2014 Volume Issue 10

October 18, 2014

For a downloadable version, click the following:

…a bit more compressed version of the PDF

COMPETITION IS THE MOST MISUNDERSTOOD, MISUSED, AND MALIGNED WORD IN THE PUBLIC’S VOCABULARY

…another take on the Keystone XL Pipeline-type debates?

If the 'cost' of shipment of crude oil is significantly less expensive to the consumer (and arguably much safer to all concerned) by pipeline than by rail, what's the hold up?

Something to consider…

www.eia.gov/todayinenergy/detail.cfm?id=7270

Most crude oil is moved in the United States by pipeline. However, because of limited pipeline infrastructure in North Dakota's Bakken region, oil producing companies there rely on rail to move their barrels. Shipping oil by rail costs an average $10 per barrel to $15 per barrel nationwide, up to three times more expensive than the $5 per barrel it costs to move oil by pipeline…

Argus Media reports that rail rates for unit trains moving Bakken oil to major refining centers on the Gulf Coast are about $12.75 per barrel to St. James, Louisiana and $12.25 per barrel to Port Arthur, Texas. The unit train delivery rate to New York Harbor is around $15 per barrel.

BNSF is the biggest railway mover of U.S. crude, transporting one-third of Bakken oil production alone with unit trains carrying up to 85,000 barrels of oil. The company's carloadings of crude oil and petroleum products increased 60% during the first six months of 2012.

Hmmm…wonder who owns BNSF - Warren Buffett - Berkshire Hathaway http://en.wikipedia.org/wiki/BNSF_Railway

Since Bakken is now producing over 1 million barrels of crude oil per day, this equates to a significant amount of revenue flowing through in the form transportation cost…if the pipeline costs in the neighborhood of $5 per barrel, versus $7-15 per barrel via train, who wins? If you owned the rail associated with getting the oil to market, what would you have to say about a pipeline? Who wins? Who loses?

Let’s move on…

The achievement of the goals of theoretical welfare economics can only be achieved if vigorous competition is present in the markets for goods and services and for the productive resources that are combined in the production process to give us those goods and services.

The common good has a similar meaning to the achievement of the goals or conditions of theoretical welfare economics as you may recall from previous newsletters on this website. These welfare goals or conditions are efficiency and equity on the microeconomic level and high employment and a reasonable degree of price level stability on the macroeconomic level.

To refresh your memory as to the meanings of these goals, please review the following articles from past newsletters on this website.

WHEN ARE WE EVER GOING TO LEARN THAT FREE MARKET CAPITALISM, SO LONG AS IT IS COMPETITIVE, IS THE BEST POSSIBLE ECONOMIC SYSTEM TO ACHIEVE THE ECONOMIC WELFARE OF ITS CITIZENS?

April 18, 2014

www.econnewsletterapr182014.com/

The Income Distribution: Why is it so and why do so many want to REDISTRIBUTE it? A calm rational analysis using relevant economic theory

May 15, 2013

www.econnewslettermay152013.com/

Separating the Light from the Heat: an analysis of the income distribution and the endless clamor for its redistribution; the whys, wherefores, and implications

February 12, 2013

…yet, we hear the term cutthroat competition as one of the great evils of our time. The fact is that exploitation of consumers by the use of monopoly power is the true evil of modern times and not its antidote, competition. The aforementioned monopoly power arises from either what are usually termed, natural monopolies and natural oligopolies and/or the deliberate elimination of competition by cartelization of markets.

The price for gasoline and diesel is around $2 or so greater than it should be given the costs of production. With the onset and continued growth of fracking technology, those prices should steadily fall, assuming that the firms producing crude oil and gas are not taken over by the traditional firms. Remember the period from roughly 1993 to 2003, when the American segment of the crude oil industry was effectively re-cartelized. That is an example of the evil of monopoly power and the failure to preserve competition which is the “good guy” and not the “evil one.” A major case of the growth of monopoly power resulting from the growth of cartelization is the failure by the well-funded government agencies to enforce the anti-trust legislation already in existence.

WHAT IS HAPPENING IN THE CRADLE OF DEMOCRACY?

July 26, 2011

www.econnewsletterjul262011.com/

Case in point---–---from lobbyist, pushing and prodding the legislative process to form policy to benefit clients; to bureaucrat guarding the chicken coop; and then back into the ranks of the foxes as a partner at a top tier Wall Street Mergers and Acquisition law firm.

Five things the Goldman tapes teach us about financial regulation

The Fed [Federal Reserve Bank of New York] is “captured,” but capture may not mean what you think it means…

The above reference to capture has to do with regulatory capture…

Do More Regulations and Regulatory Agencies lead to a better Financial System?

November 28, 2012

www.econnewsletternov282012.com/

The First Chicago School, numbering among its members, George Stigler, was much more critical of market concentration, using such terms as regulatory capture.

A Failure of Antitrust Agencies

Beginning around 1993 and continuing to around 2003, the U.S. segment of the oil industry was being re-cartelized as 13 large firms were remolded into 5 even larger firms including the merger of Exxon with Mobil. They let it be known that they would accept the prices in the market. Those prices of course, were set by OPE C so informally they became part of OPEC. A summary of this regulatory failure by the General Accountability Office emphasized that the antitrust agencies adhered to the Second University of Chicago School. Their ideology is that the market cannot fail and the economic performance of a highly cartelized market is nearly as efficient and equitable as is a much more competitive market. Does anyone really buy that baloney/malarkey?

U.S. Government Accountability Office

www.gao.gov/new.items/d04951t.pdf

July 7, 2004

ENERGY MARKETS - Mergers and Many Other Factors Affect

U.S. Gasoline Markets

One of the many factors that can impact gasoline prices is mergers within the U.S. petroleum industry. Over 2,600 such mergers have occurred since the 1990s. The majority occurred later in the period, most frequently among firms involved in exploration and production. Industry officials cited various reasons for the mergers, particularly the need for increased efficiency and cost savings. Economic literature also suggests that firms sometimes merge to enhance their ability to control prices.

This is just one of the areas where the lack of competition takes us far from the welfare goals of efficiency, equity, high employment and a reasonable degree of price level stability. The cartelization of the crude oil market and its downstream refined product markets is the enemy of the common good.

When Adam Smith wrote his ‘Wealth of Nations” in 1776, he eloquently pointed to the importance of competition in achieving the ‘common good’. He termed competition as the “Invisible Hand”. To paraphrase him, do your utmost to maximize your self- interest, and if the invisible hand of competition is present, you will be maximizing the common good. Absent the invisible hand of competition, the common good will suffer from maximizing self-interest.

Both those on the extreme left and the extreme right fail to understand the importance and beneficial outcomes from vigorous competition in the markets. The far left are of the ideological bent that the market can do no good and those on the far right of the mindset that markets, even when not competitive, can do no wrong.

Ideologies should provide a leavening agent in the analysis of economic activities. But just as is the case in the production of good tasting bread and beer where baker’s yeast and brewer’s yeast are the leavening agents, so should be the role of ideology. Tasty bread and tasty beer are not primarily made of the yeast or a leavening agent, but o many other elements such as cereal grains, hops, etc.

The lack of competition also occurs in the markets for productive resources (labor, capital, entrepreneurship and land). One such example is the cartelization of the productive resource, labor, by labor unions. One of the major reasons for the bankruptcy of the American auto companies, Chrysler and General Motors was the excessive compensation of labor through collective bargaining. This newsletter in past issues cited a well researched article by the Heritage Foundation showing that a few years ago, leading up to the bankruptcy of these auto companies, the average hourly compensation for the typical auto worker averaged nearly $75 including both wages and non wage benefits paid by the employers.

According to briefing materials prepared by General Motors, "The total of both cash compensation and benefits provided to GM hourly workers in 2006 amounted to approximately $73.26 per active hour worked."

We already have the legislation in place and the budget appropriations sufficient for the much greater enforcement of antitrust legislation to bring us much closer to competitive markets so needed to make the free market capitalism work and achieve the common good. What we lack is the will of the well-funded antitrust authorities. They clearly are failing in their duty to promote the common good and to bring us closer to the achievement of the economic welfare conditions of equity, efficiency, high employment and a reasonable degree of price level stability.

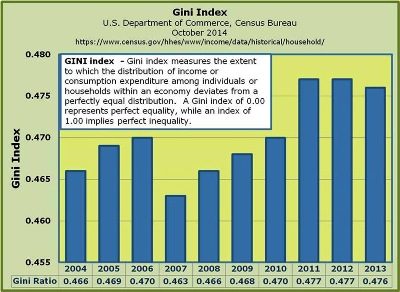

In the U.S. since 2007 the real median Household Income has fallen by $4,497, from $56,436 to $51,939. In addition, the Gini Index (sometimes referred to as the Gini Coefficient) has also shown significant signs of increasing income disparity over the last several years. There’s little doubt that the monetary and fiscal policies employed to combat the recession and the subsequent failure of the labor markets to adequately rebound has led to lower incomes and increased disparity. In a normal environment – in this case, meaning a robust recovery accompanied by policies promoting competition, those competitive forces would move to both increase the median income level by drawing more people into the labor pool, which would in turn reduce disparity (lower the Gini Ratio) due to those same competitive forces working in a like manner in the labor (productive resource) markets.