May 13, 2008

For a downloadable version, click the following:

Cartelistic v. Competitive Free Market Capitalism

Two Current Cases:

Oil v. Autos

"It was the best of times, it was the worst of times."

Thus wrote Charles Dickens in his "Tale of Two Cities."

Of course, the good times referred to London while the bad times, to Paris where the French Revolution was in full swing (maybe chop would be a better word). The guillotine was working overtime to chop off the heads of the politically incorrect, many of which had been knitted into the roll call of victims as written by Madame La Farge.

For many friends and former students who made their livelihoods in the auto industry they remind me of their buy-outs and need to either relocate or retire prematurely - for that industry it appears to be the worst of times.

Today, the best of all times could refer to the resources employed in the energy industry, suppliers of capital, labor and management. There are other beneficiaries of the oil industry's largesse (of both the OPEC branch of the cartel, and since the 1990s, the U.S. branch of the oil cartel - or OPIC, as I refer to it (Organization of Petroleum Importing Countries)). The beneficiaries include the politicians and ideologues of all spots and stripes - from the far left to the far right, the environmental movement that is also receiving their full share of this largesse as well, since the energy industry funds them heavily. Also on the receiving end of the huge growth in oil revenues, which is mostly in profits, are terrorists. Their activities have never been better funded, so they can have their "rockets red glare" that seem to be bursting everywhere, especially over Israel. There is plenty of money for suicide belts and roadside bombs to go around. By no means left out are the resurgent Taliban making sure, that Afghanistan does not stabilize and that the poppy fields keep blooming. Life is full of strange bedfellows, especially when funding is needed.

Today, the worst of all times again could refer to the UAW portion of the auto industry. Their "glory of victory" has turned into an "agony of defeat". Motown is now Macon, Georgia, Nashville, Tennessee, or Georgetown, Kentucky. Move over Elvis and Dolly, you have to make room for those Yankee invaders.

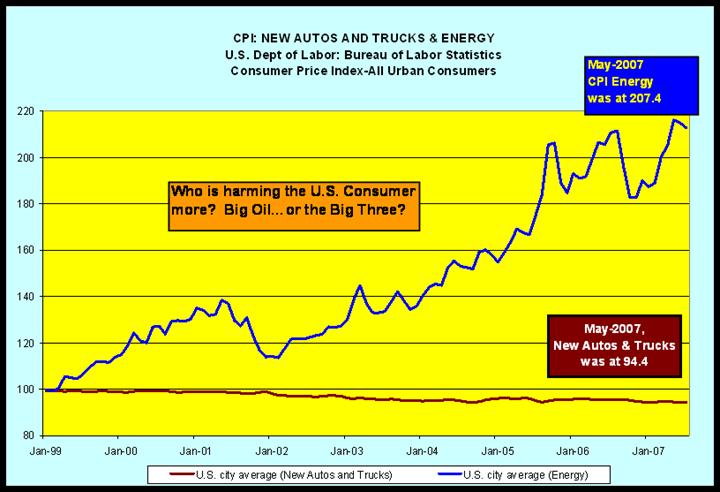

Yet, in spite of these unequal times, both industries, energy and automotive, are typically described as being forms of free market capitalism.

How can this be?

Free market capitalism, a la the recartelized American oil industry, parlayed with OPEC, is actually a cartelistic form of free market capitalism. The now much restructured U.S. auto industry is rapidly becoming a very competitive form of free market capitalism, and in many ways is already there.

How different can they be? You ask.

Both industries are populated by private sector corporations, and are only tangentially regulated by government. The regulation is in the area of environmental legislation and not in restricting the exercise of monopoly power.

They differ like night and day when economic analysis is applied however. Both in micro and macroeconomic terms, they differ substantially in how they impact society.

The "end game" or the "limiting case" for competitive free market capitalism is vastly different from the end game or limiting case for cartelistic free market capitalism.

END GAME - LIMITING CASE

Cartelism and the rise of competition in Free Market Capitalism

The Macroeconomic View

Cartelistic Free Market Capitalism

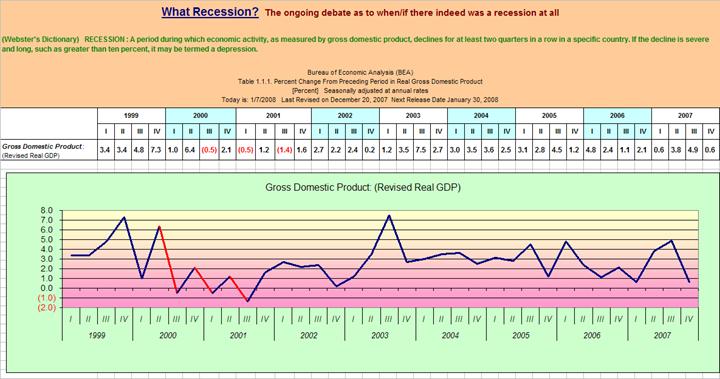

- Increasing severity and frequency of Recessions (1947 - 1983)

- Increasing severity and frequency of Inflationary Episodes (1965 - 1983)

Competitive Free Market Capitalism

- Decreasing severity and frequency of Recessions (1984 - 2008)

- Decreasing severity and frequency of Inflationary Episodes (1984 - 2008)

US Bureau of Labor Statistics

Annual Inflation Rate (CPI - Not Seasonally Adjusted)

The Microeconomic View

In cartelistic free market capitalism, the economic welfare conditions are violated (not achieved).

- In terms of violating equity, this means the income distribution becomes excessively unequal because monopoly power is exercised in cartelistic industries.

- In terms of violating efficiency, the standard of living is lower than what it should be due to growing inefficiency as a result of the use of monopoly power in cartelistic industries.

--- Without Competition, Cartelistic Competition, firms have Market Power

Objective: Control quantity in the market, in order to control Price; Total Revenue --- PROFITS

Price Elasticity of Demand

Most demand curves are said to be relatively "price inelastic" in the lower half, whether straight-lined or curved. In the upper half, demand relatively "price elastic."

What does this mean?

The important thing to firm is total revenue (price times quantity demanded). As the price is increased, the quantity demanded shrinks. If the price is in the lower half of the demand curve, the price increase causes total revenue (TR) to increase. If, however, the price increase is in the upper half, the total revenue (TR) falls, despite the market power of the cartelistic firms.

Does this mean that the market power of OPEC has its limits? Absolutely, yes! We may be close to this point at the current price levels.

This is also the problem that the Big Three ran into as they raised prices (sticker shock) to cover escalating labor costs. They began running into the roadblock of rising price elasticity of demand.

What came of this? Profits began to collapse.

- Restricting Supply to raise prices

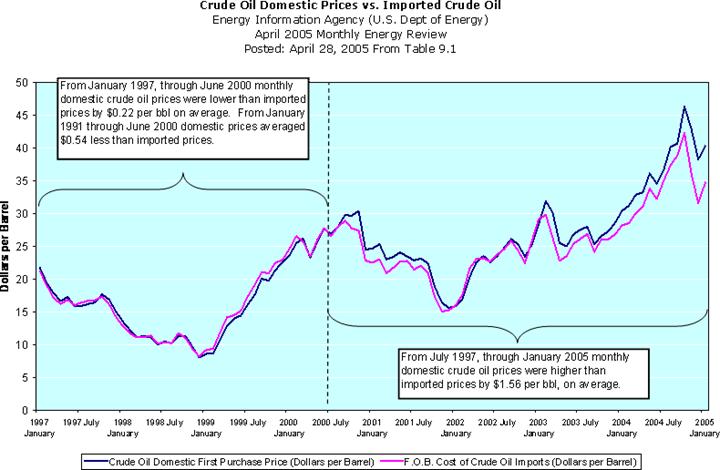

- 2003: $30/bbl

- 2008: $120+/bbl

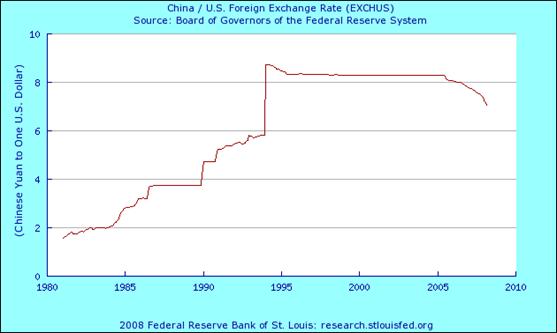

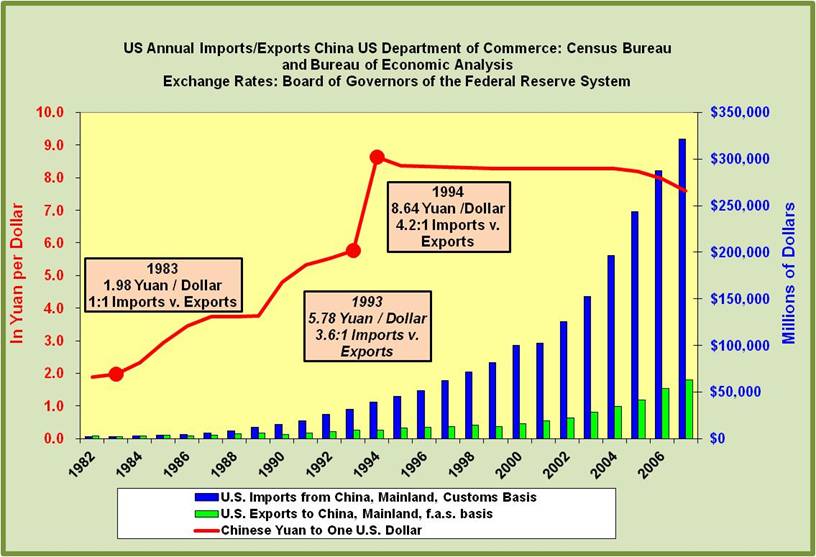

China: Devalue your currency and turn your country into an exporting juggernaut

Labor - UNIONS

(The Killing Fields: Weak links in an otherwise strong economy)

www.econnewsletterjan052006.com/

In the U.S. domestic auto market, the hourly compensation (including benefits) for workers at the three traditional nameplates is estimated at $65/hour or $130,000 per year, while a similar estimate for the transplants is about $30/hour or $60,000 per year. According to the U.S. International Trade Administration, in terms of the wage portion of auto workers total compensation package:

Auto manufacturing remains one of the economy's best paying industries. Production workers' average hourly earnings reached $29.05 (excluding benefits) in 2004. Wages were 80' greater than the national average for all manufacturing industries.

Again, the bulk of the difference between the Big Three autoworker and that of the transplant autoworker is mostly in the area of non-wage compensation (including such things as health care and pension benefits).

After Delphi filed for bankruptcy, its chairman and CEO, Robert "Steve" Miller, said that the company needs to get rid of a "substantial" number of its North American operations and reduce its 51,000-member workforce. He wants the UAW to agree to concessions that would reduce members' average wage-and-benefit packages from about $65 an hour to about $20 or $25 an hour. Of that total compensation package, the hourly wage alone would drop from $27 to $10 if Miller has his way.

The Microeconomic View - continued

In competitive free market capitalism, the economic welfare conditions are fully achieved.

- In terms of equity, this means the income distribution becomes increasingly less unequal because monopoly power is eliminated.

- In terms of efficiency, the per capita standard of living is higher than what it would have been if monopoly power had prevailed - witness the changing nature of the auto industry.

The Importance of the Limiting Case

The end game of a universe expanding at an increasing rate so its temperature will steadily fall, is Zero Kelvin (-459 degrees Fahrenheit) or zero molecular movement.

But, you say, so what?

The end game is millions if not billions of years away. As temperatures drop, good insulators become poor insulators, then become poor conductors, followed by becoming good conductors and finally by becoming perfect or super conductors, most of them long before Zero Kelvin is reached. This concept has revolutionized our knowledge of many things.

The cause of this ignorance about the difference between cartelistic and competitive free market capitalism that is pervasive among not only the population in general but economics majors leaving college, is due in large part to the teaching profession. It should bear the blame and the shame for this widespread ignorance that exists today. Many do not know and many do not care about the dichotomy of the two forms of free market capitalism. Too many in and out of academia have become so enamored of the political implications of Keynesianism or Say's Law that they have been incorporated into their ideology, forsaking any economic analysis.

Whether it be the necessity of government intervention to stabilize an inherently unstable economy as Keynes argued, or some form of laissez-faire as most Say's Law proponents (and now libertarians) argue, the sophistication and elegance of economic theory becomes of no importance - irrelevant. The end game is forgotten, and only the day-to-day politics of the ideology counts.

Let's call a truce, and move away from ideology for a few moments in order to consider how the end game of the two forms of free market capitalism agree or disagree.

Much is at stake

The rate of real economic growth, the income distribution, and the proclivity toward episodes of recession and inflation, are among the major differences in the outcome of these two types of free market capitalism.

Understand, that what I am about to present may threaten to break you loose from that comfort zone that your ideology has provided.

Throughout my presentation, remember that a household has two roles to perform in a free market capitalistic economy. It is the provider of all productive resources that when transformed by the firms in the process of production become the goods and services available for consumption, capital accumulation, government goods and services and exports.

Secondly, the households are the consumers of the economy. All households are consumers. A household's material standard of living depends upon how much it can consume. Some households have no resources they want to or can offer to the production process, but all households consume.

Let's first begin with that branch of economic theory that many professors, for whatever reason, never find time to explain…

Theoretical Welfare Economics

I am not talking about the more popular economics of social welfare, rather, I am speaking of the theoretical welfare economic where efficiency and equity are the end game. Secondly, we will consider the microeconomic foundation of Keynesianism as to when and why it is a relevant model of analysis and a basis for prescribing economic policies for government intervention, and when it is no longer relevant for those purposes.

We begin with the micro-markets and consider the two basic outcomes that optimize theoretical economic welfare: equity and efficiency.

- EQUITY

- The consumer surplus is maximized subject to the constraint that all productive resources earn their opportunity costs in long-term equilibrium, no more and no less than their opportunity costs.

Here is the translation into the lay vernacular…

The consumer surplus is an estimate of how much more consumers would be willing to pay for the market quantity purchased if they had to, but do not have to if only one price is charged to all buyers. In other words, no price discrimination occurs. Graphically, it is the area bounded by the price or Y-axis, the demand curve, and the equilibrium market price in the figure above.What the buyers actually pay collectively (total expenditures of all the buyers or total revenue to the all firms in the market), is the equilibrium market price times the equilibrium market quantity. If the firm(s) can reduce the supply from S1 to S2, as a cartel such as OPEC does, they sell fewer units (barrels of oil) and charge a higher price, now at $100+ per barrel instead of $30 per barrel. Note that part of the triangle labeled consumer surplus when supply is S1 is expropriated by the cartel when they reduce the supply and raise the price you, my good people, have been had. You are forced to financing Hammas and Hezbolah, and Al Qaeda, in their purchasing and firing of Fallujah rockets, the killing and maiming of NATO military, mostly U.S. military, etc.

Since the recartelization of the American portion of the oil industry in the 1990's, profits of American oil firms have risen precipitously, especially with prices at $100+ per barrel. Last year, 2007, Mobil-Exxon, sorry, Exxon-Mobil "earned", about $40 billion (much of which was expropriated from the consumer at around $3.00 per gallon of gas instead of $1.25 per gallon as it was, going back to around 2002). Rest assured they used every accounting trick they could find to keep it down to that record profit for an American corporation.

What are the opportunity costs of the productive resources? This is the compensation that a resource could earn in its next best COMPETITIVE alternative employment.

Remember that the productive resources include not only labor, but debt and equity capital, entrepreneurship and natural resources and space - the latter is usually referred to as land. What are often called normal profits usually means the opportunity compensation to equity capital for being employed by a firm in the transformation process called production.

Yes, normal profits or opportunity cost level profits are a cost in economics just as is the opportunity cost level of labor compensation. Compensation in excess of this opportunity cost level is called a producer surplus (economic rent in the more traditional jargon), above what is needed to bring the resource into employment. Equity capitalists are self-employed. Technically and simply, the firm they own employs them. This self-employment includes stockholders.

The older name for producer surplus was economic rent.

Where did this surplus flowing to labor or the owners (equity capitalists) come from? Simply put, it came from the consumer surplus, or the buyer, who paid more than they might otherwise have to pay in a more competitive environment.

In the case of food and much of the energy used, the consumer is the household. If the higher cost of energy is paid for by a firm selling goods to consumers, the producer surplus or economic rent ultimately comes from the householder through higher prices - if the costs can be passed on to the household as consumer. If the firm cannot pass on the higher energy costs, they will decrease the rewards to the productive resources, who, by the way are supplied by the households. Either way, the households in which we all live, bear the burden of the monopoly power of the energy firms.

EFFICIENCY

In long-term equilibrium, the price the buyers pay is equal to the marginal opportunity cost of production of the typical firm and the average total opportunity cost (same thing as cost per unit) of the typical firm is at a minimum.

Here is the translation into the lay vernacular…

The buyers are paying the firm just what it costs to produce the last unit produced, no more and no less. The cost per unit is as low as it can be; it cannot be any lower and still result in firm's producing the good or service. The cost of all productive resources (labor, debt and equity capital, entrepreneurship, and land) is just enough to employ them by bringing them from their next best (or next highest rewarding) competitive employment alternative, or as it is called in economics, rewarding them with their opportunity cost. Remember that the normal profits or the required rate of return on equity investments, (the opportunity cost of equity capital) is a cost and graphically is under the cost curve. In effect, economic analysis treats all owners as being self-employed, since they own the firm that employs their equity capital.

EQUITY: When markets are perfectly competitive, the condition of equity is achieved.

What does this mean?

Transition from highly cartelistic to increasingly competitive markets

Why are price increases prohibitive in the face of increased competition?

When demand flattens (moving from D1 to D2), and you increase prices, your quantity demanded falls much further and is less revenue enhancing than it otherwise would have been.

The MACRO ECONOMY

The biases toward recession and inflation are eliminated

When employment is at its natural level, all productive resource markets are cleared (labor, debt and equity capital, entrepreneurship and land). A very mild deflation will occur, (no longer an inflationary bias) resulting from the productivity dividend being passed forward in the form of lower prices. Only if the productive resources, e.g. labor (have embodied more human capital) have higher opportunity costs will some of the productivity dividend be passed backward in the form of higher hourly compensation.

It cannot happen you say?

I say it is happening where competition is allowed to flourish. Compare the transplant portion of the U.S. auto industry with the remnants of the formerly "Big Three"

The oil industry was allowed to recartelize in the U.S. in the 1990s under the watch of Bill J and not George W who took over the reins on January 20 of 2001. The damage was done by then.

Drilling down to the root of $125+ per bbl oil:

Re-Consolidation of the US oil industry (mergers of the last ten years)

- 1997 Ashland Oil combines most assets with Marathon Oil

- 1998 British Petroleum (BP) acquires Amoco

- 1998 Pennzoil merges with Quaker State Oil

- 1999 Exxon and Mobil join to form Exxon Mobil

- 2000 British Petroleum (BP) acquires ARCO (Atlantic Richfield)

- 2001 Chevron acquires Texaco to form Chevron Texaco

- 2002 Conoco merges with Phillips

- 2002 Royal Dutch Shell acquires Pennzoil-Quaker State

(The Energy Challenge: U.S. Oil Industry (Merger-Mania) and the FED Conundrum Continues)

www.econnewslettermay312005.com/

Over the past few years, the per-barrel of oil price went from $30 to where it is now, in the $120-130 range.

A gallon of gas has gone from $1.25 to around $4.00. Of course the FED (Federal Reserve), through there use of monetary policy has corralled it have they not?

NO!

NO!

NO!

A thousand times NO!

They have been busy destroying the mortgage and housing markets and then bailing out the financial institutions while letting hundreds of thousands of households suffer from foreclosure.

The FED's policies along with the disastrous policies of the Federal Trade Commission (their unwillingness to stop the recartelization of the American oil industry), U.S. economic policy has reached an all time low.

Revisiting Opportunity Cost

- Compensation for loss of leisure

- Compensation for Human Capital

- Compensation for Risk

- A) Financial

- B) Physical

To employ a unit of a given resource, whether labor, capital, or entrepreneurship, you must reward the supplier of the resource with just a bit more than the resource would receive in its next best COMPETITIVE alternative.

This is Equity

As competition increases in auto industry, that market moves toward the achievement of equity and efficiency.

While compensation to workers in the transplants is less than half to that paid to the traditional Big Three worker that compensation of the workers of the workers in the transplants is much closer their opportunity cost (which means less producer surplus/economic rent).

However, the consumer surplus is steadily increasing.

This is Efficiency

Real Per Capita GDP (Gross Domestic Product)

As competition increases, per capita real GDP increases.

When perfect competition is achieved, the per capita real GDP is maximized for the current resource base and state of technology.

If employment is at capacity you've reached your production possibility curve.

Competitive Free Market Capitalism

Macro implications - reiterating

Elimination of the bias toward Recession

Firms are losing their market power. Prices are becoming more flexible downward. This lessens the need for the firms to reduce output when demand weakens; as the falling prices reduce the surplus, this offsets weakening demand.

GM raising prices on most 2008 U.S. vehicles (December 18, 2007)

http://www.reuters.com/article/pressReleasesMolt/idUSN1853263420071218

General Motors Corp said on Tuesday it will increase prices by as much as $1,500 on its 2008 model-year vehicles in the United States to recover rising steel and commodity costs.

Elimination of the Bias toward Inflation

Since increasing competition causes prices to fall when demand begins to weaken, these falling prices offset - on an average basis, the rising prices when demand strengthens.

While the movement toward competitive markets seems to reduce your reward as a productive resource, remember the following points:

- Surplus rewards of resources comes from the market power of firms employing them, and not for their contribution to society as productive resources since that is already embodied in their opportunity cost, which they "fully" receive in a competitive environment.

EQUITY IS NOT EQUALITY

- For resources in competitive markets, their incomes are close to their opportunity costs

- Your real income that you earn is not simply from your employment as a productive resource, but rather - what that income or reward will procure for you when you buy products as a consumer.

So far as OIL is concerned…

EVERYBODY IS A CONSUMER

Most everyone has to buy some form of petroleum-based products NOT EVERYBODY IS A RESOURCE

Not all productive resources (labor, capital, entrepreneurship, land) are employed by the energy industry

- As competition increases, the surplus rewards to resources (producer surplus/economic rent) shrinks, while the consumer surplus increases - in the form of lower prices.

- For those who dislike taxes - the argument that government is taxing those surplus rewards/income not truly earned/deserved is no longer valid.