2012 Volume Issue 23

October 31, 2012

For a downloadable version, click the following:

…a bit more compressed version of the PDF

The Lack of a Cohesive Energy Policy by the United States is a major cause of our continued wallowing in the ongoing Recession like Economy!

Could the sun be rising on a dawn of energy independence for the U.S.?

THE PROBLEM

An abundance of usable energy, especially when converted into electricity, is the key to the economic advancement of society. The lack of cohesion in the energy policy of the U.S., if you care to call it a policy at all, has a few major factors at its root. One of them is the concern for protecting the environment. This is a noble cause but it is plagued by a great deal of science fiction and a large dose of incorrect scientific information. Some refer to it as the Al Gore brand of science.

The environmentalists stress the risk of damage to the physical environment, the land, water, and air and its accompanying health hazards. This is a good thing to do – in the right measure. However, little concern seems to be shown for the risks resulting from an anemic rate of economic growth and its excessively high unemployment rate from a lingering recession-like economic behavior; a loss of real income due an excessively high priced energy, an excessively unequal income distribution, and an exacerbated political risk facing our military and state department officials around the world from terrorists financed by huge profits on the crude oil production of unfriendly, and some self-professed friendly, OPEC nations.

Do not forget the high costs of added security domestically to prevent other 9/11s from occurring. As we pointed out in several issues of this newsletter over the past few years, one of the major causes for the collapse of housing prices, was the loss of real income due to the several years of high gasoline prices and food prices as a large amount of land was diverted to the production of dent corn for conversion into ethanol.

Killing Fields: Weak Links in Otherwise Strong Economy

January 6, 2006

Predicting Financial Collapse January 2006

In our January 2006 Newsletter article, we warned against the impending housing collapse and the danger of rising oil prices…

The U. S. Economy in 2011: A Real Bummer

March 10, 2011

www.econnewslettermar102011.com/

To satisfy the subsidized use of ethanol, hundreds of thousands of acres of crop land are being diverted to corn production for making ethanol. I just heard from an Iowa resident that farmers are taking lots of acreage out of the land bank and producing corn for ethanol. While inclement weather is also a cause of skyrocketing food prices, acreage diversion from soy beans, etc as well as diverting corn from its market derivative products including food and other uses, is also a major cause of such rising prices. The weather will improve, the diversion of acreage will not.

Yes indeed, environmental concerns, while necessary if properly understood, do have very high costs. What is needed is a new metric for establishing a balance between the risks of more scientifically measured environmental damage with the risk of economic damage from environmentally induced legislation resulting in vastly overpriced energy for a nation that is more than suited and able to be energy independent.

A second cause of our lack of a more rational energy policy is simply put, old fashioned greed in the private sector. Through the exercise of market power (more commonly referred to as monopoly power), competition is stifled in order that energy firms, especially crude oil firms, can charge excessively high prices and excessive profits leading to returns on equity (ROE of 26%+) that would make organized crime happy. By restricting supply, prices are increased well above their market clearing levels that would occur if firms lacked the market power to control significant portions of supply.

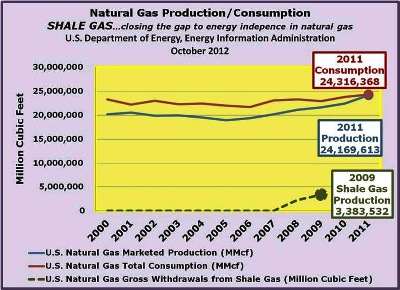

We’ve seen this most recently in the case of natural gas, where falling prices has paved the way for an industry-wide curtailment in production.

A major player in the natural gas market, Chesapeake Energy, has announced its intention to significantly cut back its production because of low natural gas prices. The significant uptick in the supply of natural gas has been the one bright spot in all this news.

Chesapeake to cut natural gas production [The Oklahoman, Oklahoma City]

Aug. 08--The country's surge in natural gas production may soon be over.

Chesapeake Energy Corp. -- which has billed itself as "America's Champion of Natural Gas" and is the country's second largest natural gas producer -- said Tuesday that it has turned off the spigot and will see a 7 percent decline in its natural gas production in 2013.

THE HOPE

Currently under way is a kind of black gold rush in shale or as some call it tight oil and shale gas. It may prove more valuable than the Klondike and similar gold rushes. Bakken, Eagle Ford, and Marcellus are beginning to bring forth oil and gas that challenge the control of such energy sources by the oil cartels. Other such shale regions are sitting there waiting for development and production efforts.

Don’t forget the federal lands, some brimming full of pools of oil ready for the proverbial picking, such as ANWR in Alaska and offshore areas such as those near California, in the Gulf of Mexico and the Atlantic seaboard.

U.S. Energy Information Administration | Assumptions to the Annual Energy Outlook 2012

www.eia.gov/forecasts/aeo/assumptions/pdf/oil_gas.pdf

The slow rise of energy from non-fossil sources is also showing the possibility of a breakout, especially for solar energy. Third generation solar panels that convert solar energy directly into electricity are now beginning to edge toward commercial applications. In a coming issue, we shall delve into these exciting developments.

…an example from Austria

Green Tech Valley – Environmental Technology and Renewable Energy

http://www.eco.at/cms/223/English/

FIBAG – Dr. Mario J. Müller

www.eco.at/cms/388/30825/fibag+-+HANS+H%D6LLWART+-+Forschungszentrum+f%FCr+integrales+Bauwesen+AG/

We have seen the price of natural gas collapse to the point than many electric utilities have been considering shifting from coal to gas fired generators. The choke point is that of the availability of pipelines to ship the gas to the refineries and end users.

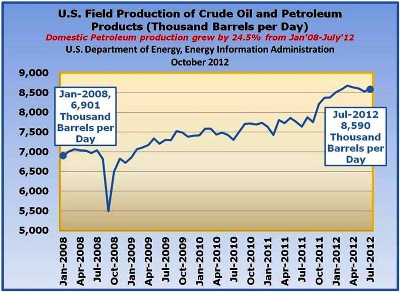

Now we are beginning to see an increase in domestic production (in the U.S.) of oil from newly exploited shale fields.

THE DATA

Here is some of the recent data on both energy sources and in particular, crude oil and petroleum products.

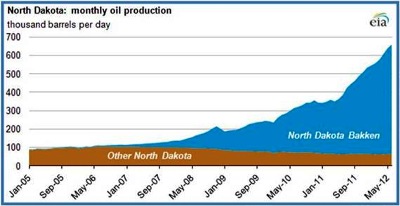

- Shale Gas and Tight Oil in North Dakota – Bakken

http://www.eia.gov/todayinenergy/detail.cfm?id=7550

August 15, 2012

North Dakota crude oil production continues to rise

Source: U.S. Energy Information Administration, based on North Dakota Department of Mineral Resources.

Note: Includes Bakken, Sanish, Three Forks, and Bakken/Three Forks pools.

North Dakota's oil production averaged 660 thousand barrels per day (bbl/d) in June 2012, up 3% from the previous month and 71% over June 2011 volumes. Driving production gains is output from the Bakken formation in the Williston Basin, which averaged 594 thousand bbl/d in June 2012, an increase of 85% over the June 2011 average. The Bakken now accounts for 90% of North Dakota's total oil production.

Production gains in the Bakken formation are the result of accelerated development activity, primarily horizontal drilling combined with hydraulic fracturing. According to the North Dakota Department of Mineral Resources, there were a total of 4,141 producing wells in the North Dakota Bakken in June 2012, up 4% from May 2012 and up 68% from the number of producing wells in June 2011.

North Dakota daily oil production up to 701,134 barrels per day for July 2012

www.dmr.nd.gov/oilgas/directorscut/directorscut-2012-10-19.pdf

North Dakota’s Director’s Cut

Lynn Helms

10/19/2012

NDIC Department of Mineral Resources

- Jul Oil 20,963,713 barrels = 676,249 barrels/day

- Aug Oil 21,735,166 barrels = 701,134 barrels/day (preliminary) (NEW all-time high)

- Jul Gas 22,295,369 MCF = 719,205 MCF/day

- Aug Gas 23,616,598 MCF = 761,826 MCF/day (preliminary) (NEW all-time high)

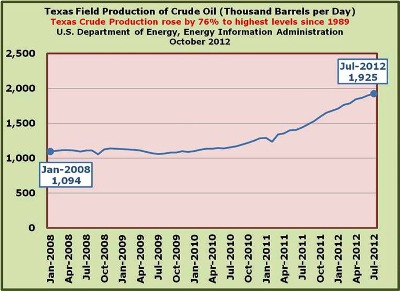

- Texas – Eagle Ford

Eagle Ford Shale – Texas

www.bloomberg.com/news/2012-09-21/eagle-ford-oil-production-above-310-000-barrels-a-day-in-july.html

Oil production in the Eagle Ford shale formation of southern Texas topped 310,000 barrels a day in July.

The nine fields that make up the majority of the 400-mile- long (644-kilometer) play pumped out 310,370 barrels a day, preliminary data on the Texas Railroad Commission’s website showed. That’s up from a revised count of 309,979 barrels a day in June, and 120,532 a day in July 2011.

Growing production out of Eagle Ford is helping fuel a renaissance in Texas crude. The state produced 1.9 million barrels a day in June, the highest monthly level since April 1991, according to the U.S. Energy Department.

www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfptx1&f=m

Massive reserves of shale gas and oil have only recently become available…

www.eia.gov/pressroom/presentations/sieminski_09272012.pdf

Energy Forecasting in Volatile Times

Federal Forecasters Conference – The Value of Government Forecasts

September 27, 2012 Washington, D.C.

Adam Sieminski, Administrator

U.S. Energy Information Administration

Shale (tight) oil has added more than one million barrels of crude oil production daily to the (petroleum) energy pipeline since 2008.

Included in the mix going into the refineries are crude oil, natural gas liquids and other liquefied refinery gases. Beyond the crude oil and petroleum products nearly a million barrels of ethanol derived from corn also goes into the refinery process.

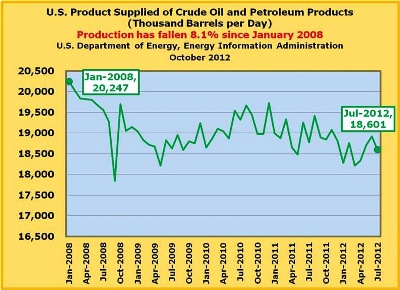

When we look at ‘Product Supplied of Crude Oil and Petroleum Products’, the refinery process includes crude oil, natural gas liquids, corn based ethanol or other renewable sources. Within each group the source is either domestic or imported. Domestic input has become an increasingly larger component and by all indications that trend will continue.

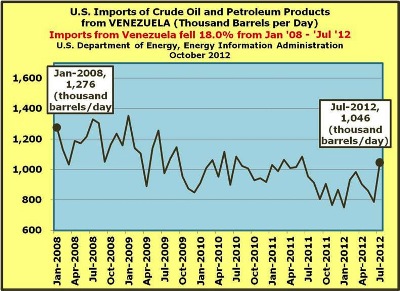

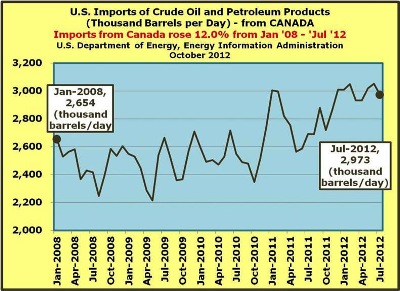

The good news on the imported crude oil (and petroleum products) side is that most of the trade (60 %+) involves non-OPEC sources, with Canada and Mexico in the vanguard. Bear in mind that as production in Alberta continues to ramp up and pipeline to the U.S. is expanded and improved, even more crude oil will be sourced from North America, with updated refineries at the ready to process it.

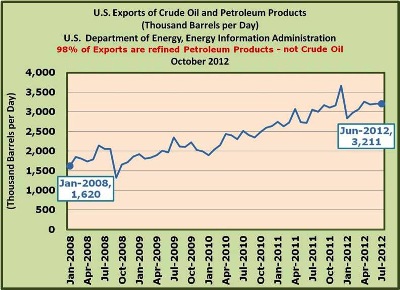

In addition, while exports of refined petroleum products have certainly increased, much of it is derived from imported crude that has been landed along the Gulf Coast and processed in Texas. With added crude flowing from domestic and other North American sources, this will enable refineries to move away from some of those less than desirable imports.

…again, keep in mind that 5% or less of U.S. petroleum exports are in the form of crude oil.

The real success story in the U.S. is the fact that we are virtually energy independent in terms of natural gas production. So long as we can keep the playing field competitive, we are pretty much assured to maintain cheap and plentiful natural gas in the years ahead.