2011 Volume Issue 3

May 15, 2011

For a downloadable version, click the following:

Miracles or Mayhem: What is the Federal Reserve really doing???

In this essay we will examine what our central bank in the U.S., the Federal Reserve System, we’ll refer to as the FED, is really doing.

As our newsletters and blogs published here at the New Economic Paradigm Associates have shown, neither the federal government nor the FED directly, creates the money that facilitates the activities of the legitimate or above ground portion of our economic and financial systems (estimates of the size of the above ground or legitimate portion of the U.S economy range from 75% to 90% of all economic activity).

Some previous articles…

The Money Supply and those (supposedly) Overworked Printing Presses (January 14, 2011)

www.econnewsletter.com/jan142011

The Great Printing Press Myth (January 6, 2011)

www.econnewsletter.com/jan062011

The Federal Reserve System: Sausage making and its relation to monetary policy (December 31, 2003)

www.econnewsletter.com/dec312003

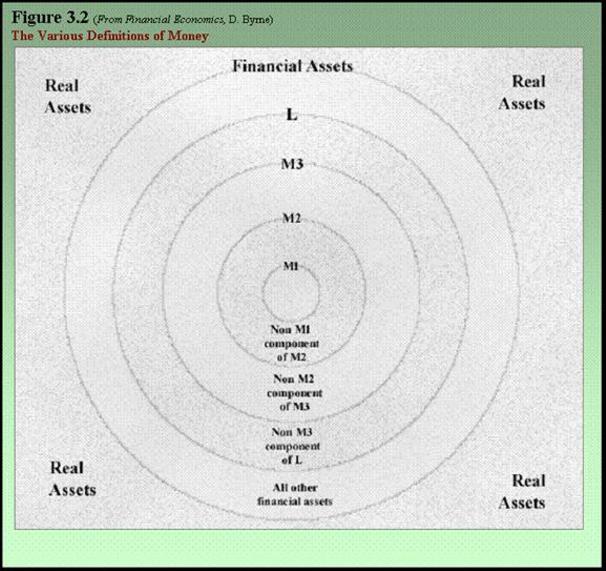

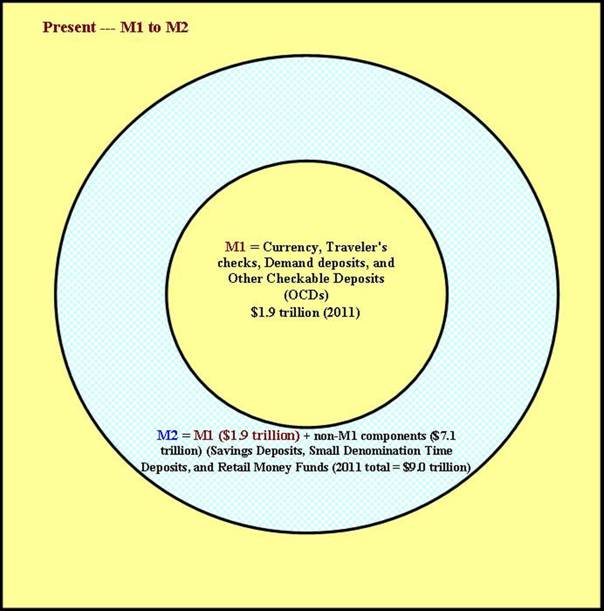

Money, as it performs its facilitating function is called M-1 money or medium of exchange money. M-1 money is the narrowest and least inclusive measure of money of all the monetary aggregates to which they are also referred. It is one of several measures of money from M-1 through M-5. Currently, the FED reports the size and components of only M-1 and M-2, but not too long ago they also reported similar figures for M-3, M-4, and M-5. At times in the not too distant past, L for liquidity was used in place of M-4 and M-5.

M-1 Money – drilling down…

The first component of M-1 money consists of currency (the paper money or Federal Reserve promissory bank notes and coins issued by the U.S. Treasury). The coins are also the Treasury’s liabilities or debts but stamped on metal instead of being printed on paper as in the case of the Federal Reserve Notes). The second component of M-1 money is comprised of checkable deposits which are liabilities or debts of private sector financial institutions called depositories. The mostly for-profit, private sector depositories include the commercial banks and the non-commercial bank depositories: credit unions, savings banks and savings and loan associations.

Note:

Do not confuse the banks with the holding companies that usually own the banks as one of several financial services subsidiaries such as investment banks like Merrill-Lynch, now owned by a holding company that also owns Bank of America, a commercial bank.

In other blogs, we will examine the distinction between commercial banks and investment banks in greater detail.

The checkable deposits consist of demand deposits, and other checkable deposits: NOW accounts or negotiable orders of withdrawal; share drafts at credit unions; and ATS or automatic transfer service accounts that are zero balance checking accounts attached to a savings account so that overdrafts on the checking account do not “bounce” but the overdraft is automatically covered by a transfer of funds from the attached savings account. The last of these – ATS accounts, have steadily declined in relative importance since the inception of NOW accounts which are simpler and earn a low but positive nominal interest rate.

In our blog from January 2011 (www.econnewsletter.com/jan142011), we pointed out, about 90% of the legitimate economy’s transactions (as opposed to the illegitimate or underground economy’s transactions) are facilitated by the use of the checkable deposit form of M-1 money and NOT the paper money component of M-1 consisting almost entirely of those Federal Reserve bank notes (irredeemable, non-interest bearing IOUs of the FED, our central bank).

As a practical matter, nearly 90% of all legitimate transactions in the US economy are facilitated by means of checkable deposits – NOT CURRENCY. In the illegitimate, or underground economy (estimated to be in the 10-25% range of the total economy), currency – or paper money, does virtually all of the facilitation of transactions.

www.econnewsletter.com/jan142011

Recall that the checkable deposit form of M-1 money is created by these private sector [depository] financial institutions as they create credit, i.e., make loans and investments, in the pursuit of profits or its equivalent for not-for-profit depositories such as credit unions. As we pointed out, the FED cannot force depositories to create checkable deposits [M-1 money] and lend it out [create credit] if it is not profitable for the depositories to do so.

The FED’s (Federal Reserve) role is to provide the legal capacity for depositories to create the checkable deposit form of M-1 money as they create credit for customers.

How does this work?

Currently in the U.S. all depositories, and only depositories, can create checkable deposit liabilities (part of M-1 money). In modern times, this is the form of M-1 money that is used in developed economies such as the U.S.; M-1 serves as the medium of exchange and to store wealth in its most liquid of all forms in the legitimate part of the economy.

Since theories of inflation such as monetarism argue that the misbehavior of the monetary aggregates such as M-1, M-2, etc., are the source of inflation, whether in a necessary or sufficient causal role, the central banks in many nations are charged with the duty of controlling this money creation process; one of their goals being that of achieving a reasonable degree of price level stability.

This means that in a modern economy such as ours is currently, the FED controls the capacity of the depositories to create the checkable deposit form of M-1 money while the depositories are creating credit (making loans and investments).

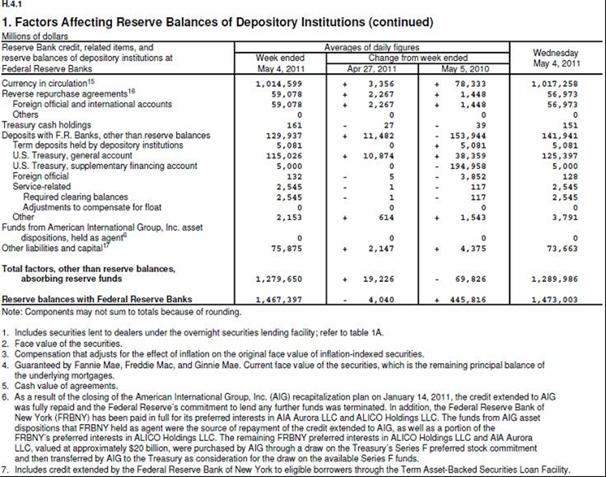

The FED, by increasing its net assets, or decreasing its liabilities and owners equity, increases the legal reserves of depositories; in other words, it increases their [depositories] capacity to create checkable deposit M-1 money and credit.*

*Note: legal reserve deposits and Federal Reserve Notes are not included as liabilities for this purpose.

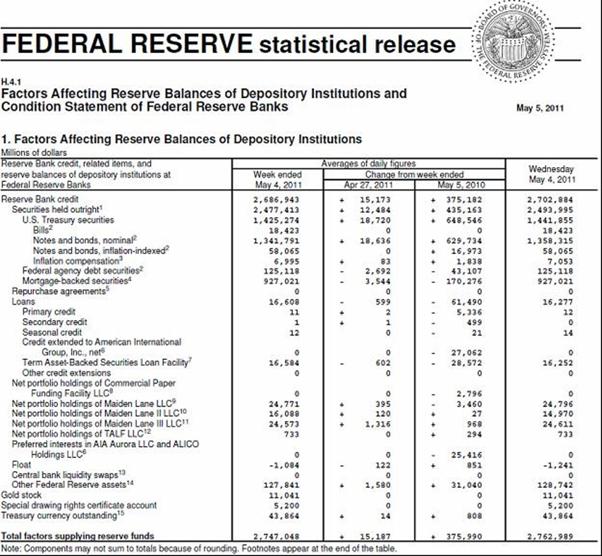

Board of Governors of the U.S. Federal Reserve System

H.4.1

Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks

To keep it simple we will focus on the FED increasing its [gross] assets, holding all else constant.

In the early days of the FED’s existence until the 1970s, an important way in which the FED attempted to control money and credit creation, was to control the legal reserves of depository institutions. Again, this activity was reserved for commercial banks until the 1970s, when savings banks were allowed to issue NOW accounts that were checkable and earned interest.

History of the Division of Banks (Massachusetts)

www.mass.gov/history-of-the-division-of-banks

The 1970s brought many changes to the industry with the rise of money market mutual funds and disintermediation. The industry rose to the challenge with new and innovative products. For example, Massachusetts state-chartered banks became the first in the country to offer NOW accounts.

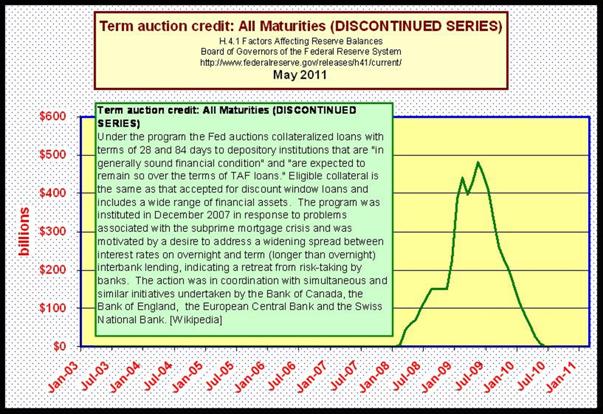

The farther back we go in time, the greater the reliance of the FED on the Discount Window facility to infuse legal reserves into the system and thus controlling the capacity of these commercial banks to create money and credit. The FED maintained the right of refusal of the requests of depositories to borrow legal reserves at the Discount Window Facility. The rate charged the borrowing commercial banks was originally called the rediscount rate and later, simply the discount rate. (federalreserve.gov/monetarypolicy/discountrate.htm) Originally the FED would buy the loans which were usually made on a discount basis and would rediscount them. As time passed, the Fed switched gradually to simply lending the reserves and termed them loans and advances.

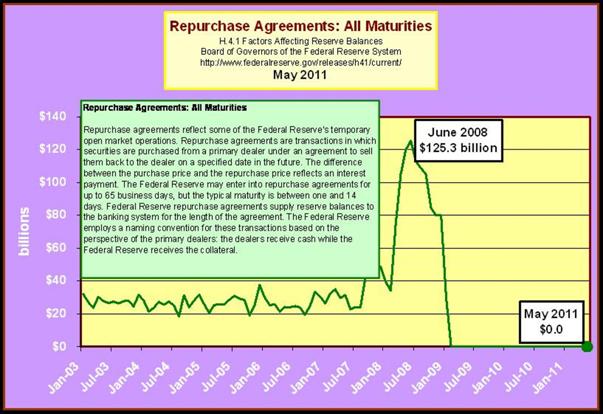

After the Great Depression of the 1930s and then the Second World War, the U.S. Federal debt had ballooned enormously and the FED gradually switched to the use of open market operations, mostly in the U.S. Government marketable debt securities portion of the U.S. financial markets. To expand the depositories’ capacity to create additional checkable deposit M-1 money, they purchased government securities and federal agency securities, either outright – a buy and hold posture, or for a temporary purpose, under repurchase or repo arrangements.

Taking apart the Fed’s Balance Sheet…

federalreserve.gov/releases/h41/Current/h41.pdf

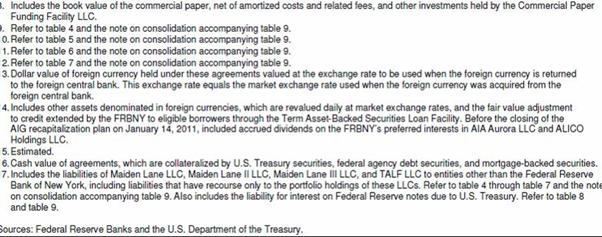

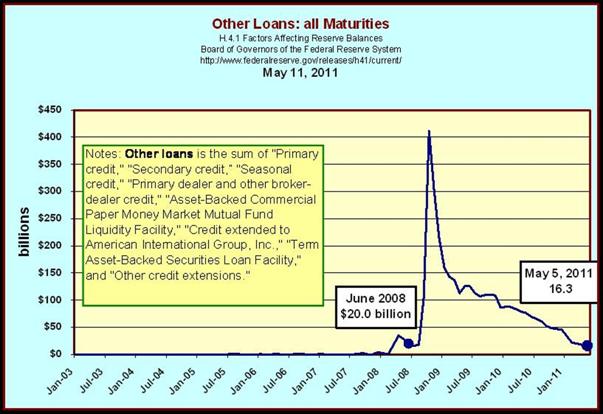

In the following we will be looking at the Federal Reserve’s “H.41 Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks.” The individual releases depict weekly and annual changes. In the subsequent graphs, we will be looking back several years to provide some context to how profound the recent changes really are.

Open Market Operations

federalreserve.gov/monetarypolicy/openmarket.htm

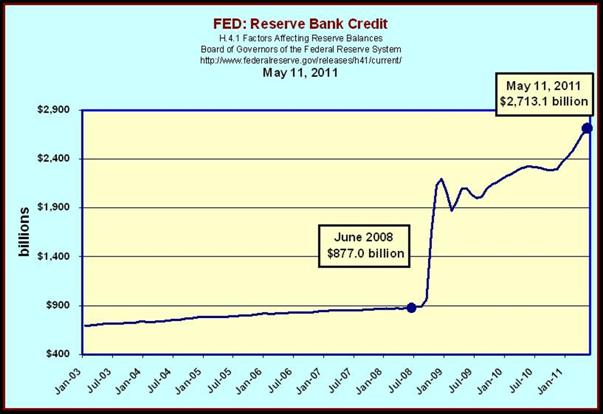

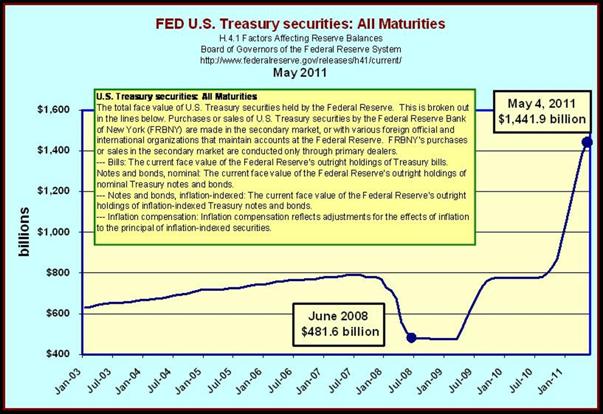

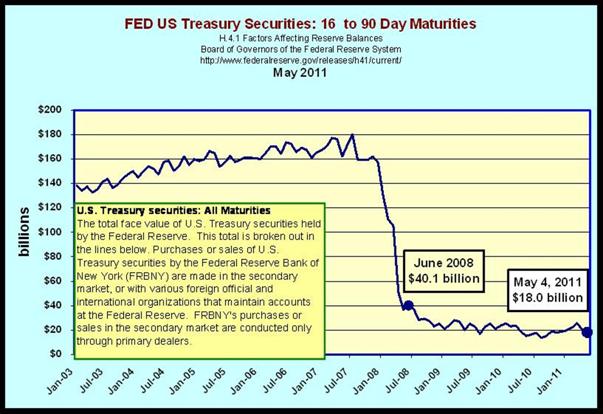

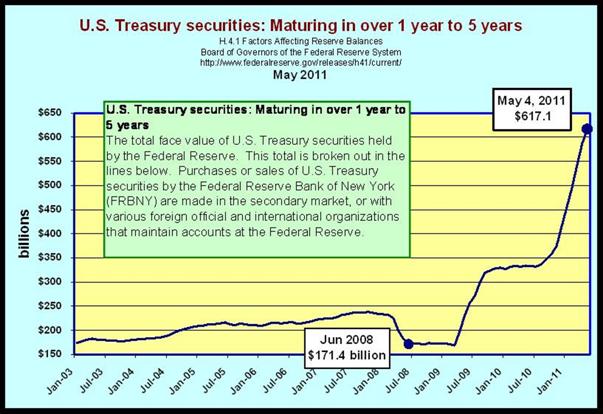

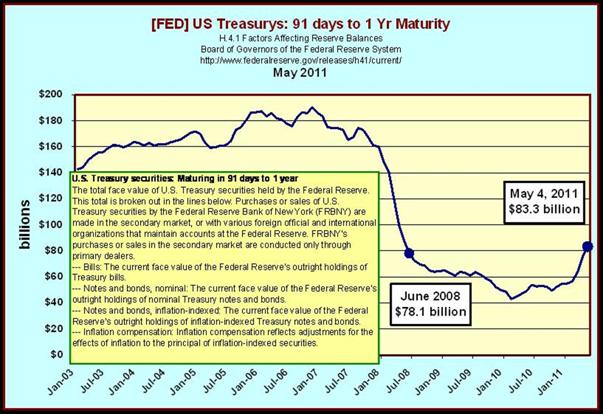

In the following chart note the drop in U.S. Treasury securities holdings. Normally this would indicate the initiation of monetary restraint. In this case however it was due to an unusual FED action of monetary stimulus, swapping some of the Treasury securities for primarily MBSs or mortgage backed securities beginning in late 2008 through much of 2009. The FED justified this action and others as necessary to prevent a collapse of the financial system. It then entered the U.S. Government securities markets and purchased huge amounts of such securities beginning around mid-2009.

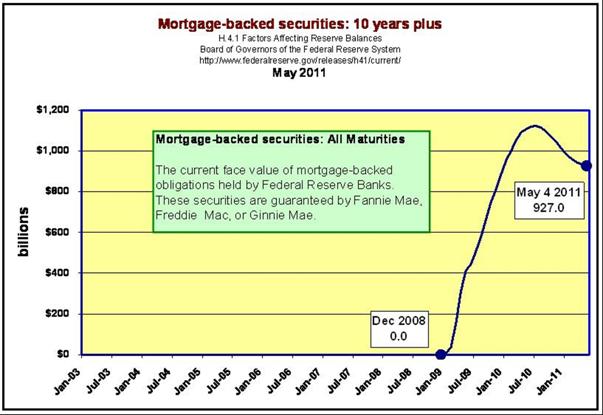

The huge increase from zero of the FED’s holdings of MBSs began in early 2009 and those holdings are still in the FED’s portfolio and probably will be until they are foreclosed, reach maturity, or are paid off early by home owners who escaped foreclosure. This can be seen in the following chart.

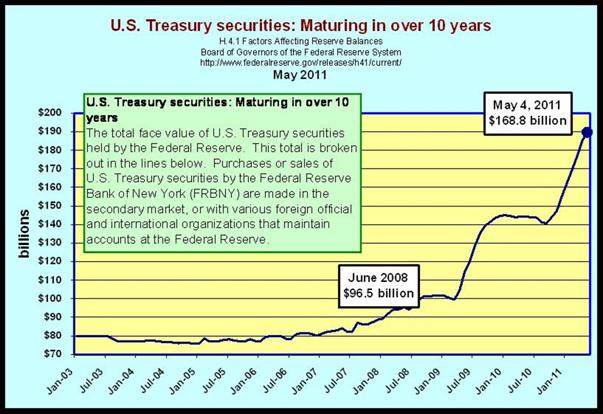

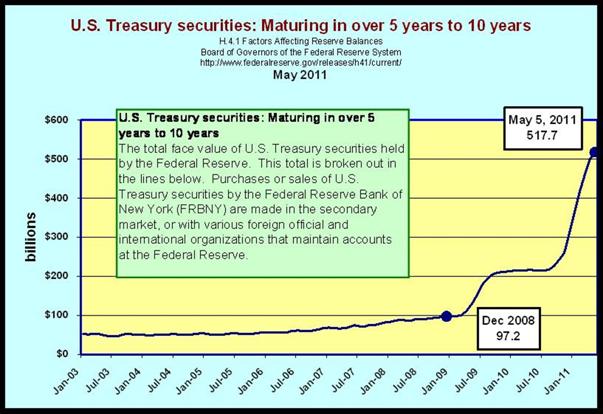

The following charts may seem to be contradictory, but note the different maturities.

The FED swapped its short term U.S. Government securities for privately held MBSs but at the same time entered the market and began to acquire very large amounts of longer term U.S. Government securities. The average maturity of such holdings by the FED increased significantly.

www.frbsf.org/publications/economics/letter/2011.html

Still, the increased size of the Fed’s current portfolio could result in unusually large financial gains and losses from market fluctuations. Furthermore, besides producing a larger balance sheet, the Fed’s purchases have shifted the composition of the Fed’s securities portfolio toward longer-maturity securities. Indeed, the duration of the Fed’s portfolio—which is roughly a measure of average maturity—rose from between two and three years before the financial crisis to between four and five years now.

Why does this lengthening of the average maturity of the FED’s holdings of U.S. Government securities? Recall the former Chairman of the FED’s Board of Governors, Alan Greenspan’s use of the term conundrum.

www.econnewsletter.com/mar102011

Again harkening back to Greenspan: he was the one who was concerned about irrational exuberance - namely that the market price of our assets (primarily homes) were growing too rapidly and that the Federal Reserve had to use its power in driving up short term interest rates through policies prescribed by the FOMC (Federal Open Market Committee) that resulted in his 'conundrum' (the short term interest rate hikes didn't flow through to the longer end of the market). The yield curve began to flatten and at times it became inverted.

www.econnewsletter.com/aug272007

Our forecasts and hence policy are becoming increasingly driven by asset price changes. The steep rise in the ratio of household net worth to disposable income in the mid-1990s, after a half-century of stability, is a case in point. Although the ratio fell with the collapse of equity prices in 2000, it has rebounded noticeably over the past couple of years, reflecting the rise in the prices of equities and houses.

Remarks by Chairman Alan Greenspan

Reflections on central banking

At a symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming

August 26, 2005

When the FED decided to drive up interest rates, it was an ill-advised policy since it was one of the major factors that led to the financial fiasco of 2008: operating in only the short term end of the government securities market, they lacked sufficient holdings of the longer term securities to directly impact longer term interest rates.

The dominant theory of the yield curve (the graph of the term structure of interest rates) is the Expectations Theory (www.econnewsletter.com/apr292005). It argues that longer term interest rates are the geometric average of expected short term interest rates over the relevant time period. Not directly impacting the longer term rates, the market expectations of future short term interest rates dominated the yield curve which flattened and even inverted as short term interest rates rose relative to the longer term interest rates.

The FED can always buy any maturity to directly impact the yield curve anywhere along its entire length when they embark on a policy of monetary ease. It is quite different when they embark on a policy of monetary restraint as they did from June 2004 through June 2006 (maintained position until August 2008) www.econnewsletter.com/jan022009 . You cannot sell what you do not own. Perhaps this time around with a more balanced portfolio of U.S. Government securities, they can avoid another “conundrum”.

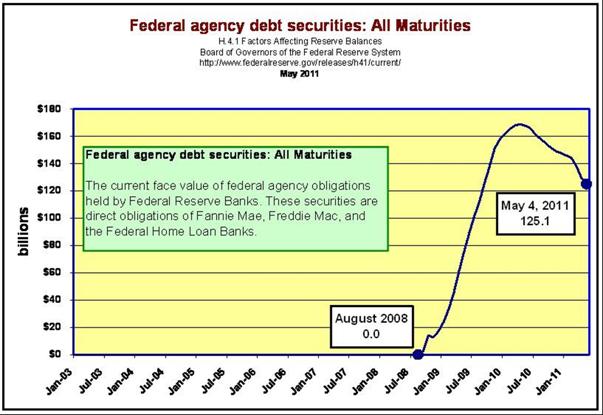

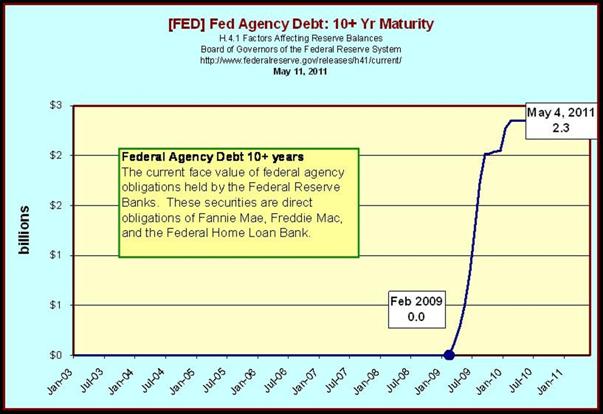

In the previous and following charts, the FED’s bail out of Fannie Mae and other mortgage market Federal agencies can be seen. Such increases in the FED assets also increase the monetary base, part of which become the legal reserves of depository institutions. This expands the capacity of the institutions and enables them to create a multiple of the checkable deposit form of M-1 money and lend them out, i.e., makes loans and investment or credit.

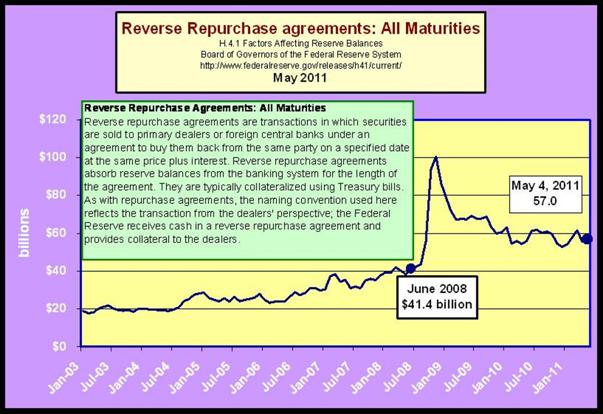

Initially, the FED pulled out all of the plugs in an attempt to forestall a collapse of the U.S. financial system. In addition to the swaps and huge additions of U.S. Government securities and Federal Agency securities, they also infused legal reserves into the system by buying securities with the agreement to resell them after an agreed upon period of time. There are called reverse repurchase agreements.

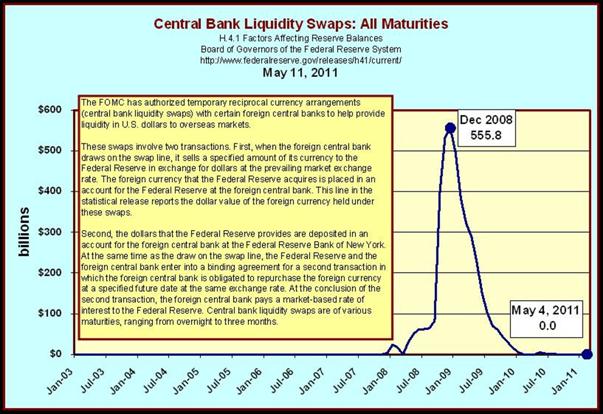

Since the crisis was spreading to other nations, the FED instituted swaps with other central banks to increase each one’s ability to intervene when it was thought needed.

It appears that other than a few scapegoats, the culprits that caused the FFTTE (Financial Fiasco of Two Thousand Eight) have kept their ill gotten gains and faded into the background waiting to return to the stage, front and center.

We strongly suggest that you read or re-read our newsletters on the causes and some solutions we offered in the following articles on this website.

The Financial Fiasco of Two-Thousand Eight (FFTTE)

www.econnewsletter.com/jan022009

Early Warning – January 5, 2006

The Killing Fields: Weak links in an otherwise strong economy

www.econnewsletter.com/jan052006

See extract from this article, immediately below.

RISING MORTGAGE INTEREST RATES

In addition to the rising energy costs and insecurity in the labor markets, households are now facing an additional burden of rising interest rates, affecting their mortgages. As short-term rates are driven up by the Federal Reserve actions in the Federal Funds rates, it influences other short-term interest rates to rise as well.

In the area of variable rate mortgages (ARMs), the Fed’s actions are gradually triggering the adjustment clauses in these mortgages. This increases the monthly payments, reducing further the disposable income available to purchase other goods and services and also reduces the cushion protecting homeowners from defaulting on mortgages.

The second area of concern is the rise in fixed rate mortgages, both for new homebuyers and those attempting to refinance from variable to fixed rates. The real question is are these short-term rates of interest, and some longer term rates of interest like 15 and 30 year fixed rates, higher because of real supply and demand factors in the market, or because of the Fed’s actions.