2012 Volume Issue 14

May 28, 2012

For a downloadable version, click the following:

HAS THE HONEYMOON OF EUROPEAN UNITY GONE KAPUT?

Has the wedding thought to be made in Heaven really been one forged in hell?

Do you remember when Margaret Thatcher stopped referring to the European Union and began to champion an ‘Atlantic Union’? While the U.S. borders on the Atlantic Ocean, the U.S. is definitely not European in geographical terms (although increasingly resembling the E.U. in economic terms, an apparent goal of the current administration in the White House).

Thatcher calls for Atlantic union in marking 50th anniversary of Churchill’s ‘Iron Curtain address’:

The Victoria Advocate, March 10, 1996

news.google.com/newspapers?nid=861dat

The audience gave Thatcher standing ovations at the opening and the end of her speech. They also punctuated her address with laughter, such as when Thatcher said the European Union had not done enough to encourage new democracies’ economies because “it was too busy contemplating its own navel.”

50th Anniversary of Winston Churchill’s Iron Curtain Speech

March 9, 1996

www.c–spanvideo.org/program/70412–1

From Minute 40 and onward: Atlantic Alliance with U.S. as the dominant partner in the West…Atlantic Initiative and Transatlantic Free Trade.

To make it crystal clear, the U.K. refused to give up monetary sovereignty and replace the Pound Sterling with the Euro. Others like Germany, Greece, France, Ireland, etc., willingly it seemed at the time, dropped their national currencies in favor of the Euro, thus surrendering monetary sovereignty to Brussels. Was such a consolidation of monetary sovereignty premature or was it to prove a never achievable goal, a so–called “Bridge Too Far”, another Arnhem, Netherlands in WWII.

Dependency on government programs to redistribute income and wealth is a hallmark of many members of the E.U., but not all. Such a heavy dependence on these programs causes a slowing of economic growth and eventual fiscal difficulties for such governments. Beggars, often very affluent beggars akin to our investment banking community, significantly outnumber those who want to be self–sufficient. Such politically expedient government programs promoting dependency on government tend to grow more rapidly than the economy and its tax base in such nations. That spells trouble right here in River City, and ‘it ain’t from playing pool’ as in the Music Man.

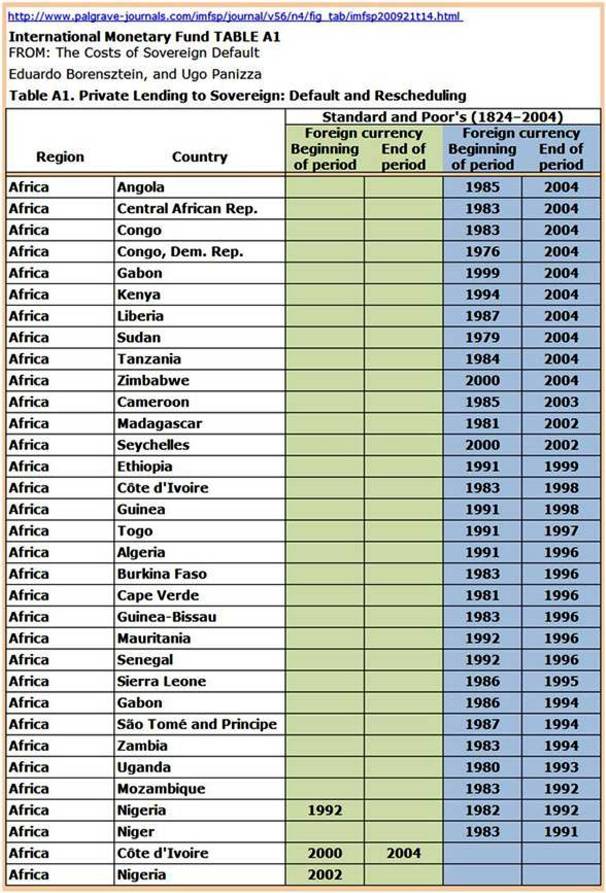

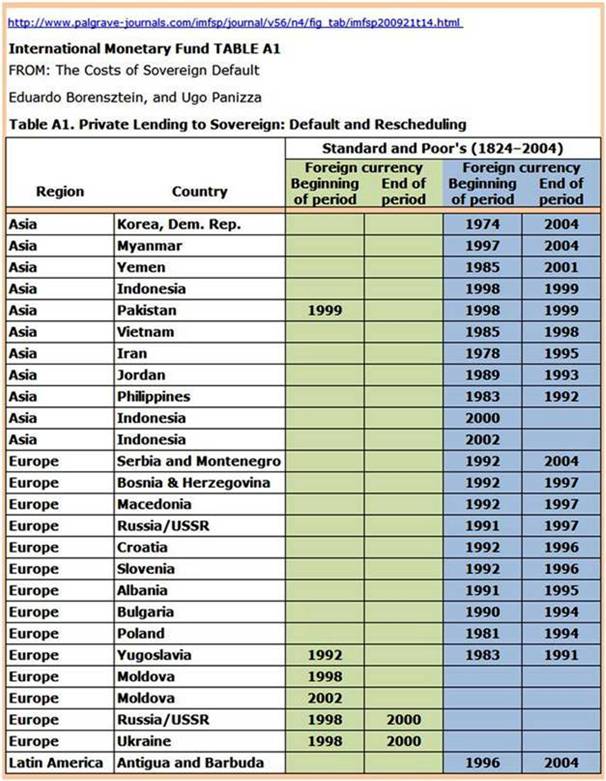

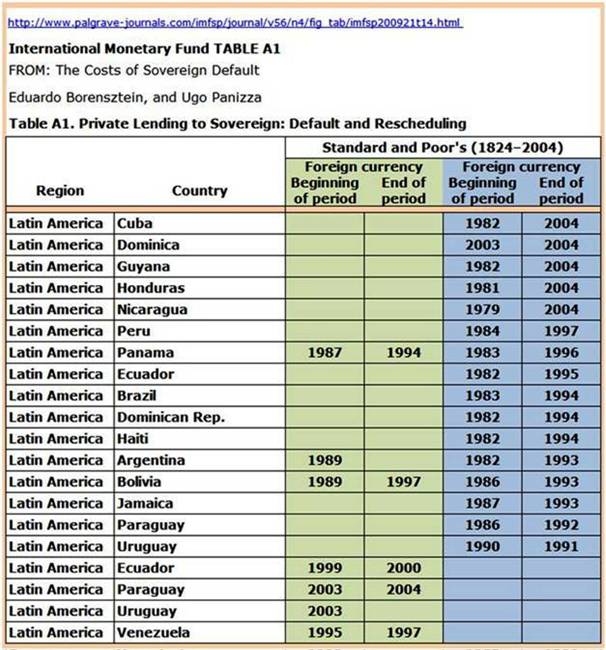

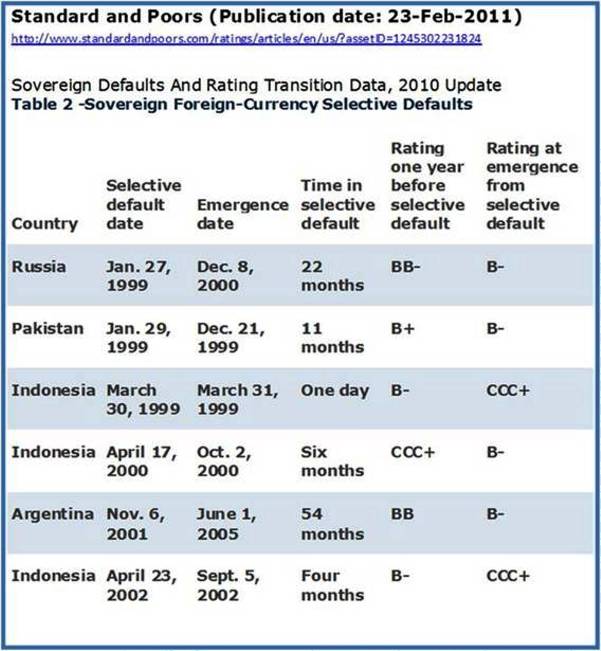

From 1991–2004, eighty–some nations defaulted on the debt of their central government’s, rather than face the fury of the dependents losing their doles in various forms.

Lest you take sovereign risk lightly and the increased probability of the central governments defaulting on their national debt, here is a list of over eighty actual defaults as published by the International Monetary Fund (IMF).

Having one’s own independent currency and remaining independent of membership in a currency bloc, can provide a method of virtually defaulting without formally doing so. Let your currency depreciate or actively intervene in foreign exchange markets and cause it to depreciate is a kind of dumping or more technically, increasing its supply and putting downward pressure on its price in terms of other nations’ currencies.

Even if your nation’s currency was part of a currency bloc, you could arrange a devaluation of your currency. Either way, this will increase the price of your imports and reduce the price to the rest of the world for your exports of goods and services. It would effectively both reduce the real burden of your national debt as well as stimulating that nation’s aggregate demand by increasing the surplus (or reducing the deficit) in its trade balance.

All that is needed are trading partners that are willing to let it happen. The US of A, despite all of its internal and external critics, has nearly always been an obliging ‘patsy’, so to speak. Why no gatherings of support for such U.S. policies in New York City’s Central Park, or the Boston Commons, or the numerous places of sit–ins on the West Coast? The ongoing equivocations of the E.U., the IMF (International Monetary Fund), the World Bank, etc is the grand stall tactic until the much criticized U.S. bails them out as we did with the victors and vanquished after WWII (Bretton Woods IMF Fixed Exchange Rate System, Marshall Plan and similar programs in Asia), and more recently China (yes, China), and soon to be the E.U. As my dear old daddy would say, facts are facts and bull blips are bull blips.

Much of the so–called Chinese economic miracle is due to this technique of keeping the price of the Chinese Yuan below its equilibrium level and hence the price of other nation’s currencies (especially the U.S. dollar) above their equilibrium levels, rather than the brilliance of the central planners and the population police keeping birth rates below the level needed to maintain or increase their population.

The Chinese Miracle…

www.econnewsletter.com/sep232010

China exports goods and the U.S. exports dollars

The U.S. imports goods and China imports jobs

Now let us look at the so called Chinese miracle and the arguments of the naysayers who are counting out the U.S. of A. More than twenty years ago in 1989, the Communist government of mainland China was busy in places like Tiananmen Square battling and sometimes killing young Chinese students. Chinese youth is just like youth everywhere, if they are not kept busy, they will raise hell. If it is really jobs they want, “give them jobs”, and at reasonable wages for the time, became the Chinese government’s answer.

(1984)

Problem: Who will buy the goods thus produced??

Solution: The over–consuming Americans will, of course.

Problem: At $0.50 U.S. for one (¥) (CNY) Yuan or Renminbi, a television imported from China was too expensive even to U.S consumers.

Solution: Go into foreign exchange markets and buy Dollars and sell Yuan until the price of a Yuan fell 75% to $0.125. Peg the exchange rate there by continued intervention. Then exports from China into the U.S. would be a bargain at 75% less than previously. At that pegged rate resulting in the Yuan price of the Dollar rising from 2 to 8 Yuan, Chinese imports from the U.S. would be four times as expensive. Within 10 years, from January 1984 to January 1994, the Yuan went from $0.488 per Yuan to $0.115 per Yuan.

In past newsletters, we have referred to such an exchange rate policy as neo–mercantilism – that is, bringing about a trade surplus as did the mercantilist nations of years back [including the French variation of Colbertism (not the Comedy Central Report) and the German variation of Kameralism].

www.econnewsletter.com/sep092011

Over several centuries, as small political units were combining into nations, an economic doctrine developed in conjunction with nation building. It was called mercantilism in England. In France a similar doctrine was called Colbertism and in Germany, Cameralism. A surplus in the trade or merchandise and services balance in those days was called a favorable trade balance. The excess of exports over imports often meant that gold or gold coins were the means of settling the balance with the gold flowing into the nation with the surplus. This was a means of financing the building up of the strength of the budding nation as it could buy mercenaries, such as Hessians for England as they conquered and occupied colonial America.

Today, a similar modernized doctrine version of these policies exists in nations like China and Korea as well as Japan and Germany in the post–WWII era. For want of a better name it is usually referred to as Neo–mercantilism. The goal is to keep a taught economy at home and export any surpluses products not consumed domestically. China has done this by pegging their currency well below the equilibrium level. In the Post WWII era, the IMF fixed exchange rate system, included pegs for the Japanese Yen and German Mark at dollar prices well below their equilibrium levels. The resulting trade surpluses of Japan and Germany with the U.S. were a major cause of the “miracles” of returning these economies to peacetime expansion.

As we have argued, the post–World War II economic miracles of Germany and Japan were more a result of pegging these nations’ currencies below their otherwise equilibrium level especially with the U.S. than the brilliance of Douglas McArthur or Conrad Adenauer. The costs to the U.S. for pursuing this enlightened policy were persistent and mildly depressing trade and current account deficits. The benefit was to enable the U.S. to achieve aggregate consumption (both private and collective) and capital accumulation (both private and collective) possibilities beyond our production possibilities.

THE CHINESE MIRACLE; OR IS IT REALLY A U.S. POLICY DEBACLE?

www.econnewsletter.com/feb032012

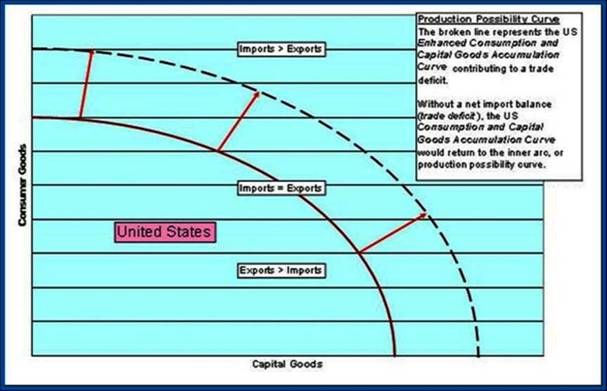

US Production Possibility Curve

The broken line represents the Enhanced Consumption and Capital Goods Accumulation Curve contributing to a trade deficit. Without a net import balance (trade deficit), the US Consumption and Capital Goods Accumulation Curve would return to the inner arc, or production possibility curve.

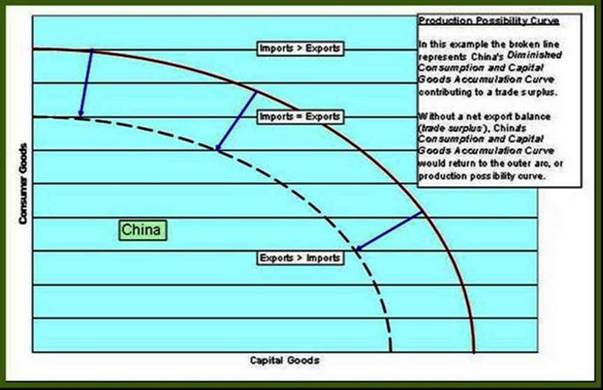

Chinese Production Possibility Curve

In this example, the broken line represents China’s DIMINISHED Consumption and Capital Goods Accumulation Curve contributing to a trade surplus.

Without a net EXPORT balance (trade SURPLUS), China’s Consumption and Capital Goods Accumulation Curve would return to the OUTER arc, or production possibility curve.

Brazil had a long standing policy of creeping devaluation of its currency, primarily to offset their inability or refusal to control inflation partly arising from the pressure of collective consumption and investment.

http://en.wikipedia.org/wiki/Brazilian_real

The modern real was introduced in 1994 as part of the Plano Real, a substantial monetary reform package that aimed to put an end to three decades of rampant inflation. At the time it was meant to have approximately fixed 1:1 exchange rate with the United States dollar. It suffered a sudden devaluation to a rate of about 2:1 in 1999, reached almost 4:1 in 2002, then partly recovered and has been approximately 2:1 since 2006. The exchange rate as of January 22, 2012 is BRL 1.75 to USD 1.00.

The U.K. pursued persistent devaluation policies as did other nations that were members of the IMF Bretton Woods fixed exchange rate system dominant after WW II until the very early 1970s when that system collapsed (such as Italy and pre–de Gaulle France).

To paraphrase Winnie the Pooh, What to do? What to do?

First of all, start limiting the federal budgetary expenditures to a level equal to or less than expected tax revenues. Stop squandering the margin we have left in our federal debt to GDP ratio. We are moving quickly to the margin where sovereign risk in respect to the U.S. national debt becomes serious.

Secondly, focus on growing the economy and not increasing dependency on government. Do this via tax reductions as pioneered by Secretary of the Treasury, Andrew Mellon during the term of President Calvin Coolidge. Put a stop to tax increases, including those related to the very unpopular and potentially catastrophic Obama health care legislation passed during his first year in office.

Thirdly, enforce existing anti–trust legislation that seems to have withered on the vine with the moribund batch of bureaucrats in the Justice Department and the Federal Trade Commission, our legally designated protectors against the monopoly power of excessively large firms as in the oil industry. High oil and refined petroleum product prices such as those of gasoline and jet fuel are a major cause of our current economic stagnation and high unemployment rates with all their attendant problems.

This would include keeping oil and natural gas production in the shale regions (Marcellus, Bakken, Eagle Ford, Monterey, etc.) out of the clutches of the big oil companies!

Fourthly, let the high rollers know we mean business when we say ‘read my lips’ means no more bail outs! If so called hedge funds and investment bankers want to play risky games with financial derivatives like CDSs, when the risks materialize, they will not be bailed out as has been the case in the last decade beginning with the Black–Scholles Bailout (Long Term Capital Management) in 1998.

There are other things needed to get our economy back on track. Stay tuned and we will examine them in future newsletters.

Let’s stop trying to become more European…look where it is taking them.