2015 Volume Issue 16

December 30, 2015

For a downloadable version, click the following:

…a bit more compressed version of the PDF

DECEMBER 30, 2015

Who wins with the rising Fed Funds Rate and how is the FED making this happen without creating chaos in the markets?

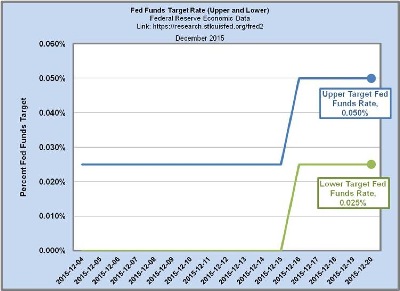

So they raised the target rate from 0.0% – 0.25 % to 0.25% – 0.50%…what does this mean? Who gains? Who loses? Does it matter?

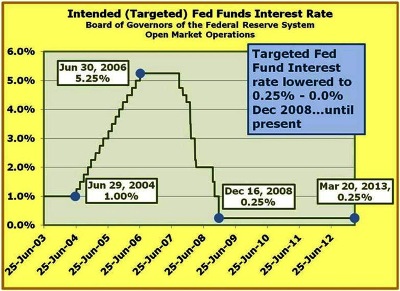

The outcome of the FED’s FOMC (Federal Open Market Committee) meeting was a unanimous decision to raise the target Fed Funds from 0.0% – 0.25% to 0.25% – 0.50%.

FOMC Press Release Date: December 16, 2015

www.federalreserve.gov/newsevents/press/monetary/20151216a.htm

There was a good deal of hemming and hawing in the FOMC statement, pointing to falling unemployment, inflation fears and blah, blah, blahhing about raising rates, yet at the same time remaining accommodating (raising Fed Funds target rates is synonymous with restrictive monetary policy, but what the heck).

The Committee judges that there has been considerable improvement in labor market conditions this year, and it is reasonably confident that inflation will rise, over the medium term, to its 2 percent objective. Given the economic outlook, and recognizing the time it takes for policy actions to affect future economic outcomes, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent. The stance of monetary policy remains accommodative after this increase, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

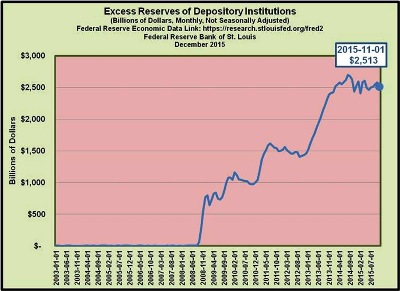

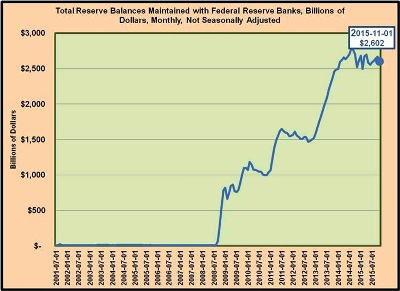

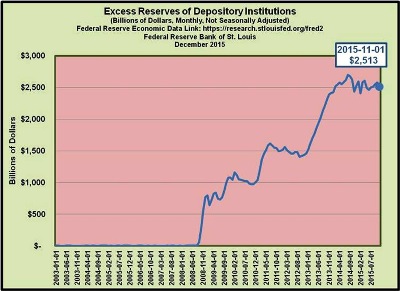

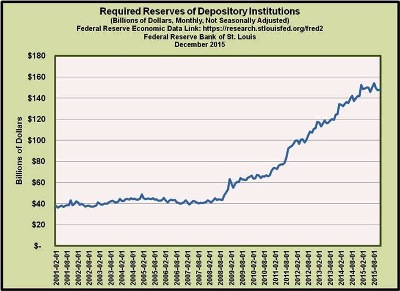

So among the concerns we had was how in the world was the FED going to implement its target in the Fed Funds market, changing the effective rate from the 0.15% range to something higher without selling off its vast trove of securities (undergirding the $2.5 trillion in excess reserves)? The effective Fed Funds rate rose to 0.37% on December 17, 2015 – the day after the FOMC announcement.

Talk about a quandary…hmm.

www.marketnews.com/content/yellen-letter-ralph-nader-text

November 23, 2015

We all hope and expect that the economy will continue to expand, that the jobs market will continue to make progress, and that inflation will move toward our 2 percent price stability objective," Yellen wrote. "If that is the case, my colleagues and I have indicated it will be appropriate to begin to normalize interest rates.

So how would the FED go about pressuring the Fed Funds rate upward if the excess reserves amounted to over $2.5 trillion? Dumping even half of that total would certainly cause problems in terms of US Treasury and/or mortgage backed securities markets.

Change Regulation D --- the FED’s answer to avoiding chaos

Decisions Regarding Monetary Policy Implementation (Dec 16, 2015)

www.federalreserve.gov/newsevents/press/monetary/20151216a1.htm

The Board of Governors of the Federal Reserve System voted unanimously to raise the interest rate paid on required and excess reserve balances to 0.50 percent, effective December 17, 2015.

www.federalreserve.gov/monetarypolicy/reqresbalances.htm

The effective date of this authority was advanced to October 1, 2008 (note: prior to the financial meltdown in 2007/2008, there was no interest paid on reserve balances)

Regulation D --- Interest on Required Balances and Excess Balances

The interest rate on required reserves (IORR rate) is determined by the Board and is intended to eliminate effectively the implicit tax that reserve requirements used to impose on depository institutions. The interest rate on excess reserves (IOER rate) is also determined by the Board and gives the Federal Reserve an additional tool for the conduct of monetary policy. According to the Policy Normalization Principles and Plans adopted by the Federal Open Market Committee (FOMC), during monetary policy normalization, the Federal Reserve intends to move the federal funds rate into the target range set by the FOMC primarily by adjusting the IOER rate.

Interest Rates on Reserve Balances for December 24, 2015

Last Updated: December 24, 2015 at 4:30 p.m., Eastern Time Rates (percent) Effective Date

Rate on Required Reserves (IORR rate) 0.50 12/17/2015 Rate on Excess Reserves (IOER rate) 0.50 12/17/2015

www.federalreserve.gov/monetarypolicy/0693lead.pdf

Reserve Requirements as a Tax

Some uncertainty exists as to whether the Federal Reserve Act permits interest to be paid on reserves. In fact, the Federal Reserve has never actually paid interest on required reserve balances.

Prior to the financial crisis in 2007, the FED didn’t pay interest on reserves, required or otherwise. All bets were off when the financial meltdown occurred in 2007…bear in mind that the FED did not act on the Fed Funds Rate until August/September 2007

www.econnewslettermar202013.com/

www.econnewsletteraug272007.com/

August 27, 2007

The Meltdown

This view of Fed policy of constraint resulting in rising short-term rates abruptly changed when the largest French bank, BNP Paribas announced that it was unable to estimate the value of mortgage related asset backed securities of its investment companies. The Fed reacted very quickly, supplying funds to the financial markets through repurchase agreements, cutting the effective Federal Funds rate from an elevated 5.41% on August 9 to 4.54% on August 14, 2007. On August 15, Countrywide Mortgage, the largest U.S. mortgage lender, recently purchased by private equity firm KKR, followed BNP Paribas’ lead, announcing that they had similar problems in valuing their assets. As of Thursday afternoon, August 16, 2007, not only had the effective Federal Funds rate fallen, but the 10-year U.S. Treasury constant maturity bond had also fallen to 4.66, or 7 basis points below what it was when the Fed began its credit crunch in 2004.

In a nutshell

On the one hand, prospects for rising variable mortgage rates significantly increased the cash flow for investors. On the other hand, the rising mortgage payments raised the level of delinquency and foreclosure rates. Investors like Bear Sterns, BNP Paribas, Countrywide, etc., anticipating significantly higher cash flows from their mortgage portfolios, have instead been left with falling cash flows and a shrinking asset base.

The Fed and other central banks have been quick to come to the aid of those financial institutions who knowingly stepped into what they imagined were lucrative investments, but what of those people who have lost or will lose their homes due to this resetting process. Will the Fed intervene on their behalf?

Paying interest on Reserves: Required and Excess

In altering the rules of the road regarding Regulation D the FED is now paying interest on both required reserves and excess reserves. While this might seem a bit abstract, it’s actually fairly simple.

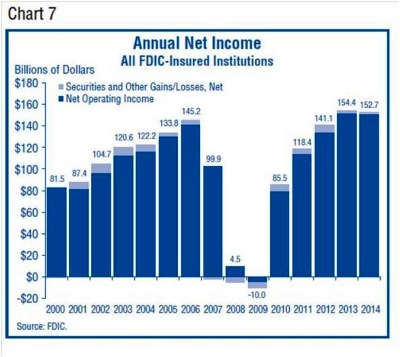

The Banks have been Hurting in Terms of Profits

Wall Street Journal Feb 15, 2015

The vast majority of the nation’s 6,509 banks reported increased earnings for 2014, the FDIC said in its quarterly report on the health of the banking industry. But seven of the 10 largest banks posted lower earnings than the previous year, driving the industry total below its 2013 level.

https://www5.fdic.gov/qbp/2014dec/qbp.pdf

Full-Year Earnings Fall $1.7 Billion, to $152.7 Billion

How much is there to gain in raising the Fed Funds Rate a quarter point (from 0.25% - 0.50%)?

Raising the Fed Funds Rate without Rocking the Boat?

The Total Reserves (required and excess reserves) are $2.6 trillion and the annual interest on 0.25% amounts to:

$2.6 trillion X 0.25% = $6.25 billion

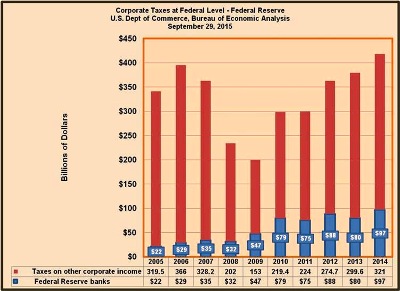

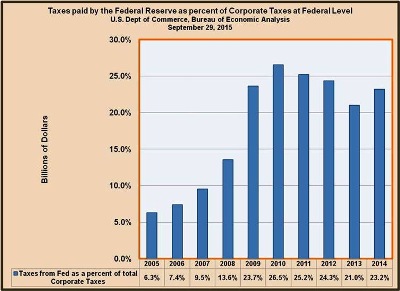

If 0.25% translates into $6.25 billion, then it’s entirely conceivable that the FED, given current taxes paid of $97 billion annually (in the form of corporate taxes to the Treasury), could easily ‘afford’ to move the ‘upper target’ of the Fed Funds Rate up to 3.0%, leaving them with profits back in the 10% range, while paying the 3% on the reserves.

Assuming the 0.25% equates with $6.25 billion dollars paid on reserves, then moving to the 3.0% paid on the upper target level (for required and excess reserves), this would add $68 billion to earnings for the depositories ($6.25 billion X 11*) = 68.75

*[note: (11 X 0.25 = 2.75 increase in upper target on Fed Funds going from 0.25% to 3.0%)

The Federal Reserve Banks' 2014 estimated net income

http://www.federalreserve.gov/newsevents/press/other/20150109a.htm

January 9, 2015

The Federal Reserve Board on Friday announced preliminary unaudited results indicating that the Reserve Banks provided for payments of approximately $98.7 billion of their estimated 2014 net income to the U.S. Treasury. Under the Board's policy, the residual earnings of each Federal Reserve Bank are distributed to the U.S. Treasury, after providing for the costs of operations, payment of dividends, and the amount necessary to equate surplus with capital paid-in.

The Federal Reserve Banks' 2014 estimated net income of $101.5 billion was derived primarily from $115.9 billion in interest income on securities acquired through open market operations (U.S. Treasury securities, federal agency and government-sponsored enterprise (GSE) mortgage-backed securities (MBS), and GSE debt securities).

Wrap-up

Now that we see how the FED could go about returning the Fed Funds Rate back to normal levels (whatever that means…the average Fed Funds rate was in the 3% range from 2000-2008), we have to ask the real question: why would the FED follow that path and what purpose does that serve in terms of its macroeconomic mandate?

Macroeconomic theory tells us that raising interest rates is a policy of constraint and not accommodation. To use the phrase ‘continuing to follow a policy of accommodation’ is misleading. What the FED seems to be referring to Is that the huge volume of excess reserves will be maintained.

As we have explained on numerous occasions over the years on this website is that the power of the FED to influence the economy is asymmetrical. It has enormous power to constrain the growth of the economy but very little power to stimulate economic growth. The process of money and credit creation depends upon the depository institutions such as commercial banks to make loans and investments pursuant to the profit motive. Absent the expectations of profits, making available humongous amounts of excess reserves by itself will not do the job. The economic milieu must generate expectations in the mindset of the financial institutions that loans and investments they make will be profitable.

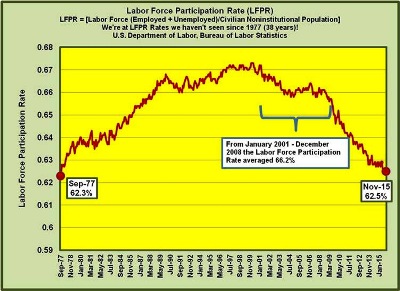

The ongoing uncertainty, in effect, has added a large risk premium to decisions and has reduced the expectations of the profitability of such loans and investments resulting in the low and erratic rate of growth in the economy. If the uncertainty could be reduced, the depository institutions will create new checkable deposit M-1 money and lend it out or invest it. Given the dismal economic data over recent years such as the historically low Labor Force Participation rate, the outlook will continue to be dismal despite the denial by the FED and other supporters of the monetary and fiscal policy making at the FED and the Federal Government. In simply applying the average pre-Great Recession 66% Labor Force Participation Rate to the current employment picture, the unemployment rate would be in the 10% range, rather than the current 5%

www.econnewsletterdec152015.com/

December 15, 2015

Modified for a 66% Labor Force Participation Rate LFPR (66.2% average from 2001-2008)

Civilian Nonininstitutional Population (CNP) = 251,747,000

Civilian Labor Force (employed + unemployed) = 157,301,000

At 66%…

251,747,000 CNP X 66% LFPR = 166,153,000 Labor Force

Employment is 149,364,000

Unemployed = Labor Force [at 66% LFPR] 166,153,000 – Employed 149,364,000

Unemployed [at 66% LFPR] = 16,789,000 (Current Unemployed is at 7.9 million --- 9 million more unemployed)

Unemployment Rate [at 66% LFPR] = 10.1%

One more thing…

Using the U-3 definition of the unemployment rate makes the real problem disappear – like a magician performing a disappearing act in the labor markets, especially for the younger portion of the population trying to find work. Discouraged workers are defined as being ‘not in the labor force’ by the U-3 definition but are nonetheless unemployed. The U-6 definition of unemployment, while not perfect, does not define the problem away and gives a much better sense of the health of the labor markets than does the U-3 definition.

We will be looking into the various aspects of the FED policy in future newsletters. Included in the discussion/analysis will be possible scenarios regarding the FED monetary policy.