Increases

According to a 2004 U.S. Treasury report, high income taxpayers accelerated the receipt of wages and year-end bonuses from 1993 to 1992—over $15 billion—in order to avoid the effects of the anticipated increase in the top rate from 31% to 39.6%. At the end of 1993, taxpayers shifted wages and bonuses yet again to avoid the increase in Medicare taxes that went into effect beginning 1994.

Bush Tax Cuts

Economic Growth and Tax Relief Reconciliation Act of 2001

Jobs and Growth Tax Relief Reconciliation Act of 2003

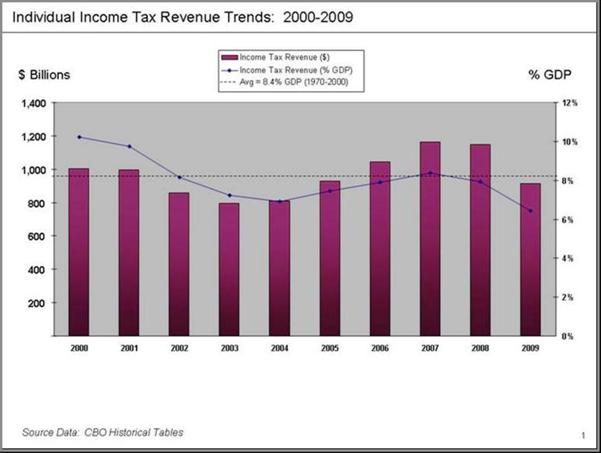

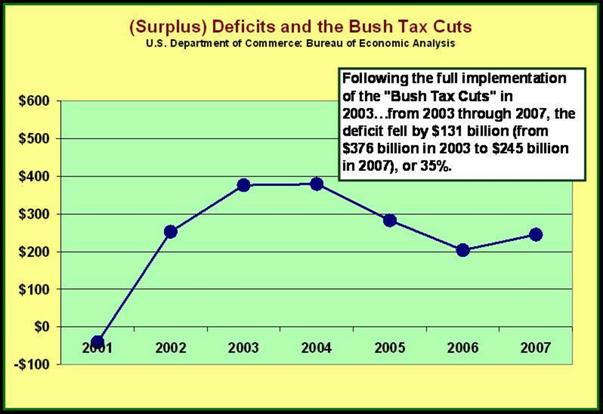

Since it took until May 2003 to pass all of the so-called Bush tax cuts, the effect wasn’t felt until 2004 and onward until 2007 when the economy was showing signs of deterioration and began heading toward the collapse of the financial system. In two years, from 2004 through 2006, the deficit went from $380 billion to $204 billion, dropping $176 billion or 46%.

Did the Bush Tax Cuts go too Far?

A bit of a different twist on [income] taxes as they relate to having a stake in the economy…

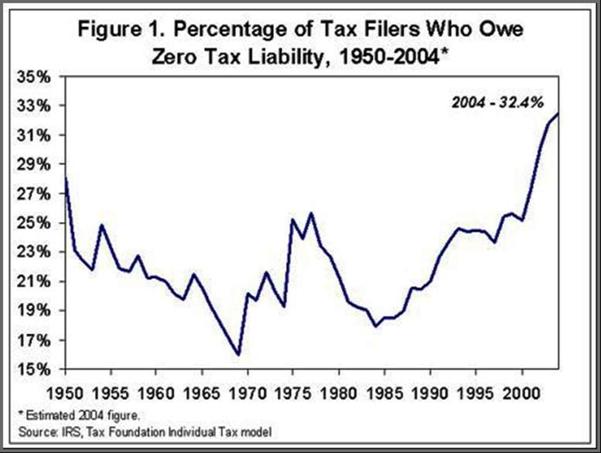

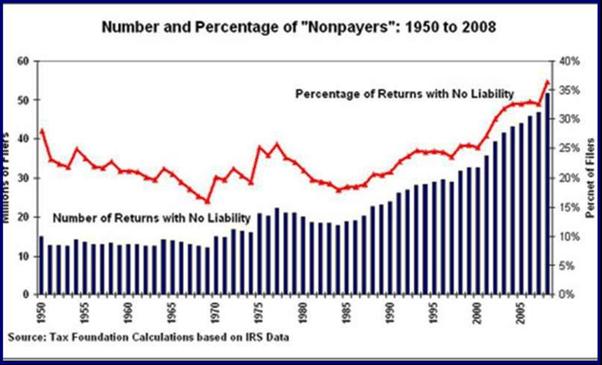

Despite the charges of critics that the tax cuts enacted in 2001, 2003 and 2004 favored the “rich,” these cuts actually reduced the tax burden of low- and middle-income taxpayers and shifted the tax burden onto wealthier taxpayers. Tax Foundation economists estimate that for tax year 2004, a record 42.5 million Americans who filed a tax return (one-third of the 131 million returns filed last year) had no tax liability after they took advantage of their credits and deductions. Millions more paid next to nothing.

www.taxfoundation.org/news/show/25962.html

Over the past two decades, Washington lawmakers have increasingly turned to the tax code to deliver social benefits, incentivize behaviors, and funnel money to targeted groups, which they always refer to as "helping the middle class." These measures have not only added complexity to an already Byzantine tax system, they have also eliminated the income tax obligation for millions of tax filers and their families. As a result, a record 51.6 million tax filers—36 percent of all filers—had little or no connection with the basic costs of government in 2008.

www.taxfoundation.org/blog/printer/26905.html

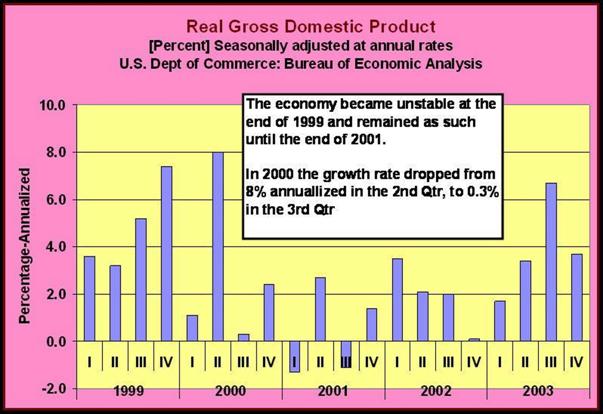

In case you have forgotten, in the third quarter of 2000 real GDP literally collapsed from a growth rate of a positive 8.0% to 0.3%. In the 4th Quarter of 1999 to the 1st Quarter of 2000, the GDP went from 7.4% to 1.1%. The economy literally collapsed and did not revive until the 4th quarter of 2001 George W. Bush's first year in office.

As a recent article on this web site pointed out, preventive maintenance is always more efficient than damage control.

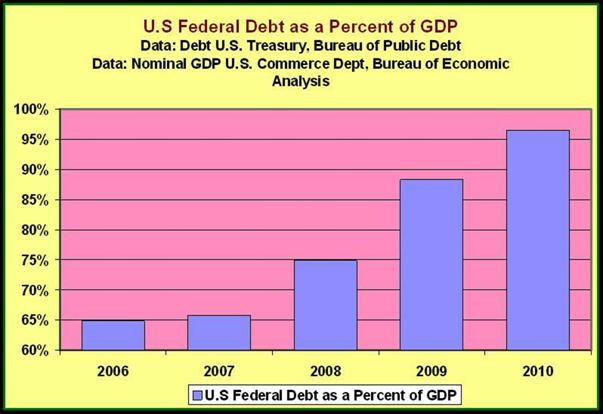

It was also pointed out in that same article that time is running out. The Federal Deficit has ballooned in the last three years and has increased the Federal debt from 75% in 2008 to 97% of GDP in 2010.

This precipitous rise in the federal debt to GDP ratio is real and gives support to the downgrading of the U.S. Government securities. The past few years have given the rating agencies a painful learning experience. Are they good students? As the Daily Finance columnist, Charles Hugh Smith, posed the following question on February 28, 2011: What Are We Getting for an Extra $1 Trillion in Federal Spending?

Après Moi, le Deluge – July 1, 2011

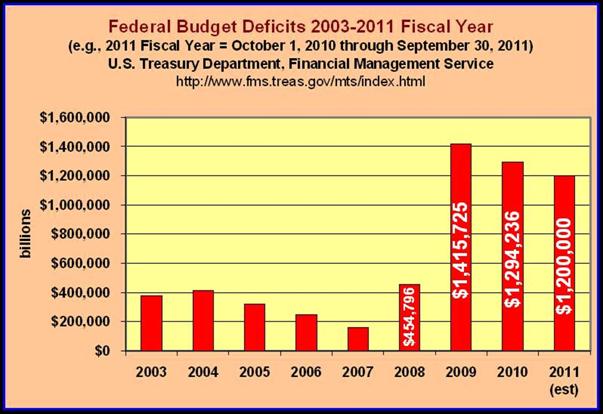

As Charles Hugh Smith in a Daily Finance article of several weeks ago commented, the Federal deficits have risen from just under one half of a trillion dollars to one and on half trillion dollars. The only perceptible benefit of this trillion dollar increase in the federal deficit was to maintain the pre-existing status quo or those ‘too big too fail’. Was this the change we were promised by the victors in the election of 2008? Did the promised changes include not passing a budget for the federal government for the last two years?

All we have achieved for the ONE TRILLION DOLLAR PLUS INCREASES in the Federal budgetary deficit for the last three years compared to those that preceded the last three years, is a status quo and we add to that a rising and scary unemployment rate, in excess of 16% by the U 6 measure. The duration of unemployment has been steadily and significantly rising.

For further analysis on the unemployment situation, be sure to read: